The world of trading is evolving rapidly, with millennial traders at the forefront of this transformation. One of the key tools they are leveraging to gain an edge in the markets is sell-side research. Traditionally seen as the domain of institutional investors and hedge funds, sell-side reports are now being used more extensively by millennial traders to inform their decisions and optimize their trading strategies. In this article, we will explore how millennial traders use sell-side reports, the different methods and strategies they adopt, and why these reports are indispensable to their success.

TL;DR

Millennial traders increasingly rely on sell-side research to enhance their trading strategies, using insights from financial analysts to inform both short- and long-term decisions.

Sell-side reports can offer invaluable data, including earnings forecasts, market trends, and risk assessments, helping traders stay ahead of the curve.

We’ll explore two key methods millennial traders use sell-side reports for: technical analysis and fundamental analysis.

We will also dive into the advantages and potential pitfalls of integrating sell-side data into trading models.

Table of Contents

Introduction to Sell-Side Reports

How Sell-Side Reports Aid Millennial Traders

Using Sell-Side Research for Technical Analysis

Leveraging Sell-Side Research for Fundamental Analysis

Active vs. Passive Use of Sell-Side Reports

Active Use: Customizing Strategies

Passive Use: Incorporating Research into Long-Term Portfolios

The Advantages of Using Sell-Side Reports

Increased Access to Market Insights

Data Accuracy and Credibility

Timely Reports and Market Reactions

Pitfalls and Challenges When Using Sell-Side Reports

Overreliance on External Opinions

Conflicts of Interest in Sell-Side Research

Best Practices for Millennial Traders Using Sell-Side Reports

FAQs

Introduction to Sell-Side Reports

Sell-side research refers to the market analysis, stock recommendations, and other financial insights provided by analysts working at brokerage firms or investment banks (the “sell side” of the financial markets). These reports typically cover a wide range of topics including company performance, market conditions, macroeconomic trends, and sector outlooks.

For millennial traders, sell-side reports offer a wealth of information that can help with the decision-making process. Traditionally, these reports were reserved for institutional clients and high-net-worth individuals, but the rise of digital platforms and online brokerages has democratized access to this invaluable resource. As a result, millennial traders now use these reports to refine their strategies, build confidence in their positions, and understand broader market dynamics.

How Sell-Side Reports Aid Millennial Traders

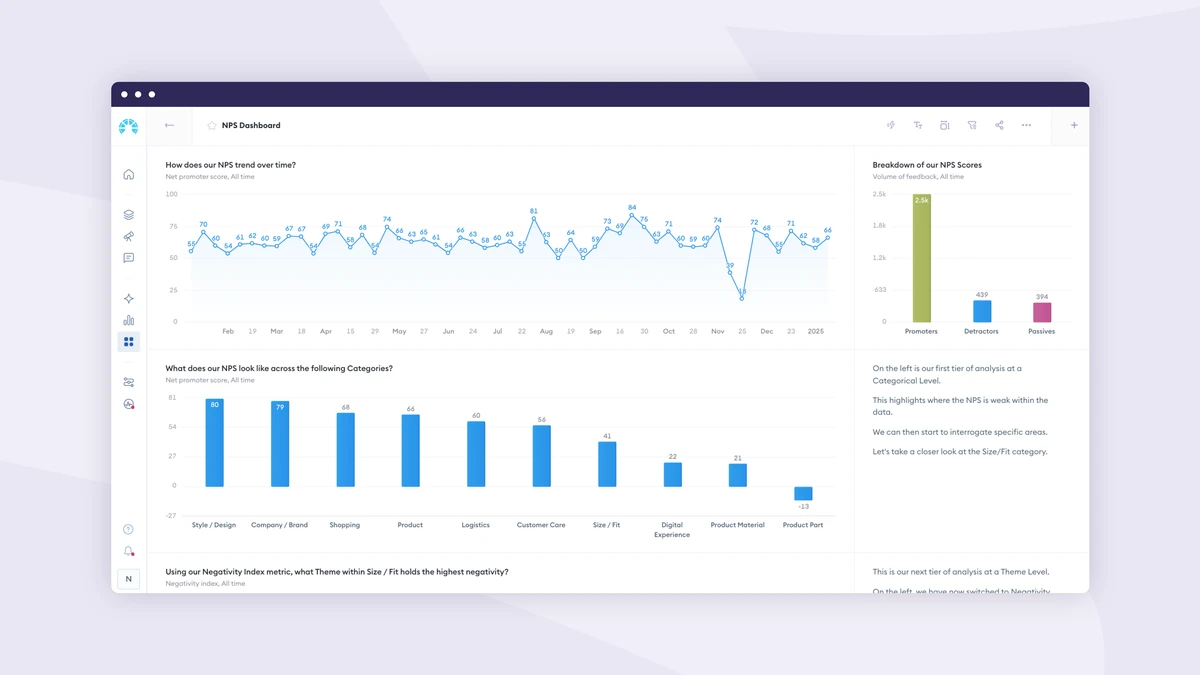

Using Sell-Side Research for Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistical trends from market activity, such as price movements and volume. Sell-side reports are integral to technical analysis because they provide the latest data on:

Price targets and recommendations: Sell-side analysts regularly publish reports with price targets and stock recommendations (buy, sell, hold). These can serve as key inputs for a trader’s technical strategy.

Volume and market sentiment analysis: Some sell-side reports dive into the psychological aspect of trading, analyzing investor sentiment, market trends, and price momentum.

Charting patterns and indicators: Sell-side research often includes insights on technical patterns (e.g., head and shoulders, moving averages), which help traders predict future price movements.

For example, a millennial trader might use sell-side reports to identify when a stock has experienced a breakout or a reversal pattern, providing a clear entry or exit signal based on technical factors.

Leveraging Sell-Side Research for Fundamental Analysis

On the other hand, fundamental analysis involves evaluating a company’s financial health, earnings reports, growth prospects, and broader market conditions to make long-term investment decisions. Sell-side research is particularly valuable here because it provides:

Earnings forecasts: Analysts predict future earnings for companies, which can help traders gauge whether a stock is undervalued or overvalued.

Valuation metrics: Sell-side analysts calculate price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and other financial ratios that traders use to assess the attractiveness of an investment.

Sector and industry reports: Sell-side firms often provide in-depth reports on specific sectors, helping traders understand broader industry trends, regulatory risks, and competitive dynamics.

Millennial traders use these insights to assess the intrinsic value of a stock or asset, often integrating this information into long-term portfolio strategies.

Active vs. Passive Use of Sell-Side Reports

Active Use: Customizing Strategies

Active traders typically incorporate sell-side reports into their short-term trading strategies, using the data to:

Identify stocks or sectors that are currently overperforming or underperforming.

Make real-time decisions based on analyst upgrades, downgrades, or revised price targets.

Adjust risk and reward metrics as new data comes from the sell side.

This active approach requires a millennial trader to constantly monitor sell-side reports, making quick adjustments to positions based on the latest recommendations or market shifts.

Passive Use: Incorporating Research into Long-Term Portfolios

Conversely, passive traders or investors may take a longer-term approach, incorporating sell-side reports into their overall strategy. For these traders, the focus is on:

Identifying strong, fundamentally sound companies to hold for the long term.

Using sell-side research to spot macroeconomic trends that might impact their holdings (e.g., interest rate changes, regulatory updates).

Focusing on low-cost, diversified portfolios while still integrating the occasional sell-side insight to optimize their investment mix.

In this case, sell-side reports serve as a supplementary resource, not the primary driver of trading decisions.

The Advantages of Using Sell-Side Reports

Increased Access to Market Insights

For millennial traders, one of the most significant advantages of sell-side reports is the access to exclusive, professionally curated market insights. These reports often include proprietary data, expert opinions, and forecasts that help traders make informed decisions in complex markets.

Data Accuracy and Credibility

Sell-side analysts typically have years of experience and access to resources that individual traders may not. Their reports are usually data-rich and based on rigorous research, making them reliable sources of information when evaluating investment opportunities.

Timely Reports and Market Reactions

The speed at which millennial traders can access sell-side reports is another key advantage. As markets evolve rapidly, having timely information allows traders to react faster to new developments, whether it’s a sudden earnings beat or a market correction.

Pitfalls and Challenges When Using Sell-Side Reports

Overreliance on External Opinions

One of the risks of relying heavily on sell-side research is over-dependence on external opinions. Millennial traders, in particular, might fall into the trap of blindly following analyst recommendations without performing their own due diligence or considering alternative viewpoints.

Conflicts of Interest in Sell-Side Research

Another challenge is the potential conflict of interest. Sell-side analysts are often employed by firms that are engaged in trading or investment banking, which could influence their recommendations. Traders must be aware of these conflicts and consider the objectivity of the analysis.

Best Practices for Millennial Traders Using Sell-Side Reports

Cross-reference multiple sources: Don’t rely on a single report. Compare insights from multiple analysts or firms to ensure balanced perspectives.

Use sell-side reports as part of a comprehensive strategy: Incorporate sell-side insights into a broader strategy, including technical, fundamental, and sentiment analysis.

Stay updated: Markets move quickly. Regularly monitor new sell-side research to ensure your strategies remain relevant.

Develop independent judgment: While sell-side reports are valuable, always perform your own analysis and question assumptions.

FAQs

FAQ 1: How often should I use sell-side reports in my trading strategy?

The frequency with which you should use sell-side reports depends on your trading style. Active traders may reference reports daily, while passive investors may consult them quarterly or when considering major adjustments to their portfolios.

FAQ 2: Are sell-side reports always reliable?

While sell-side reports are generally well-researched and credible, they may be influenced by internal factors or biases. Always verify key points with independent research and be aware of potential conflicts of interest.

FAQ 3: Can sell-side reports help me find hidden investment opportunities?

Yes, sell-side research can uncover investment opportunities that may not be immediately apparent to retail traders. Analysts often have access to exclusive data, industry reports, and insider information that can highlight undervalued stocks or emerging sectors.

Conclusion

0 Comments

Leave a Comment