In the world of quantitative trading, making informed decisions is crucial for success. While much of the focus in quantitative strategies has traditionally been on data analysis, algorithm design, and market behavior, one often overlooked but highly influential factor is the role of the sell side. Sell-side firms, such as investment banks, brokers, and research analysts, offer insights and services that significantly shape quantitative trading decisions. Understanding how these sell-side influences operate can enhance the performance and accuracy of quantitative strategies. This article explores how sell-side research, data, and services affect quantitative trading, and how traders can integrate these insights into their models for optimal results.

The Role of Sell-Side in Quantitative Trading

What is the Sell-Side?

The sell side refers to firms or institutions that provide services related to the selling of financial products. These include:

Investment banks: Provide market research, analytics, and recommendations to investors.

Brokers: Facilitate the buying and selling of securities.

Sell-Side Analysts: Produce detailed research reports on companies, sectors, and markets.

In the context of quantitative trading, sell-side research and data can serve as crucial inputs, influencing trading algorithms and decision-making processes.

Sell-Side Research and Market Insights

Sell-side firms produce in-depth research reports that cover everything from macroeconomic trends to individual stock analysis. These reports often contain:

Equity Research: Deep dives into specific companies or sectors, which include earnings forecasts, valuation models, and risk assessments.

Economic Outlooks: Broad insights on economic conditions, interest rates, inflation, and geopolitical events.

Sentiment Analysis: Reports that gauge market sentiment and investor behavior based on news, earnings reports, and other data points.

These insights are valuable because they give quantitative traders a perspective on market sentiment, potential market-moving events, and individual security performance, all of which can be factored into trading models.

How Sell-Side Research Influences Quantitative Models

Quantitative trading strategies often rely on data-driven decisions, where the goal is to develop models that predict price movements or identify arbitrage opportunities. Sell-side research can provide critical data and market expectations that influence these models in several ways:

Enhancing Forecasting Models: Sell-side analysts often publish forecasts and price targets. Quant traders can incorporate these predictions into their machine learning algorithms, using them as variables to improve forecasting accuracy.

Market Sentiment: Sell-side reports often analyze investor sentiment, which can be translated into quantitative factors, such as sentiment scores or crowd behavior indices, used in algorithmic trading models.

Event-Driven Strategies: Sell-side research often highlights upcoming earnings announcements, mergers, or regulatory changes. Quantitative models can be tuned to execute trades around these events for profit opportunities.

Integration of Sell-Side Data in Quantitative Models

Quantitative models can benefit from integrating sell-side data by using it in a structured way. Common methods of integration include:

- Feature Engineering:

Sell-side research can be turned into features (independent variables) in trading algorithms. For example, an analyst’s sentiment score on a company might be converted into a feature that helps the algorithm predict whether the stock will rise or fall.

- Sentiment Analysis:

Natural language processing (NLP) techniques are often used to analyze sell-side research reports and extract sentiment signals. Traders can use sentiment analysis to inform trading decisions, especially in markets where investor sentiment plays a major role.

- Data Fusion:

By combining sell-side data with other types of data, such as macroeconomic indicators, alternative data, and historical price data, quants can create a more comprehensive view of the market, improving decision-making in the model.

Strategies to Incorporate Sell-Side Data into Quantitative Trading

- Using Sell-Side Research for Statistical Arbitrage

Statistical arbitrage strategies depend heavily on mean reversion and pair trading models, where the algorithm identifies pairs of securities that historically move in sync but diverge temporarily. Sell-side earnings reports, analyst upgrades/downgrades, and other research can help quants identify events likely to trigger these price divergences, improving the timing and accuracy of arbitrage trades.

Advantages:

Better Timing: Sell-side insights on upcoming earnings or announcements provide critical information that allows quants to time trades more effectively.

Enhanced Signal Strength: Sell-side reports can amplify signals in statistical arbitrage models, making them more reliable and accurate.

Disadvantages:

Noise: Not all sell-side research is useful. Traders must sift through large amounts of data and assess the relevance to their models, which can be time-consuming.

Lag in Data: Some sell-side insights are released after market-moving events, reducing their immediate trading value.

- Sentiment-Driven Quantitative Strategies

Sentiment-driven strategies use market sentiment, derived from sell-side research and news sources, to drive algorithmic trading decisions. By analyzing how sell-side analysts react to events, quants can gain an edge in predicting market reactions.

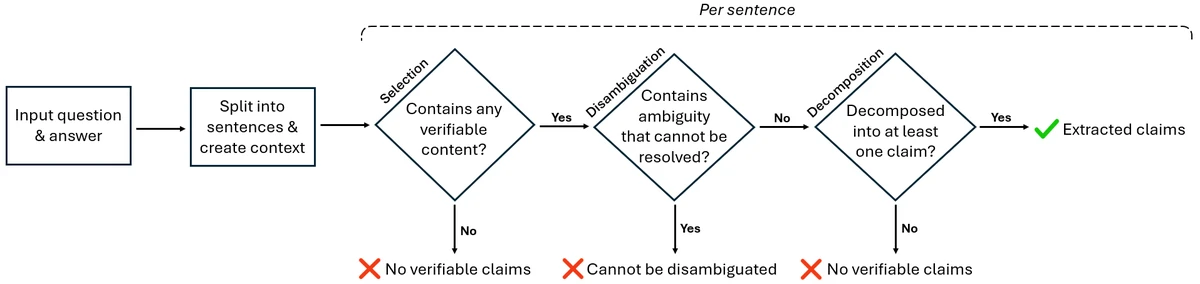

Process:

Collect Sell-Side Sentiment: Aggregate sentiment data from sell-side reports.

Quantify Sentiment: Use NLP to convert qualitative sentiment into a quantitative measure (positive, neutral, negative).

Implement in Algorithm: Feed sentiment scores into a predictive model that drives trading decisions based on sentiment changes.

Advantages:

Leverage Market Sentiment: Sentiment-driven strategies can capitalize on rapid market movements driven by sentiment shifts, which are often overlooked by traditional quantitative models.

Real-Time Insights: Sell-side reports often react quickly to events, providing real-time insights that quants can leverage.

Disadvantages:

Market Noise: Not all sentiment data will result in significant price movements, so filtering out noise is key.

Complexity: Building sentiment models can be challenging, especially when integrating large amounts of unstructured data.

Evaluating Sell-Side Data and Reports

- Accuracy of Forecasts

Sell-side analysts may offer forecasts on stock prices, earnings, and macroeconomic trends. Quantitative traders need to evaluate the accuracy of these forecasts by backtesting them against historical data. If an analyst consistently predicts the direction of a stock, their insights may provide valuable information for trading models.

- Consistency of Analysis

Look for patterns in the recommendations made by analysts. Are they typically early movers in identifying trends? Do they consistently beat the market? Understanding this will help quants determine the weight to assign to sell-side reports in their models.

- Correlation with Market Movements

Quant traders can analyze the historical correlation between sell-side analyst activity (upgrades, downgrades, price target changes) and price movements. This can help gauge how much influence sell-side data actually has on market behavior, allowing for better integration into models.

FAQ: Common Questions about Sell-Side Influence in Quantitative Trading

- How can sell-side research improve quantitative trading strategies?

Sell-side research provides valuable insights on market sentiment, stock valuations, and expected market events. By integrating these insights into quantitative models, traders can improve the accuracy and timing of their trades, leading to better profitability.

- What are the risks of relying on sell-side data in quantitative models?

While sell-side research can provide valuable information, not all of it is accurate or timely. Traders must assess the quality of the research and avoid overfitting their models to sell-side recommendations. Additionally, sell-side reports may be biased or influenced by conflicts of interest.

- How can quants filter out noise in sell-side reports?

To filter out noise, quants can use techniques like natural language processing (NLP) to analyze the sentiment and relevance of sell-side reports. By focusing on significant events or changes in analyst behavior, traders can eliminate irrelevant data and make more informed decisions.

Conclusion

Sell-side firms and their research have a significant impact on quantitative trading decisions. Whether you are looking to incorporate sell-side research into statistical arbitrage strategies or sentiment-driven models, understanding how to evaluate and integrate these insights can enhance your trading success. By leveraging sell-side data carefully, quants can improve their models’ performance and gain a competitive edge in the market.

Want to learn more about how to use sell side research in quantitative trading

or where to find sell side analysis for quantitative strategies

? Stay tuned for more insights and strategies to boost your quantitative trading skills!

0 Comments

Leave a Comment