==============================================

Regression analysis is one of the most powerful tools available to traders looking to improve their decision-making processes. For individual day traders, this statistical technique provides a way to predict market movements, refine strategies, and improve profitability by understanding the relationships between different market variables. This comprehensive guide will explore how regression analysis can be applied in day trading, focusing on key strategies, practical implementations, and the advantages it offers for individual traders.

What is Regression Analysis?

In its simplest form, regression analysis is a statistical method used to model the relationship between a dependent variable and one or more independent variables. In trading, the dependent variable often represents asset prices (e.g., stocks, commodities, or forex), and the independent variables represent factors that may influence those prices, such as economic indicators, past price movements, and technical indicators.

Key Types of Regression Used in Trading:

- Linear Regression: Models the relationship between two variables in a straight line.

- Multiple Regression: Uses multiple independent variables to predict the dependent variable.

- Logistic Regression: Applied when predicting binary outcomes, such as whether a price will go up or down.

Why Use Regression Analysis in Day Trading?

For individual day traders, regression analysis can significantly enhance trading strategies by providing insights into market trends, correlations, and future price movements. Here are a few reasons why regression analysis is crucial in day trading:

1. Predicting Market Trends

Regression models can identify trends and patterns in market data, allowing traders to predict potential price movements. For example, a trader might use linear regression to predict the next price point of a stock based on its historical performance.

2. Identifying Relationships Between Variables

Traders can use regression to assess how different factors influence an asset’s price. For instance, a trader may examine how technical indicators (such as the RSI or MACD) correlate with price movements and use this information to optimize trade entries and exits.

3. Improving Trading Accuracy

By using historical data and statistical models, traders can fine-tune their strategies and make more informed decisions, thus increasing their chances of success.

4. Backtesting and Strategy Optimization

Regression analysis allows traders to backtest their strategies, ensuring that their approaches have been effective in various market conditions. By testing strategies against historical data, traders can refine and improve their methods.

Types of Regression Techniques for Day Traders

Several types of regression techniques can be used in day trading, each suited for different types of market analysis. Let’s explore two of the most commonly used techniques for day traders.

1. Simple Linear Regression

Simple linear regression is often used when a trader wants to understand the relationship between two variables. In day trading, this might involve predicting the future price of a security based on its previous prices.

How It Works:

Equation: The basic equation for linear regression is:

Y=a+bXY = a + bXY=a+bX

Where:- YYY is the predicted value (future price).

- XXX is the independent variable (historical price).

- aaa is the intercept (the starting point of the line).

- bbb is the slope (indicating the strength of the relationship).

- YYY is the predicted value (future price).

Advantages:

- Simplicity: Linear regression is easy to implement and understand.

- Fast Analysis: It requires less computational power, making it ideal for quick analysis on short time frames.

Disadvantages:

- Limited to Two Variables: It only works well when you have a direct relationship between two variables, which can be a limitation in more complex trading scenarios.

2. Multiple Regression Analysis

Multiple regression analysis is more advanced and allows traders to model relationships between a dependent variable and multiple independent variables. This is particularly useful in day trading, where prices can be influenced by a variety of factors, such as volume, volatility, and macroeconomic data.

How It Works:

Equation: The equation for multiple regression is more complex:

Y=a+b1X1+b2X2+…+bnXnY = a + b_1X_1 + b_2X_2 + … + b_nX_nY=a+b1X1+b2X2+…+bnXn

Where:- YYY is the predicted price.

- X1,X2,…,XnX_1, X_2, …, X_nX1,X2,…,Xn are independent variables (like moving averages, volume, volatility).

- b1,b2,…,bnb_1, b_2, …, b_nb1,b2,…,bn are the coefficients that show the influence of each variable on the price.

- YYY is the predicted price.

Advantages:

- More Accurate Predictions: By considering multiple factors, traders can create more robust models that better reflect market realities.

- Flexibility: It allows the use of various technical and fundamental indicators, offering a more nuanced view of the market.

Disadvantages:

- Complexity: Multiple regression can be more difficult to implement and interpret, especially for beginners.

- Data Overfitting: When using too many variables, there’s a risk of overfitting, where the model becomes too tailored to historical data and fails to predict future trends effectively.

How to Use Regression Analysis to Improve Your Day Trading Strategy

Now that we have covered the basics of regression analysis, let’s explore how individual day traders can implement these techniques in their trading strategies.

1. Identify Relevant Variables

For regression analysis to be effective, you need to identify the most relevant independent variables that impact your asset’s price. Common variables for day traders include:

- Previous closing prices

- Volume

- Moving averages

- Volatility indicators

- Economic indicators (such as interest rates)

2. Backtest Using Historical Data

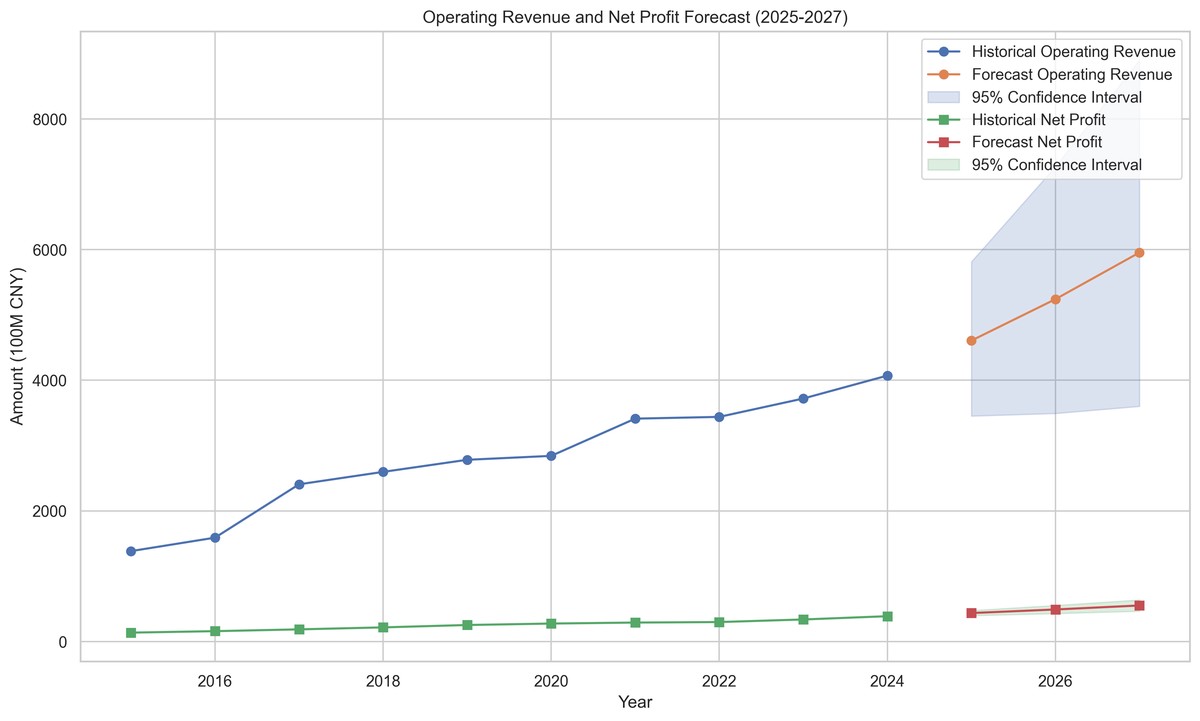

Once you have identified the variables, the next step is to backtest your regression model using historical data. This allows you to evaluate how well the model would have predicted past price movements, giving you an idea of its potential effectiveness.

3. Optimize the Model

Based on your backtesting results, refine your regression model by adjusting the variables or modifying the equation. For example, if you notice that adding an additional moving average improves the model’s performance, you can include it in your analysis.

4. Real-Time Trading

Once your regression model is optimized, you can apply it in real-time trading. For example, you might use the model to predict the future price of a stock or asset and then place trades based on the expected movement. Regression analysis can also help you decide the best entry and exit points for your trades.

FAQ: Regression Analysis for Day Traders

1. What is the difference between simple and multiple regression for day trading?

- Simple regression analyzes the relationship between a single independent variable (e.g., historical prices) and the dependent variable (e.g., future price), while multiple regression uses several independent variables (e.g., volume, volatility, and other technical indicators). Multiple regression offers more flexibility and accuracy by considering a broader range of factors.

2. How do I know if my regression model is accurate enough for day trading?

The accuracy of a regression model can be assessed through backtesting. You can compare the model’s predictions against historical data to see how well it performs. Additionally, key metrics like the R-squared value (which shows how well the model fits the data) can give you an idea of its predictive power.

3. Can regression analysis help with risk management in day trading?

Yes, regression analysis can help with risk management by identifying the factors that influence price movements and allowing you to predict potential drawdowns. For example, if your regression model predicts a high probability of a price drop, you can adjust your stop-loss orders or reduce leverage to mitigate risk.

Conclusion

Regression analysis is a powerful tool that individual day traders can use to refine their strategies and improve trading outcomes. By understanding the relationship between key market variables, traders can predict price movements, optimize trade entries and exits, and ultimately enhance their trading profitability. Whether you’re just starting out or you’re an experienced trader looking to fine-tune your approach, integrating regression analysis into your day trading strategy can provide a significant edge in today’s competitive markets.

Feel free to share your thoughts or ask any questions about how to use regression analysis in your day trading journey!

0 Comments

Leave a Comment