========================================================================

Introduction

Over the past decade, quantitative trading for professional retail investors has grown from a niche pursuit into a mainstream investment approach. Once the domain of hedge funds and proprietary trading firms, quantitative techniques—ranging from algorithmic execution to data-driven strategy design—are now accessible to ambitious retail investors with the right tools and discipline.

As someone who began as a retail trader experimenting with Excel-based backtests before moving into more advanced algorithmic platforms, I’ve seen firsthand how quant trading can transform an investor’s performance. However, success requires more than coding skills—it requires strategy, risk management, and a clear understanding of market dynamics.

This article provides a deep dive into quantitative trading for professional retail investors, exploring strategies, tools, benefits, challenges, and best practices. We’ll compare at least two key approaches, highlight their strengths and weaknesses, and conclude with recommendations for professional-level retail traders looking to scale. Along the way, we’ll naturally integrate insights from related guides such as how does quantitative trading work for retail traders and where can retail traders learn quantitative trading.

What Is Quantitative Trading?

A Clear Definition

Quantitative trading (or “quant trading”) is the use of mathematical models, statistical techniques, and automated systems to make trading decisions. Unlike discretionary trading, which relies on intuition, quant trading applies data analysis and algorithms to systematically exploit market inefficiencies.

Why Retail Investors Are Embracing It

The democratization of technology has enabled retail traders to access affordable trading platforms, data APIs, and cloud computing power. With brokers offering APIs and commission-free trading, quantitative trading for professional retail investors is no longer out of reach.

Why Quantitative Trading Matters for Professional Retail Investors

- Consistency – Algorithms trade based on rules, eliminating emotional bias.

- Scalability – Systems can monitor hundreds of assets simultaneously.

- Speed – Automated execution ensures trades are placed in milliseconds.

- Backtesting – Traders can simulate strategies on historical data before risking capital.

As markets become more competitive, the ability to combine systematic strategies with proper risk controls can mean the difference between long-term success and short-term failure.

Core Strategies in Quantitative Trading

1. Mean Reversion Strategies

Mean reversion assumes that asset prices eventually revert to their historical average.

- Example: A stock deviates 2 standard deviations from its moving average; the algorithm triggers a trade expecting reversion.

- Advantages: Works well in range-bound markets; relatively simple to code.

- Limitations: Performs poorly in trending markets; risk of extended deviations.

Prices often oscillate around a mean, creating trading opportunities.

2. Momentum and Trend-Following Strategies

Momentum strategies exploit persistent market trends by entering trades in the direction of movement.

- Example: Using moving averages (e.g., 50-day vs. 200-day crossover) to capture trends.

- Advantages: Profits from large directional moves; robust across asset classes.

- Limitations: False breakouts and whipsaw losses; requires strong risk controls.

Momentum systems thrive when markets exhibit strong directional movement.

3. Statistical Arbitrage

Statistical arbitrage (or “stat arb”) involves exploiting temporary mispricings between correlated assets.

- Example: Pair trading two highly correlated stocks—going long on one and short on the other when their spread diverges.

- Advantages: Market-neutral, reducing exposure to broad market risk.

- Limitations: Requires sophisticated modeling, high-quality data, and rapid execution.

Comparing the Strategies

| Strategy Type | Best Market Condition | Advantages | Weaknesses |

|---|---|---|---|

| Mean Reversion | Range-bound markets | Easy to implement | Weak in trending markets |

| Momentum | Trending markets | Captures big moves | False breakouts |

| Statistical Arbitrage | Relative mispricings | Market-neutral | Complex & data-heavy |

From experience, combining momentum and stat arb strategies provides balance: momentum captures large moves, while stat arb provides stable, market-neutral returns.

Tools and Platforms for Professional Retail Quant Traders

Trading Platforms

- MetaTrader, NinjaTrader, QuantConnect – Ideal for retail algorithmic traders.

- Python (with libraries like pandas, NumPy, backtrader) – Highly flexible, professional-grade environment.

Data Sources

- Free: Yahoo Finance, Alpha Vantage.

- Premium: Bloomberg Terminal, Quandl, Tick Data.

Execution Infrastructure

- Broker APIs (e.g., Interactive Brokers).

- Cloud computing (AWS, Google Cloud).

- VPS for 24⁄7 strategy execution.

Risk Management in Quantitative Trading

Professional retail investors must treat risk management as a cornerstone, not an afterthought.

- Position Sizing: Use volatility-adjusted sizing to avoid concentration risk.

- Stop Losses and Profit Targets: Algorithms must include automated exits.

- Portfolio Hedging: Apply protective puts or futures to reduce systemic exposure.

- Drawdown Control: Limit capital loss thresholds to preserve trading longevity.

Where Can Retail Traders Learn Quantitative Trading?

A common challenge for retail investors is education. Fortunately, access has improved dramatically:

- Online Courses – Coursera, QuantInsti, and Udemy provide structured learning.

- Open-Source Communities – GitHub, QuantConnect forums, and Kaggle offer real-world projects.

- Academic Papers and Books – Classics like Algorithmic Trading by Ernest Chan bridge theory and practice.

This directly connects to the broader topic of how does quantitative trading work for retail traders, which emphasizes that learning by doing—through backtesting, paper trading, and community engagement—is essential for mastery.

Industry Trends in Quantitative Trading for Retail Investors

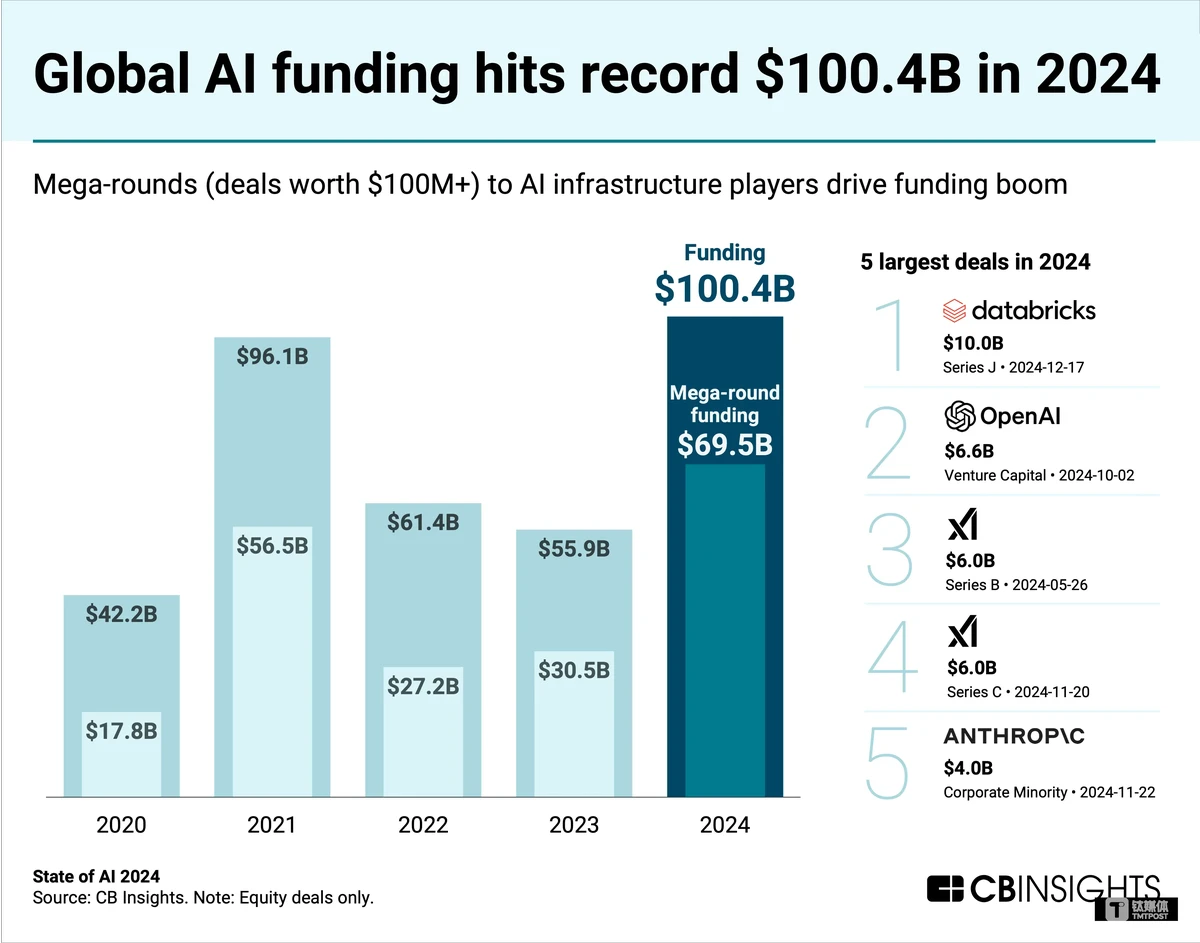

- AI and Machine Learning: Increasingly used to identify complex patterns.

- Alternative Data: Retail traders are tapping into satellite data, social media sentiment, and credit card spending insights.

- Fractional Investing: Enables smaller accounts to implement institutional-level diversification.

- Low-Code Platforms: Emerging solutions allow traders to build strategies without advanced coding skills.

AI and machine learning are reshaping quantitative trading for retail investors.

Common Challenges and How to Overcome Them

- Data Quality – Garbage in, garbage out. Retail investors must validate and clean datasets.

- Overfitting – Building strategies too closely tailored to historical data often leads to poor live results.

- Infrastructure Costs – Cloud computing and data feeds can add up; professional retail traders must balance sophistication with affordability.

- Psychological Discipline – Even systematic traders can interfere with algorithms; trust in the system is crucial.

FAQ: Quantitative Trading for Professional Retail Investors

1. Is quantitative trading suitable for all retail investors?

No. While powerful, it requires discipline, technical skills, and patience. Beginner retail traders may start with simpler strategies before scaling to complex models.

2. What initial capital is needed for professional retail quantitative trading?

It depends on the strategy. Mean reversion and swing trading strategies can start with \(10,000–\)25,000, while high-frequency or stat arb approaches often require $100,000+ due to infrastructure and data costs.

3. How long does it take to become proficient in quantitative trading?

Typically 12–24 months of consistent learning, backtesting, and live trading are needed before achieving consistent results. Joining communities and mentorship programs can significantly accelerate learning.

Conclusion

Quantitative trading for professional retail investors represents a paradigm shift in how markets are accessed and exploited. With the right mix of strategies, tools, and education, retail traders can now compete at a near-institutional level.

The best path forward often lies in combining strategies—such as momentum for trend capture and statistical arbitrage for stable returns—while maintaining strict risk management. By leveraging communities, platforms, and modern data science, retail investors can transform their trading into a professional-grade enterprise.

💡 Are you experimenting with your own quantitative trading system? Share your experience below, and don’t forget to share this article with fellow traders who are ready to take their retail trading to the next level!

0 Comments

Leave a Comment