=================================================================

Introduction

In the fast-paced world of quantitative finance, trade execution strategies for algorithmic trading determine whether a system can deliver consistent alpha or fall behind compe*****s. Knowing where to learn trade execution strategies for algorithmic trading is not just about academic theory—it is about building practical, experience-driven skills to optimize execution quality, reduce costs, and adapt to evolving markets. With increasing market fragmentation, high-frequency players, and advanced liquidity routing, the ability to learn and master execution is a key differentiator for traders, quants, and portfolio managers.

This comprehensive guide explores the best educational paths, practical methods, and training resources for learning trade execution strategies. We will compare structured learning environments with hands-on practice, evaluate industry tools, and explain how professionals can integrate these strategies into their workflow. By the end, you’ll know exactly where and how to gain expertise in this critical domain.

Why Trade Execution Strategies Matter in Algorithmic Trading

Slippage and Transaction Costs

One of the biggest challenges in algorithmic trading is managing slippage—the difference between expected and actual execution price. Poor execution inflates costs and erodes profits, especially for high-turnover strategies.

Market Impact and Liquidity Access

Execution is not just about speed but also about minimizing market impact. Large institutional orders can move prices unfavorably if executed without intelligent algorithms. Access to hidden liquidity, smart order routing (SOR), and dark pools plays a vital role.

Risk and Alpha Preservation

Even the best signal models cannot generate alpha if trades are not executed efficiently. Execution quality directly determines whether a strategy’s theoretical performance translates into real returns.

Where to Learn Trade Execution Strategies for Algorithmic Trading

1. University and Academic Programs

Top universities with quantitative finance and algorithmic trading specializations offer structured courses. Institutions like Carnegie Mellon, MIT, and London School of Economics provide research-backed education with exposure to execution theory, market microstructure, and algorithmic systems.

Pros: Rigorous, theory-rich, strong peer network.

Cons: Expensive, limited hands-on industry simulation.

2. Online Courses and Specialized Platforms

Platforms such as Coursera, QuantInsti (EPAT), and Udemy offer focused modules on execution strategies, order types, and algo trading. Courses often include coding labs in Python, R, and C++ to simulate execution environments.

Pros: Flexible, cost-effective, industry-relevant coding projects.

Cons: Quality varies, limited real-market exposure.

3. Proprietary Trading Firms and Hedge Fund Internships

Learning within a prop firm or hedge fund provides exposure to real trading desks, where execution strategies are tested live. Many firms train recruits in-house with proprietary systems.

Pros: Direct market experience, access to cutting-edge technology.

Cons: Highly competitive, limited availability for beginners.

4. Broker and Exchange Training Programs

Brokers and exchanges like Interactive Brokers, CME, and Nasdaq offer webinars, execution tutorials, and advanced tools training. They also provide data feeds and execution analytics dashboards.

Pros: Industry-relevant, access to real execution platforms.

Cons: May be biased toward promoting proprietary platforms.

5. Hands-On Practice with Simulated and Live Markets

Using paper trading environments or simulated matching engines like QuantConnect and AlgoTrader allows safe experimentation with execution strategies before deploying capital. Live micro-trading with small amounts also builds experience in handling liquidity and slippage.

Pros: Practical, low-risk, customizable.

Cons: Lacks psychological realism of high-capital trades.

Comparing Two Learning Approaches

Academic/Structured Learning

Academic or structured online learning builds strong theoretical foundations in market microstructure, order flow, and execution theory. It is ideal for quants, researchers, and traders who want a systematic knowledge base.

Advantages:

- Strong conceptual depth

- Access to faculty and peer discussions

- Ideal for those aiming for institutional roles

Disadvantages:

- Limited exposure to real execution challenges

- Slow to adapt to new market innovations

Industry/Practical Training

Hands-on learning through internships, prop firms, and simulated environments provides real-world problem-solving skills. It focuses more on execution implementation and optimization.

Advantages:

- Practical, fast learning curve

- Exposure to professional tools

- Builds intuition about order book dynamics

Disadvantages:

- Access barriers (competitive recruitment)

- Limited theoretical grounding

Recommended Approach

A hybrid model—starting with structured courses to build fundamentals, then transitioning to hands-on trading labs and internships—offers the most balanced and effective learning path.

Key Concepts to Master When Learning Execution

1. Smart Order Routing (SOR)

Algorithms that distribute orders across multiple venues to minimize costs and maximize fill rates.

2. Time-Weighted Average Price (TWAP) vs. Volume-Weighted Average Price (VWAP)

Execution algorithms benchmarked against time and volume metrics.

3. Dark Pools and Hidden Liquidity

Understanding alternative liquidity venues and how to avoid signaling to the market.

4. Latency and High-Frequency Dynamics

Where milliseconds matter, execution speed directly influences profitability.

Internal Resource Links for Further Learning

When mastering execution, it is important to also understand why faster trade execution boosts algorithmic trading performance, since latency arbitrage opportunities often determine competitive advantage. Additionally, exploring trade execution training for algorithmic traders provides structured pathways designed specifically for quants and algo developers.

Practical Tools and Resources

- Backtesting Engines: QuantConnect, Zipline, Backtrader

- Execution Platforms: FIX Protocol simulators, MetaTrader 5, AlgoTrader

- Data Feeds: Refinitiv, Bloomberg Terminal, Polygon.io

- Execution Analytics: Transaction Cost Analysis (TCA) tools from brokers

FAQs About Learning Trade Execution Strategies

1. What skills are essential before learning trade execution strategies?

You should have a foundation in market microstructure, programming (Python, C++), statistics, and trading basics. Without these, execution strategy learning becomes purely theoretical.

2. How long does it take to become proficient in execution strategies?

On average, 6–12 months of focused study and practice is needed for proficiency. Academic learners may take longer, while those in prop firms can accelerate learning through direct exposure.

3. Can retail traders learn execution strategies effectively?

Yes. While institutional players have more resources, retail traders can use broker APIs, paper trading, and algorithmic platforms to learn. Execution learning for retail is more about minimizing costs than competing on latency.

4. Are execution strategies the same for all asset classes?

No. Execution in equities, forex, and crypto differs due to liquidity structures, volatility, and market fragmentation. For example, crypto markets are open 24⁄7, requiring different execution risk management.

Conclusion

Learning where to learn trade execution strategies for algorithmic trading requires a mix of structured education, hands-on experience, and access to real-market tools. The most effective approach combines theoretical grounding from academic or online programs with practical training in prop firms, brokers, and simulation environments. As execution becomes increasingly complex due to fragmented liquidity and faster technology, continuous learning is essential for professionals.

If you found this guide useful, share it with your trading peers, comment with your own learning journey, and help others discover the most effective ways to master trade execution.

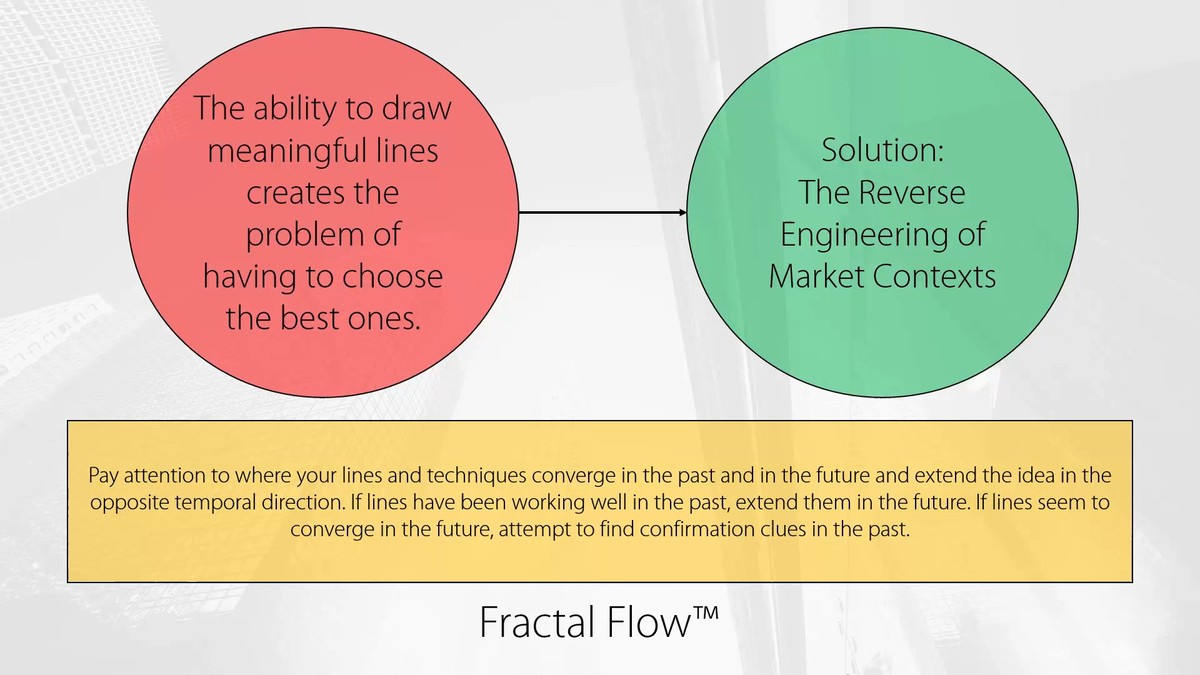

Execution flow in algorithmic trading showing order routing, dark pools, and liquidity providers

0 Comments

Leave a Comment