====================================

Optimization has become one of the most critical aspects of quantitative finance and algorithmic trading. By systematically adjusting parameters, evaluating strategies, and refining models, traders can significantly improve profitability, reduce risks, and maintain a competitive edge in increasingly efficient markets. This article provides a comprehensive exploration of optimization case studies in trading, showcasing real-world examples, practical techniques, and lessons learned from applying different optimization approaches.

Why Optimization Matters in Trading

Optimization ensures that trading strategies are not only theoretically sound but also practically effective in dynamic market environments. Without optimization, even the most well-conceived models may fail due to poor calibration, weak execution, or unmitigated risks.

Key benefits include:

- Enhancing profitability through parameter tuning.

- Reducing drawdowns by applying risk optimization techniques.

- Improving execution efficiency for high-frequency trading.

- Strengthening robustness across changing market conditions.

For deeper insights, resources like how to optimize quantitative trading strategies offer structured guidance on building optimization frameworks for real-world trading.

The trading optimization cycle: research, testing, validation, and execution

Case Study 1: Portfolio Optimization Using Mean-Variance Analysis

Background

A mid-sized asset management firm managing equity portfolios wanted to reduce volatility while maximizing returns. The team employed the classic Markowitz mean-variance optimization framework.

Methodology

- Defined expected returns based on historical averages.

- Calculated covariance matrices for asset correlations.

- Applied quadratic programming to find the efficient frontier.

Results

- Achieved a 12% reduction in volatility.

- Improved Sharpe ratio from 1.1 to 1.35.

- However, the strategy was highly sensitive to input assumptions, particularly expected returns.

Lessons Learned

- Pros: Straightforward and mathematically rigorous.

- Cons: Fragile under changing market regimes. Requires robust estimation techniques like shrinkage covariance methods.

Case Study 2: Machine Learning for Strategy Optimization

Background

A proprietary trading firm sought to optimize a momentum-based intraday strategy. Instead of relying solely on static thresholds, the firm turned to machine learning.

Methodology

- Applied random forest regression to model price momentum signals.

- Conducted feature engineering on volume, volatility, and order book data.

- Used walk-forward optimization to avoid overfitting.

Results

- Improved win rate by 7%.

- Reduced average drawdown by 10%.

- Higher transaction costs offset part of the gains, underscoring the need for execution optimization.

Lessons Learned

- Pros: Adaptability to non-linear market behaviors.

- Cons: Requires significant computational resources and risk of overfitting.

This illustrates why traders use machine learning for optimization, especially when market dynamics are too complex for traditional models.

Machine learning optimization loop for trading strategies

Case Study 3: Risk Optimization for Portfolio Managers

Background

A hedge fund running multi-asset portfolios needed to reduce downside exposure without sacrificing returns.

Methodology

- Implemented Conditional Value-at-Risk (CVaR) optimization.

- Incorporated tail risk measures to account for extreme market moves.

- Used Monte Carlo simulations to validate robustness.

Results

- Reduced tail-risk exposure by 18%.

- Limited losses during a 2022 market correction compared to peers.

- Portfolio turnover increased, leading to higher transaction costs.

Lessons Learned

- Pros: Strong risk mitigation during extreme volatility.

- Cons: Transaction costs can erode benefits if not managed carefully.

Case Study 4: Backtesting Optimization for Algorithmic Strategies

Background

An algorithmic trader building an options volatility strategy faced challenges with inaccurate backtesting due to look-ahead bias and survivorship bias.

Methodology

- Implemented robust data cleaning procedures.

- Optimized backtesting framework to include realistic slippage and fees.

- Applied walk-forward validation to test out-of-sample performance.

Results

- Identified that original strategy was overfitted.

- True performance was 30% lower than initial backtest.

- After adjustments, the strategy achieved sustainable profitability.

Lessons Learned

- Pros: Proper backtesting optimization prevents costly mistakes.

- Cons: Slower testing cycles due to more computationally intensive simulations.

This aligns closely with best practices in how to optimize backtesting for trading strategies, which stress realistic assumptions and validation methods.

Workflow for optimized backtesting in trading

Comparing Optimization Approaches

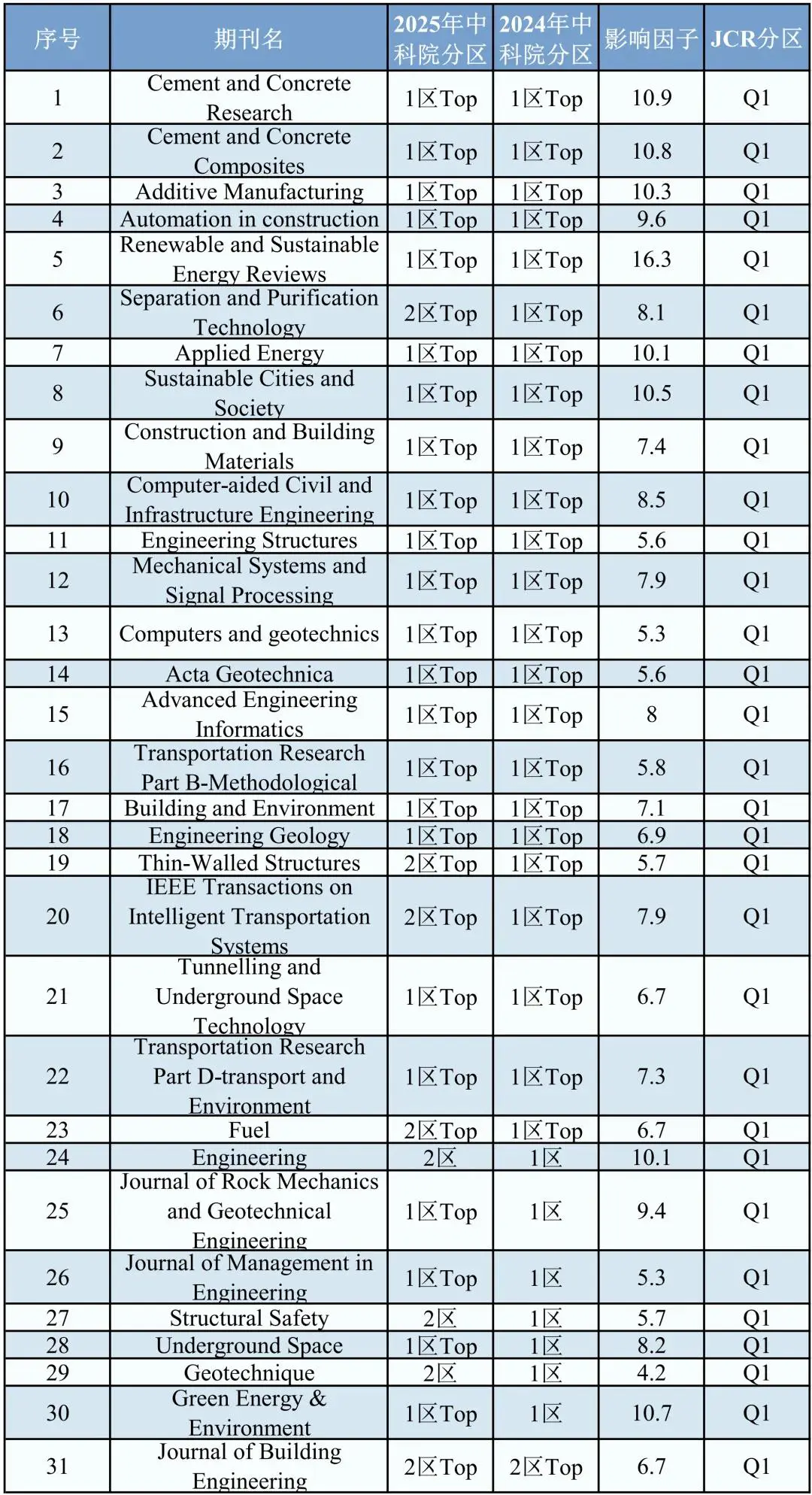

| Method | Best Use Case | Advantages | Limitations |

|---|---|---|---|

| Mean-Variance Optimization | Traditional portfolio construction | Simple, mathematically elegant | Sensitive to assumptions, may fail in volatile markets |

| Machine Learning Optimization | Complex signal discovery | Handles non-linear relationships, adaptive | Risk of overfitting, computationally heavy |

| CVaR Risk Optimization | Hedge fund risk management | Strong tail-risk control | Increased turnover and costs |

| Backtesting Optimization | Retail and institutional algo strategies | Prevents overfitting, realistic simulations | Slower and resource-intensive |

Industry Trends in Optimization

- Shift Toward AI & ML: More firms are integrating reinforcement learning and neural networks.

- Real-Time Optimization: Increasing demand for adaptive algorithms that recalibrate during live trading.

- Risk-Centric Models: Greater focus on stress testing and scenario analysis post-2008 and 2020 crises.

- Cloud Computing: Optimization processes are moving to scalable cloud infrastructures to reduce costs.

Frequently Asked Questions (FAQ)

1. How do I avoid overfitting when optimizing a trading strategy?

Use walk-forward optimization and out-of-sample testing. Avoid relying solely on historical performance. Implement cross-validation techniques where applicable.

2. Which optimization method is best for beginners in trading?

Start with mean-variance portfolio optimization or simple parameter tuning. These methods are easier to understand before moving into machine learning or advanced statistical models.

3. Can optimization guarantee profitability?

No. Optimization improves robustness and performance but cannot eliminate market risk. Markets evolve, so strategies must be continuously monitored and re-optimized.

4. What role does execution play in optimization?

Execution is critical. Even perfectly optimized strategies can fail if slippage, latency, and transaction costs are not accounted for in the optimization process.

Conclusion

Optimization is not a one-time process but an ongoing cycle of refinement, testing, and validation. From portfolio optimization to machine learning-driven strategies, case studies reveal both the potential and pitfalls of applying optimization in trading.

For most traders, the best approach is a hybrid framework: start with simple, transparent optimization techniques, then gradually incorporate advanced methods like machine learning and CVaR as experience grows.

What do you think — do you prefer traditional optimization methods or cutting-edge AI-driven techniques? Share your insights in the comments below, and if you found this guide helpful, spread it among your trading community.

0 Comments

Leave a Comment