Introduction: Understanding Order Book Analysis in Trading

In the fast-paced world of financial markets, the ability to make timely, informed decisions can make the difference between profit and loss. One of the most powerful tools available to traders is order book analysis. The order book represents a real-time list of buy and sell orders, showing the market depth and offering critical insights into market liquidity, supply, and demand dynamics. By examining the order book, traders can predict short-term price movements, identify potential support and resistance levels, and make more informed trading decisions.

In this article, we will explore how order book analysis enhances trading decisions by diving deep into its key components, benefits, and strategies. Additionally, we will compare various methods of order book analysis, highlighting their strengths and weaknesses, and offer recommendations on how to use them effectively.

What is the Order Book?

Before diving into how order book analysis enhances trading decisions, it’s essential to understand what an order book is. In financial markets, the order book is a list of buy and sell orders for a particular asset, arranged by price levels. It is continuously updated as traders place, modify, or cancel orders.

Key Components of the Order Book:

Bid Orders: These are the orders from buyers, showing the price they are willing to pay for the asset.

Ask Orders: These are the orders from sellers, indicating the price at which they are willing to sell the asset.

Market Depth: This refers to the number of orders on both the buy and sell sides, which shows the liquidity at different price levels.

Spread: The difference between the highest bid and the lowest ask. A narrower spread usually indicates a more liquid market.

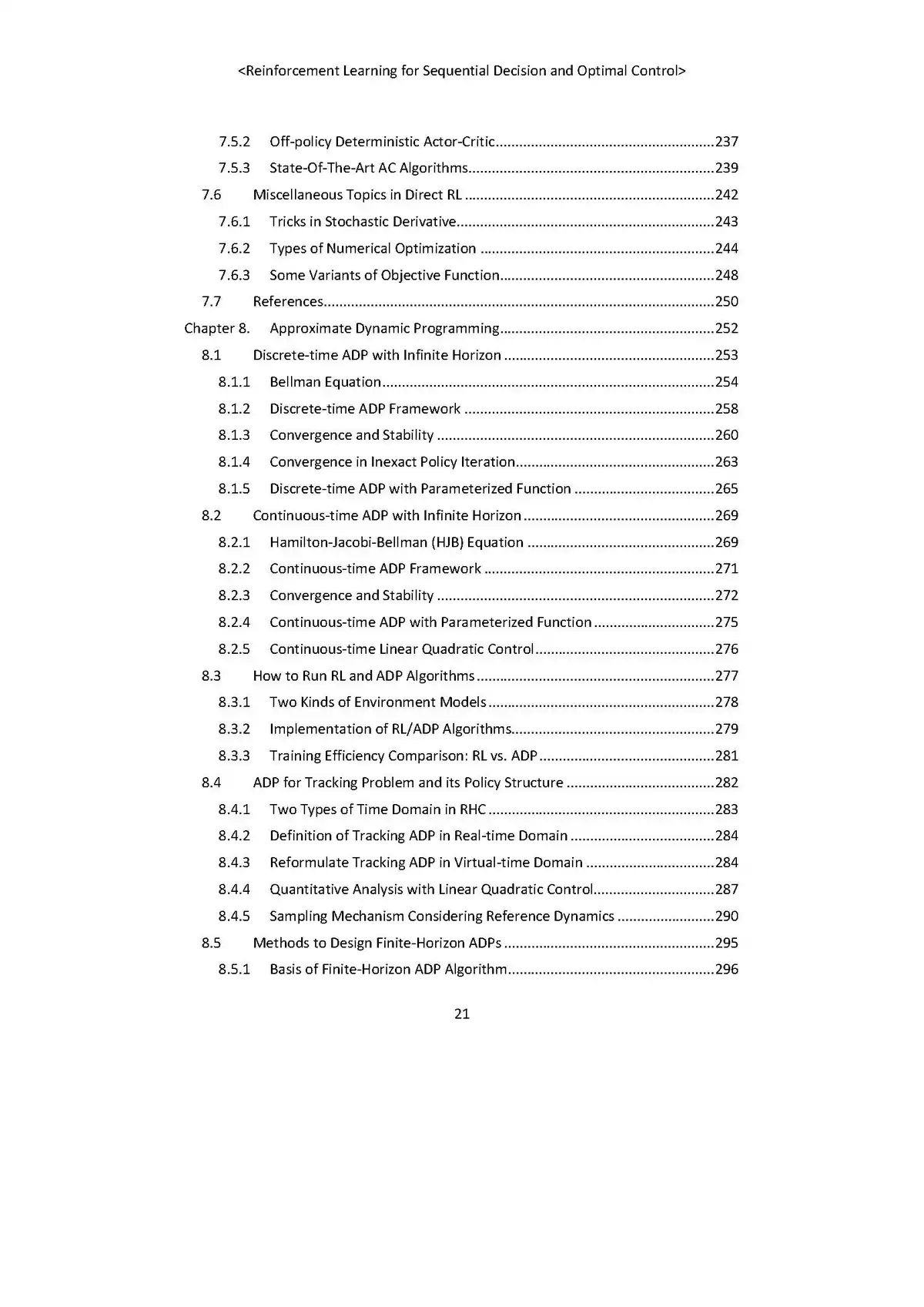

Order Book Visualization

The order book is often visualized in a level 2 chart, where traders can see the market’s bid-ask spread, order quantities at different price points, and the general market depth.

How Order Book Analysis Enhances Trading Decisions

Order book analysis provides traders with a wealth of real-time data, allowing them to anticipate price movements, identify support and resistance levels, and gauge market sentiment. Here are several ways that order book analysis can enhance trading decisions:

- Identifying Market Sentiment

One of the most significant advantages of order book analysis is its ability to reveal market sentiment. By analyzing the balance between buy and sell orders, traders can gauge the overall mood of the market.

Buy-side Dominance: When there are more buy orders than sell orders at various price levels, it signals bullish sentiment. This could suggest that the market is preparing for an upward move.

Sell-side Dominance: When sell orders dominate, it reflects bearish sentiment, potentially indicating a downward price movement.

By using real-time order book data, traders can adjust their strategies to align with prevailing market sentiment.

- Predicting Price Movements

Order book data can also help traders predict short-term price movements. Price movements are often driven by the imbalance between buy and sell orders. A sudden increase in buy orders might push the price up, while an influx of sell orders might lead to a price decline.

Order Imbalance: If there’s a significant discrepancy between buy and sell orders, this can signal a potential price movement. For instance, if there’s a large number of buy orders at a certain price level, the price may rise when those orders are filled.

- Detecting Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis. The order book can help traders identify these levels by showing where significant buy and sell orders are placed.

Support: If there are many buy orders at a particular price level, it may act as support, preventing the price from falling further.

Resistance: Similarly, large sell orders at a particular price level can act as resistance, preventing the price from rising above that point.

By recognizing these levels, traders can plan their entries and exits more effectively, reducing the risk of unfavorable trades.

Methods of Order Book Analysis

There are several methods of analyzing the order book, each offering unique insights into market dynamics. Here, we will compare two commonly used methods: Basic Order Book Analysis and Algorithmic Order Book Strategies.

- Basic Order Book Analysis

Basic order book analysis involves manually observing the buy and sell orders, bid-ask spread, and market depth. Traders can use this method to identify key levels of support and resistance, spot potential price movements, and gauge overall market sentiment.

Advantages:

Simple and intuitive: Traders can make quick decisions based on live market data.

Direct insights: Real-time data provides immediate market sentiment and potential price action.

No need for advanced tools or algorithms.

Disadvantages:

Time-consuming: Constant monitoring of the order book is required.

Limited to human analysis: Complex patterns might be missed, as human analysis can only process a limited amount of data at a time.

- Algorithmic Order Book Strategies

Algorithmic trading uses sophisticated quantitative models and machine learning algorithms to analyze large volumes of order book data. These algorithms can process vast amounts of data in real-time and make automated trading decisions based on predefined strategies.

Advantages:

Speed and accuracy: Algorithms can process and act on data much faster than humans.

Scalability: Algorithms can analyze multiple markets or assets simultaneously.

Consistency: Algorithms follow strict rules, eliminating emotional trading decisions.

Disadvantages:

Complexity: Developing and maintaining trading algorithms requires significant expertise.

Overfitting: Algorithms might perform well in backtesting but fail in live markets.

High costs: Advanced algorithms require powerful computing resources and may incur higher fees.

Order Book Data Integration with Trading Algorithms

Integrating order book data with trading algorithms can significantly enhance decision-making. By incorporating market depth, liquidity metrics, and order imbalances into algorithmic models, traders can improve the effectiveness of their strategies.

How to Integrate Order Book Data

Traders can integrate order book data into their algorithms by using market data APIs, which provide real-time data feeds from exchanges. These data points can then be analyzed using statistical models or machine learning algorithms to make more accurate predictions about price movements, trends, and market behavior.

Visual Insights on Order Book Dynamics

Order book visualization showing bid and ask levels.

FAQs on Order Book Analysis

- How can beginners learn order book trading?

For beginners, learning to read the order book involves understanding the key components, such as bid-ask spreads, market depth, and order imbalances. Starting with demo accounts on platforms that offer real-time order book data can help build familiarity. Additionally, there are numerous online courses and tutorials available that break down order book trading for beginners.

- How does order book analysis work in high-frequency trading (HFT)?

In high-frequency trading, algorithms analyze order book data at ultra-fast speeds to identify micro-trends and execute trades in fractions of a second. HFT firms often employ advanced machine learning techniques to predict market movements based on order book data and can exploit tiny inefficiencies in the market that human traders cannot detect.

- How do institutional traders use order book analysis?

Institutional traders often rely on sophisticated order book software to conduct market impact analysis and assess liquidity conditions. By understanding where large orders are placed, institutional traders can plan their trades to minimize market slippage and execute large orders without significantly moving the market.

Conclusion: Leveraging Order Book Analysis for Smarter Trading Decisions

Incorporating order book analysis into your trading strategy can provide you with critical insights into market liquidity, sentiment, and potential price movements. Whether you choose to manually analyze the order book or use algorithmic strategies, understanding the dynamics of the order book is essential for making informed trading decisions.

By integrating order book data with your trading algorithms or using real-time market analysis, you can enhance your ability to spot key market levels, understand market sentiment, and make smarter, more profitable trades.

If you found this article helpful, feel free to share it with your trading community. And don’t forget to comment below—how has order book analysis helped you in your trading decisions?

👉 Want to dive deeper into advanced order book techniques for seasoned investors? Let me know, and I can expand on how professional traders leverage these methods for high-frequency trading.

0 Comments

Leave a Comment