==============================================

Slippage is a critical factor that affects trading performance in high-frequency trading (HFT), a strategy that relies on speed, automation, and precision to capture small price movements in financial markets. In high-frequency trading, where trades are executed in milliseconds, even the smallest deviation between the expected price and the actual execution price can result in significant profit or loss. This is why slippage is not just an inconvenience but a major consideration that can affect the profitability of trading strategies.

In this article, we will explore why slippage matters in high-frequency trading, the causes behind it, how it impacts HFT performance, and what strategies can be employed to manage or mitigate slippage. We will also dive into the role of slippage in algorithmic trading, examine real-world scenarios, and offer expert recommendations on reducing its impact.

What is Slippage?

Slippage occurs when there is a difference between the expected price of a trade and the actual execution price. In other words, slippage happens when an order is placed at a certain price, but by the time the trade is executed, the price has moved in the market. This can happen in any market, but it is particularly prominent in high-frequency and algorithmic trading, where the volume of trades and the speed at which they are executed can cause price changes within milliseconds.

There are two main types of slippage:

- Positive Slippage: This occurs when the trade is executed at a better price than expected. It is generally seen as a benefit.

- Negative Slippage: This occurs when the trade is executed at a worse price than expected. This is detrimental and can erode profits or lead to losses.

Slippage is an inevitable part of trading, especially in fast-moving and volatile markets. However, the extent to which slippage affects HFT strategies can vary based on several factors such as liquidity, market volatility, and the efficiency of the execution system.

Why Slippage Matters in High-Frequency Trading

In high-frequency trading, speed and execution precision are paramount. The goal is to profit from small, rapid price movements, often measured in milliseconds. Because trades are executed at such high speeds, even a slight delay or price fluctuation can have a significant impact on the profitability of a strategy.

1. Impact on Profitability

Slippage directly affects the profitability of high-frequency trading strategies. Since HFT is based on executing large volumes of trades with extremely small profit margins, even a small negative slippage can wipe out the potential gains from multiple trades.

For instance, if a trading algorithm expects to buy an asset at \(100, but due to slippage, the actual price is \)100.10, the trader has already incurred a 0.1% loss on the trade. This may seem negligible on a single trade, but in high-frequency trading, where thousands or even millions of trades are executed, the cumulative effect of slippage can be substantial.

2. Compounding Effect of Slippage

The compounded effect of slippage in HFT is particularly concerning. Since these strategies often involve short-term trades with high volumes, even small slippages can accumulate quickly. If multiple trades experience negative slippage, the total slippage incurred can outstrip the profits generated from the trades themselves.

For example, if a high-frequency trader executes 1,000 trades in a day, each with a 0.1% negative slippage, that results in a 10% reduction in profitability, even if each individual trade generates a small positive return. This makes controlling slippage critical for ensuring long-term profitability.

3. Market Liquidity and Slippage

Slippage is closely linked to market liquidity. In a highly liquid market, where there is a large volume of buy and sell orders, prices tend to remain stable, and slippage is minimal. However, in markets with low liquidity, such as certain stocks or cryptocurrencies, slippage can become more pronounced as the available liquidity may not be enough to fill orders at the desired price.

In HFT, liquidity is especially important because these strategies rely on executing many trades in a short time. If an HFT algorithm tries to execute a large order in a low-liquidity market, it may cause the market price to move, resulting in higher slippage.

4. High-Speed Execution and Price Movements

In high-frequency trading, orders are executed at lightning speeds, often in the milliseconds. However, even with sophisticated trading algorithms and lightning-fast execution systems, slippage can still occur due to rapid price movements. As the market moves, orders may be filled at different prices than expected, especially when there is sudden volatility or unexpected market events.

This is particularly important in algorithmic trading, where traders rely on pre-programmed strategies to automatically execute trades. A rapid price shift during the order execution window can lead to unfavorable slippage, diminishing the effectiveness of the trading algorithm.

5. Impact on Execution Models

The execution model chosen by traders can also impact the degree of slippage they experience. Market orders, which are executed immediately at the best available price, tend to be more prone to slippage compared to limit orders, which specify a price at which an order should be executed.

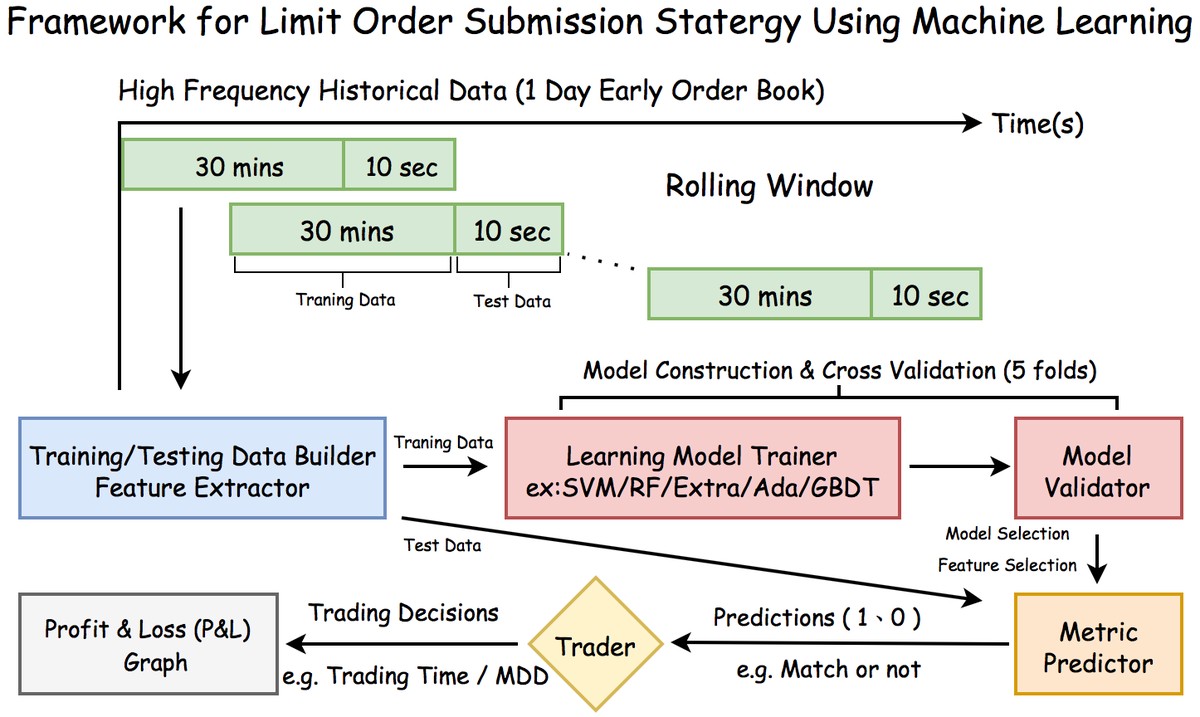

In HFT, algorithms may use market orders for faster execution, increasing the likelihood of slippage. On the other hand, limit orders can reduce slippage by ensuring that orders are only filled at specific prices, but they come with the risk of the order not being executed at all if the price doesn’t reach the specified level.

How to Minimize Slippage in High-Frequency Trading

Slippage may be an inherent part of high-frequency trading, but there are strategies to manage or reduce its impact. Below, we outline several approaches that can help mitigate slippage in HFT.

1. Optimizing Order Execution

Efficient order execution algorithms are crucial for minimizing slippage. These algorithms are designed to execute trades as efficiently as possible, ensuring that orders are filled at the best possible prices.

- Smart order routing (SOR): SOR algorithms automatically route orders to the venues offering the best liquidity, reducing slippage by ensuring orders are filled quickly at the most favorable prices.

- Iceberg orders: These orders break a large order into smaller pieces, allowing the trader to execute it over time without moving the market too much, which can help reduce slippage.

2. Liquidity Provision

Market participants can reduce slippage by providing liquidity to the market, especially in lower-volume trading environments. By using limit orders instead of market orders, traders can avoid the potential for slippage by specifying the price at which they want to trade.

3. Using Slippage-Adjusted Models

Some high-frequency trading strategies incorporate slippage-adjusted models that explicitly account for the likelihood of slippage in the backtesting phase. These models simulate how slippage will impact the strategy’s performance and adjust the trading parameters accordingly. This allows traders to design strategies that are more resilient to slippage in live markets.

4. Monitoring Market Conditions

High-frequency traders should closely monitor market conditions such as liquidity, volatility, and order book depth. By doing so, they can adjust their strategies in real time to minimize the impact of slippage. For example, during periods of high volatility or low liquidity, traders may choose to reduce the size of their trades to avoid triggering large price movements and incurring slippage.

FAQ

1. How does slippage affect trading performance in high-frequency trading?

Slippage negatively affects trading performance by eroding the profits from each trade. Since high-frequency trading strategies rely on small profit margins, even slight negative slippage can significantly impact the overall profitability of the strategy.

2. What causes slippage in high-frequency trading?

Slippage in high-frequency trading can be caused by several factors, including market volatility, low liquidity, rapid price movements, and delays in execution. These factors can cause the price of the asset to change between the time the order is placed and the time it is executed.

3. How can traders manage slippage in volatile markets?

Traders can manage slippage in volatile markets by using limit orders instead of market orders, optimizing order execution algorithms, and adjusting trade sizes to match current liquidity levels. Additionally, traders can incorporate slippage-adjusted models into their strategies to account for the impact of slippage in real-time.

Conclusion

Slippage is a significant factor in high-frequency trading, where precision and speed are crucial to success. While it is an inevitable part of trading, understanding the causes and impacts of slippage allows traders to implement strategies that minimize its effect. By using smart order routing, providing liquidity, optimizing order execution, and incorporating slippage-aware models, traders can mitigate the risks associated with slippage and ensure that their strategies remain profitable in a fast-paced market environment.

Effective management of slippage is not just about reducing losses, but also about ensuring that trading algorithms function as intended and that profits are maximized in competitive, high-speed markets.

0 Comments

Leave a Comment