===========================================================

Introduction

In today’s highly competitive financial markets, sell side contributions to quantitative trading innovations play a central role in shaping how institutional investors, hedge funds, and even retail participants design and implement trading strategies. The sell side—comprising investment banks, broker-dealers, and research arms—provides not only liquidity and execution services but also proprietary data, advanced analytics, and insights that fuel the evolution of quantitative trading. This article explores the depth of sell side involvement, reviews different strategies and tools, compares their advantages and drawbacks, and highlights how traders can maximize value from sell side inputs.

Understanding the Role of Sell Side in Quantitative Trading

The Definition of Sell Side

The sell side represents financial institutions whose primary business is selling securities, providing market-making services, and offering research to buy side clients such as hedge funds, pension funds, and asset managers. Their contribution extends far beyond execution, acting as an essential pipeline of research, technology, and liquidity access.

Why the Sell Side Matters in Quantitative Trading

In quantitative trading, innovation is often linked to data-driven strategies. Sell side firms supply:

- Proprietary datasets (flow data, order book depth, client sentiment).

- Execution algorithms optimized for cost reduction.

- Macro and sector research embedded in systematic frameworks.

- Regulatory insights and compliance tools, vital for global trading strategies.

This makes the sell side indispensable for quants aiming to generate alpha while managing risk effectively.

Key Sell Side Contributions to Quantitative Trading Innovations

1. Advanced Execution Algorithms

Sell side firms pioneered execution algorithms such as VWAP, TWAP, POV, and more sophisticated adaptive algos. For quants, these tools enable precise trade execution while reducing slippage.

- Advantages: Lower transaction costs, improved execution quality, and scalability for high-frequency trading (HFT).

- Drawbacks: Heavy reliance on broker-specific models may reduce transparency for quants seeking customization.

2. Proprietary Market Data & Analytics

Sell side research teams deliver proprietary datasets, including order flow analytics, liquidity fragmentation reports, and volatility surfaces. These datasets form the backbone of many quantitative models.

- Advantages: Access to unique, non-public datasets enhances model precision.

- Drawbacks: Dependence on sell side datasets can create vendor lock-in and increase costs.

3. Innovation in Risk Management Tools

With growing regulatory scrutiny, sell side firms provide quantitative risk dashboards and stress-testing frameworks. These innovations help portfolio managers backtest strategies under extreme conditions.

- Advantages: Regulatory compliance and robust risk-adjusted returns.

- Drawbacks: Standardized sell side tools may lack flexibility for niche quant strategies.

Sell side contributions extend beyond execution to data, analytics, and risk management

Comparing Sell Side vs. Buy Side Innovations

Sell Side Strengths

- Scale of data collection across markets.

- Ability to invest in advanced technology like machine learning for execution.

- Direct regulatory and compliance expertise.

Buy Side Strengths

- Customization of strategies to meet client objectives.

- Ability to integrate sell side tools into proprietary models.

- Higher flexibility in testing alternative datasets.

Ultimately, sell side contributions complement buy side innovation, creating a symbiotic relationship where both sides co-evolve.

Methods to Leverage Sell Side Contributions in Quantitative Trading

Integrating Sell Side Data into Models

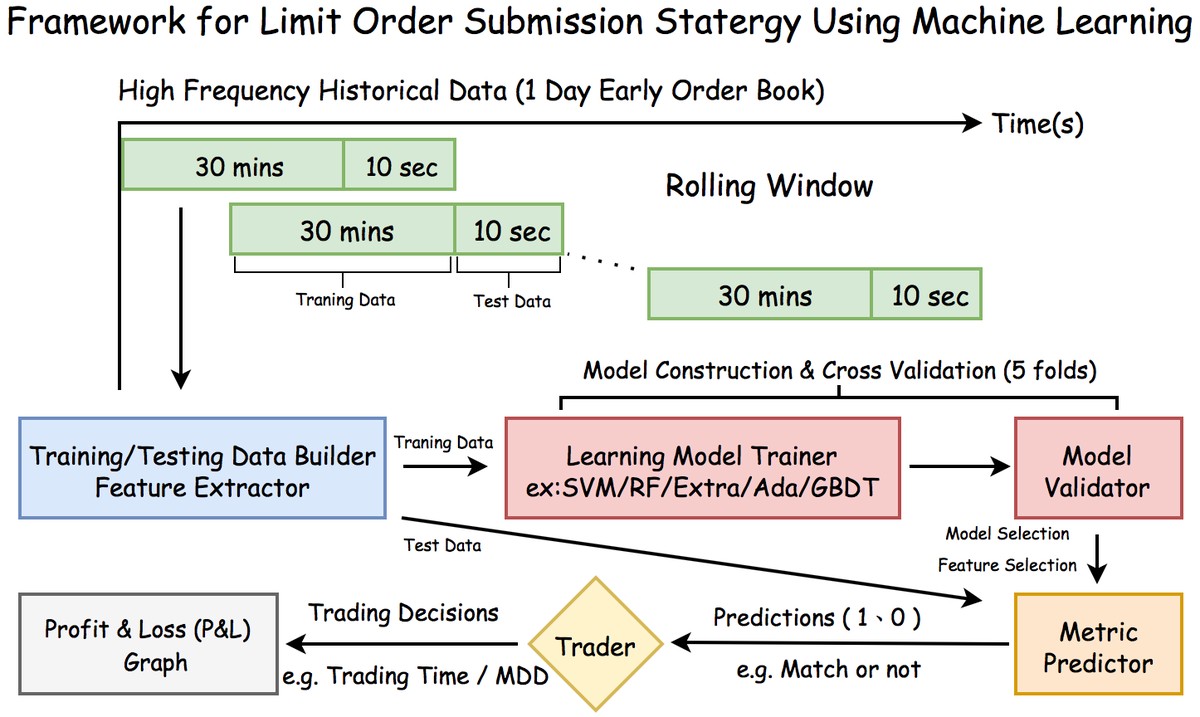

Quantitative traders often integrate sell side data feeds, from sentiment indices to cross-asset volatility metrics, directly into machine learning frameworks. Understanding how to use sell side research in quantitative trading effectively ensures that models capture forward-looking signals.

Leveraging Sell Side for Execution and Liquidity

For portfolio managers, sell side liquidity provision helps to minimize execution costs, particularly in fragmented markets. Execution algorithms designed by the sell side can be benchmarked and enhanced for better performance.

Emerging Trends in Sell Side Contributions

1. AI-Driven Execution and Forecasting

Sell side firms are increasingly deploying deep learning to anticipate market impact and recommend optimized order placements.

2. ESG Integration in Quant Models

Sell side research now incorporates ESG (environmental, social, governance) scoring, which quantitative funds can embed into risk-adjusted strategies.

3. Collaboration with Academia

Sell side teams collaborate with academic researchers to test new modeling techniques, creating fertile ground for next-generation innovations.

The ecosystem of sell side–buy side collaboration drives continuous innovation

Practical Case Studies

Case Study 1: Execution Cost Optimization

A hedge fund partnered with a sell side broker to implement adaptive execution algorithms, reducing average execution costs by 20% compared to traditional TWAP strategies.

Case Study 2: Alternative Data Integration

An institutional quant desk used sell side proprietary sentiment data from retail flow analysis to improve short-term market predictions, boosting alpha capture in equity derivatives.

These examples underscore the measurable value of sell side contributions.

Recommended Best Practices

- Diversify Sell Side Relationships: Avoid dependency on a single provider to reduce systemic risk.

- Benchmark Execution Algorithms: Regularly compare sell side algos with internal benchmarks.

- Integrate Data Selectively: Prioritize high-impact datasets rather than absorbing all available feeds.

- Collaborate Closely: Foster a partnership model with sell side research teams to co-develop ideas.

FAQs on Sell Side Contributions to Quantitative Trading

1. How do sell side firms influence quantitative model performance?

Sell side firms influence performance by offering proprietary datasets, execution strategies, and research insights that traders can integrate into their models. This enhances predictive accuracy and reduces trading costs.

2. Can quants rely solely on sell side tools for innovation?

No. While sell side tools are valuable, successful quants often combine them with proprietary models, alternative datasets, and independent research. Overreliance may limit innovation and create dependency.

3. Where can traders find sell side analysis for quantitative strategies?

Sell side analysis is available through broker research platforms, investment bank portals, and direct collaborations with research teams. Knowing where to find sell side analysis for quantitative strategies is critical for competitive advantage.

Conclusion

The sell side contributions to quantitative trading innovations remain indispensable in today’s markets. From advanced execution algorithms and proprietary data to risk management tools and ESG integration, the sell side provides the infrastructure that allows quants to innovate. However, traders must balance reliance on external resources with in-house development to ensure sustainable alpha generation.

If you found this article useful, feel free to share it with peers, comment with your experiences, or discuss how your trading strategies leverage sell side insights. Your engagement helps expand the conversation and strengthen the trading community.

Would you like me to also create a structured table that compares different sell side contributions (execution, data, risk management, ESG) with their advantages, limitations, and best use cases? That would make the article even more actionable for readers.

0 Comments

Leave a Comment