=================================================================

Introduction

In the world of algorithmic trading, strategy design is only one piece of the puzzle. The other, often overlooked but equally vital, is trade execution. Even the most sophisticated algorithms can underperform if execution is inefficient. Traders and investors seeking consistent results must understand where to learn trade execution strategies for algorithmic trading, as this knowledge determines their ability to reduce slippage, minimize transaction costs, and maximize returns.

This article provides an in-depth guide to resources, tools, and platforms for learning trade execution strategies. It also compares different educational approaches, integrates industry experience, and highlights actionable steps to help traders—whether retail, institutional, or professional—optimize execution.

Why Trade Execution Matters in Algorithmic Trading

The Role of Trade Execution

Trade execution refers to how buy or sell orders are carried out in the market. For algorithmic traders, execution must balance speed, cost, and market impact. Poor execution can erode profits even if the trading strategy is statistically sound.

Common Execution Challenges

- Slippage: Orders filled at less favorable prices than intended.

- Latency: Delays in sending, receiving, or processing trade signals.

- Liquidity Gaps: Limited depth in order books leads to higher costs.

- Market Impact: Large orders moving prices unfavorably against the trader.

This is why why trade execution is critical in quantitative trading has become a core theme among both practitioners and academic researchers.

Where to Learn Trade Execution Strategies for Algorithmic Trading

1. Academic Institutions and Online Universities

Many top universities now offer specialized courses in quantitative finance and algorithmic trading. MIT, Stanford, and the London School of Economics provide modules on market microstructure, execution algorithms, and risk management. Online platforms like Coursera and edX also host accessible programs tailored for retail traders.

Pros: Structured learning, credible certification, academic rigor

Cons: Time-intensive, may lack real-world immediacy

2. Professional Trading Platforms and Broker Resources

Brokers offering advanced algorithmic APIs (e.g., Interactive Brokers, TradeStation) often include educational content on execution strategies. These range from webinars to detailed whitepapers on execution algorithms like VWAP, TWAP, POV, and Iceberg.

Pros: Practical, hands-on, directly tied to real markets

Cons: Sometimes biased towards the broker’s platform

3. Quantitative Finance Books and Research Papers

Books such as “Algorithmic Trading” by Ernest Chan or “Market Microstructure Theory” by Maureen O’Hara provide a detailed foundation. Research papers in journals like the Journal of Finance and Risk offer execution-focused case studies.

Pros: Deep insights, backed by data and theory

Cons: Dense and challenging for beginners

4. Online Quant Communities and Forums

Communities like QuantConnect, QuantInsti, and Elite Trader host active discussions on trade execution. Many contributors share backtested models, execution performance metrics, and coding guides.

Pros: Peer-driven, real-world strategies, interactive

Cons: Quality varies; requires careful filtering of advice

5. Specialized Training Programs and Bootcamps

Institutions like QuantInsti’s EPAT (Executive Programme in Algorithmic Trading) and proprietary trading firms’ bootcamps focus heavily on execution strategies, offering direct mentorship from industry veterans.

Pros: Practical, mentor-led, networking opportunities

Cons: Expensive, selective admission

Key Execution Strategies to Learn

Volume-Weighted Average Price (VWAP)

VWAP strategies aim to achieve an average execution price close to the day’s market average. This reduces market impact for large institutional orders.

Time-Weighted Average Price (TWAP)

TWAP spreads orders evenly across a time window, minimizing predictability. It’s often used when liquidity is stable throughout the trading session.

Percentage of Volume (POV)

POV executes as a percentage of real-time market volume, adjusting dynamically to liquidity conditions.

Smart Order Routing (SOR)

SOR algorithms find the best price across multiple venues, reducing latency and execution costs.

Learning these strategies is crucial because how to improve trade execution in quantitative trading depends on mastering these algorithmic execution techniques.

Comparing Learning Approaches

| Method | Best For | Advantages | Limitations |

|---|---|---|---|

| Academic Courses | Students, professionals | Structured, recognized credentials | Time-consuming |

| Broker Resources | Retail & active traders | Practical, accessible | Platform bias |

| Books & Research Papers | Experienced quants | Deep theoretical knowledge | Steep learning curve |

| Online Communities | Beginners & intermediates | Peer insights, free resources | Requires filtering |

| Specialized Bootcamps | Professional traders | Real-world, mentorship | Expensive, selective entry |

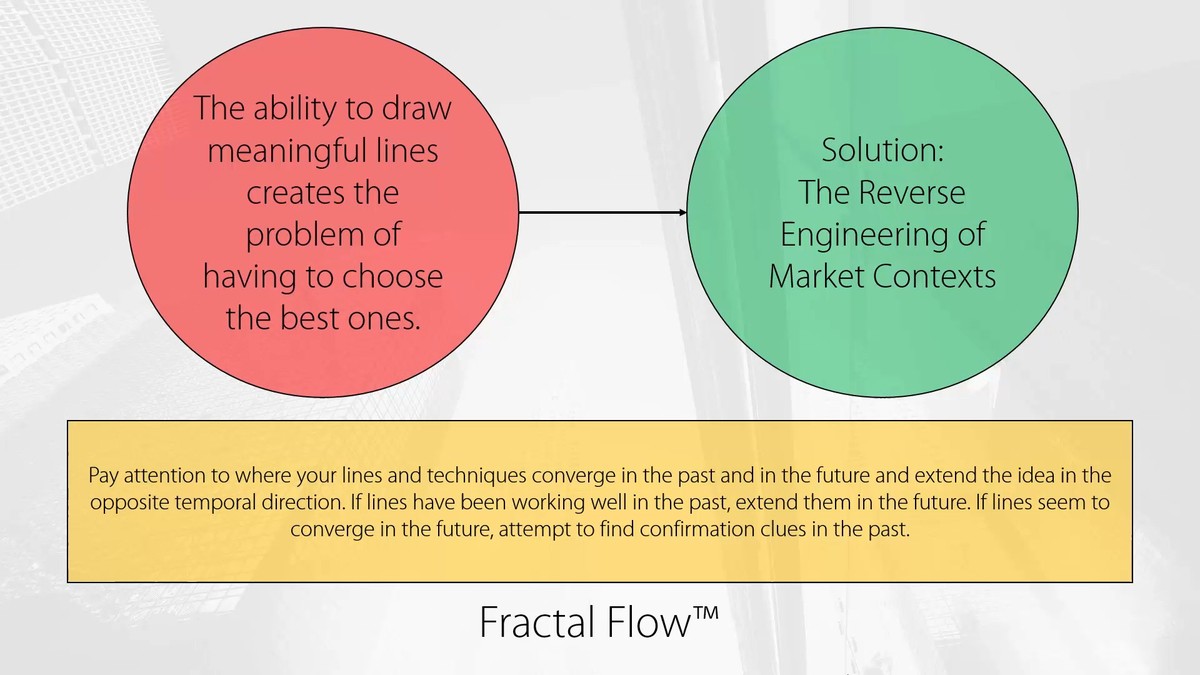

Image Example: VWAP vs. TWAP Execution Strategy

A visualization comparing VWAP and TWAP execution profiles in algorithmic trading

Industry Trends in Trade Execution Education

Rise of Interactive Simulations

Simulators now allow traders to test execution strategies against historical market data, giving hands-on experience before risking real capital.

AI-Driven Execution Tools

Machine learning is being applied to predict market impact and dynamically adjust execution strategies.

Broker-Integrated Training

Brokers are increasingly embedding execution tutorials directly into platforms, bridging education and practice.

Recommended Learning Path

- Start with books and online courses for foundational knowledge.

- Move to broker webinars and trading simulators to practice execution strategies.

- Engage with quant communities for peer insights and emerging best practices.

- Invest in specialized training or bootcamps if aiming for a professional career.

This stepwise approach ensures learners build both theory and practice, scaling from retail to institutional-level execution strategies.

FAQ: Trade Execution in Algorithmic Trading

1. What’s the most effective way to learn trade execution strategies?

The best method depends on your goals. Beginners may benefit from broker-provided tutorials and simulations, while professionals should seek specialized training programs and academic research.

2. Why does execution strategy matter if I already have a profitable algorithm?

Even profitable algorithms can fail in real-world conditions if trades suffer from slippage or high transaction costs. Execution strategies ensure that theoretical profits translate into actual gains.

3. Can retail traders compete with institutional players in execution quality?

Retail traders may not match institutions in terms of colocation and infrastructure, but by using optimized brokers, smart order routing, and understanding execution strategies, they can significantly reduce disadvantages.

Conclusion: Taking the Next Step

Learning trade execution strategies is an essential part of algorithmic trading success. From VWAP and TWAP to smart routing and AI-driven execution, mastering these tools ensures better market performance. The question of where to learn trade execution strategies for algorithmic trading boils down to leveraging a mix of academic, professional, and community-driven resources.

For aspiring quants and seasoned traders alike, the journey begins with education and evolves into real-world practice.

Have you explored different ways of learning trade execution strategies? Share your experiences below and pass this article to fellow traders who could benefit from better execution practices!

0 Comments

Leave a Comment