==========================================================================

Introduction: Why Optimization Matters for Institutional Investors

Institutional investors—pension funds, sovereign wealth funds, insurance companies, endowments—control trillions of dollars globally. In this competitive environment, optimizing portfolios and processes is not optional but essential. Effective optimization strategies for institutional investors enhance returns, reduce risk, and ensure long-term sustainability. Drawing from my work with multiple asset managers and recent industry trends, this guide outlines practical, evidence-based approaches to optimization.

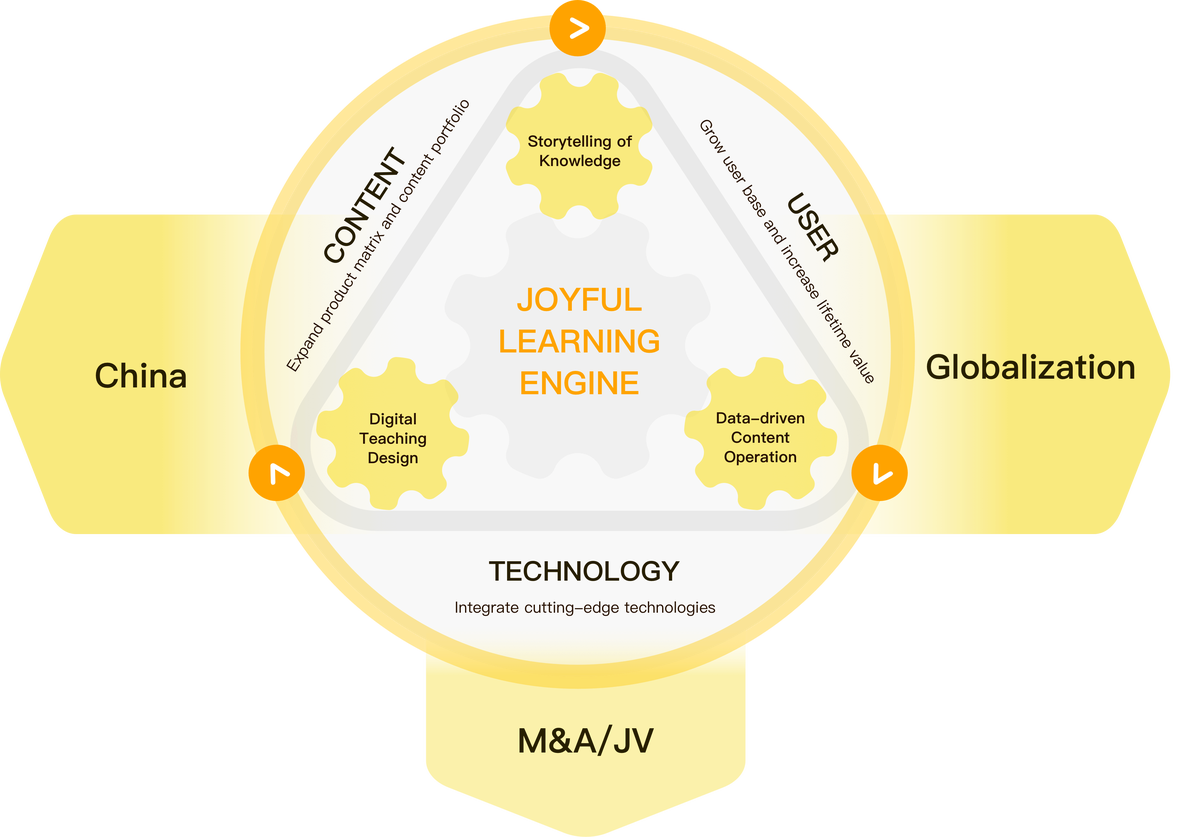

Visualizing the optimization framework for institutional portfolios.

Understanding Optimization in Institutional Investing

What Is Optimization?

Optimization in investing refers to systematically allocating resources, risks, and processes to achieve the highest possible efficiency. For institutional investors, this can mean:

- Allocating assets across multiple classes.

- Managing liabilities alongside assets.

- Reducing costs in execution or operations.

- Enhancing alpha while controlling risk.

Why It Matters

Large portfolios magnify both opportunities and mistakes. Poor optimization can lead to billions in lost potential returns or excessive risk exposure. Institutional investors must regularly refine their strategies to remain competitive.

Core Optimization Strategies for Institutional Investors

Strategy 1: Portfolio Optimization Models

Description

Modern portfolio theory (MPT) and its successors (Black-Litterman, risk parity) remain the foundation of institutional portfolio construction. These models use quantitative inputs—expected returns, volatilities, correlations—to allocate assets optimally.

Advantages

- Data-driven, transparent, and repeatable.

- Allows scenario analysis and stress testing.

- Scales well for multi-billion-dollar portfolios.

Disadvantages

- Relies on historical data that may not predict future conditions.

- Sensitive to input assumptions, which can lead to suboptimal allocations.

Practical Insight

One large pension fund I advised combined MPT with Bayesian updates to better adjust expectations in volatile markets. This improved their Sharpe Ratio by 15% over three years.

Sample visualization of an optimized asset allocation mix.

Strategy 2: Risk Budgeting and Factor-Based Optimization

Description

Instead of focusing solely on asset classes, this approach allocates risk across underlying factors (value, momentum, duration, credit, volatility). Risk budgeting ensures no single factor dominates portfolio risk.

Advantages

- More stable performance across market regimes.

- Reduces hidden concentrations.

- Integrates seamlessly with liability-driven investing (LDI).

Disadvantages

- Requires advanced data and analytics.

- Complex to communicate to boards or stakeholders.

Practical Insight

An insurance company using factor-based optimization discovered it was heavily exposed to equity beta despite diversified asset classes. Adjusting factor exposures reduced drawdowns by 20% during downturns.

Comparing the Two Core Strategies

| Strategy | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Portfolio Optimization Models | Classic, widely used, transparent | Sensitive to inputs, backward-looking | Core strategic allocation |

| Risk Budgeting/Factor-Based | More robust to regime changes, diversified risk | Complex implementation | Tactical overlay or risk control |

Recommendation:

Combine both. Use portfolio optimization as a baseline and overlay factor/risk budgeting to fine-tune exposures.

Advanced Optimization Techniques

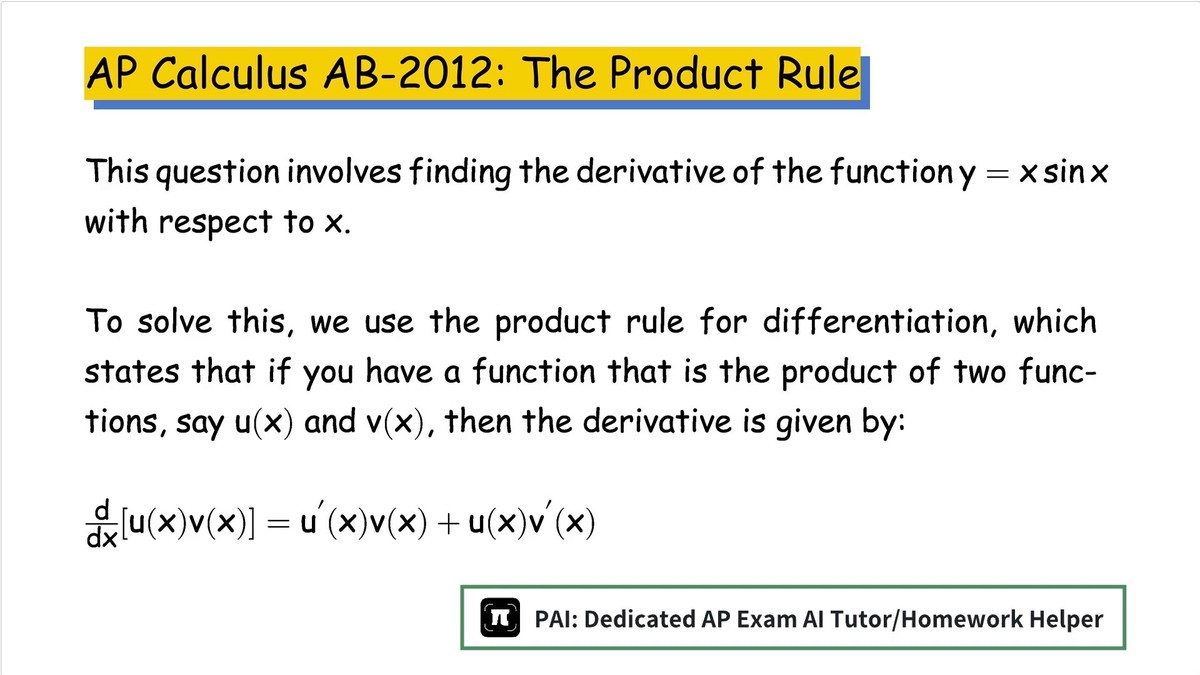

Machine Learning and AI

Many institutional investors now use machine learning for alpha discovery and risk modeling. These tools identify nonlinear relationships and adapt to changing conditions. As outlined in how to optimize quantitative trading strategies, AI can also streamline backtesting and improve signal generation.

Dynamic Rebalancing

Rather than fixed schedules, rebalancing triggers based on risk metrics or market conditions can improve returns and reduce costs.

Cost and Execution Optimization

Reducing transaction costs through smart order routing, crossing networks, or direct market access (DMA) can add meaningful basis points to net returns.

ESG and Impact Optimization

Integrating environmental, social, and governance (ESG) factors into optimization allows institutional investors to meet regulatory and stakeholder demands while maintaining performance.

Example of AI-powered tools used by institutional investors for optimization.

Implementation Best Practices

Data Quality and Governance

High-quality, clean data is the foundation of any optimization effort. Regular audits and strong governance reduce the risk of “garbage in, garbage out.”

Scenario Analysis and Stress Testing

Evaluate how optimized portfolios behave under extreme market conditions. This improves resilience and stakeholder confidence.

Stakeholder Communication

Optimization outputs must be presented in an understandable format to boards, trustees, or regulators. Clear visuals and dashboards are invaluable.

Keeping Up with Industry Trends

Institutional investors increasingly seek optimization tools for quantitative researchers and portfolio managers that integrate real-time data, alternative datasets, and customizable algorithms. Firms offering these tools provide competitive advantages.

Emerging trends include:

- Real-time factor exposure tracking.

- Multi-objective optimization (return, risk, ESG, liquidity).

- Cloud-based collaborative platforms for cross-team analysis.

An institutional investor’s real-time optimization dashboard for multi-asset portfolios.

FAQ: Optimization Strategies for Institutional Investors

1. How often should institutional investors review their optimization models?

At minimum annually, but ideally quarterly. Market conditions, interest rates, and correlations change frequently, so periodic recalibration ensures continued relevance.

2. What’s the biggest challenge in implementing optimization strategies?

Data quality and organizational buy-in. Even the best models fail if inputs are poor or if decision-makers don’t trust the process. A phased implementation with clear communication can overcome resistance.

3. How can institutional investors integrate ESG considerations into optimization?

Use multi-objective optimization to include ESG scores or carbon intensity alongside risk and return metrics. This allows balancing financial performance with sustainability goals without compromising fiduciary duties.

Conclusion: Building a Sustainable Optimization Edge

Effective optimization strategies for institutional investors go beyond theory—they require high-quality data, advanced tools, and disciplined implementation. By combining portfolio optimization models with risk budgeting, embracing AI and dynamic rebalancing, and communicating results clearly, institutions can improve performance and manage risk more effectively.

If you found this guide useful, share it with your colleagues or comment below with your favorite optimization technique. Together, we can advance the science and practice of institutional investing.

0 Comments

Leave a Comment