===================================================

Stop loss is a well-established risk management tool used by traders to limit potential losses in a trade by automatically closing positions once a certain threshold is reached. Despite its widespread use and effectiveness in many scenarios, stop loss mechanisms can fail in some quantitative trading strategies. This article delves into the reasons why stop loss may fail, the limitations of relying on it, and how to mitigate these issues in quantitative strategies.

Understanding Stop Loss in Quantitative Trading

In quantitative trading, stop loss is designed to prevent excessive losses by triggering an automatic exit from a trade once predefined loss thresholds are breached. While stop loss is a crucial part of risk management, it’s not a one-size-fits-all solution.

The Role of Stop Loss in Quantitative Trading

- Risk Management: The primary goal of a stop loss is to define the maximum amount a trader is willing to lose on a trade.

- Automation: In algorithmic trading, stop losses are automated, ensuring that trades are exited without emotional interference.

- Capital Preservation: Stop losses protect capital by limiting losses to a set percentage of the trading capital.

While the mechanics behind stop loss appear straightforward, its effectiveness can be compromised under certain conditions, especially in volatile markets or when integrated into complex quantitative models.

Why Stop Loss Fails in Some Quantitative Strategies

Several factors contribute to the failure of stop loss in quantitative strategies. Let’s explore the most common reasons.

1. Slippage and Market Gaps

Slippage refers to the difference between the expected price of a trade and the actual execution price. During volatile market conditions or in fast-moving markets, slippage can prevent a stop loss order from being executed at the desired price.

How Slippage Affects Stop Loss:

- In fast-moving markets, prices may move quickly past a stop loss threshold, leading to execution at a worse price than expected.

- Gaps between trading sessions, especially in markets like cryptocurrencies, can cause stop loss levels to be missed entirely.

Example:

If a stock’s price closes at \(100 and opens the next day at \)90, a stop loss set at $95 would fail, as the price gap bypasses the trigger.

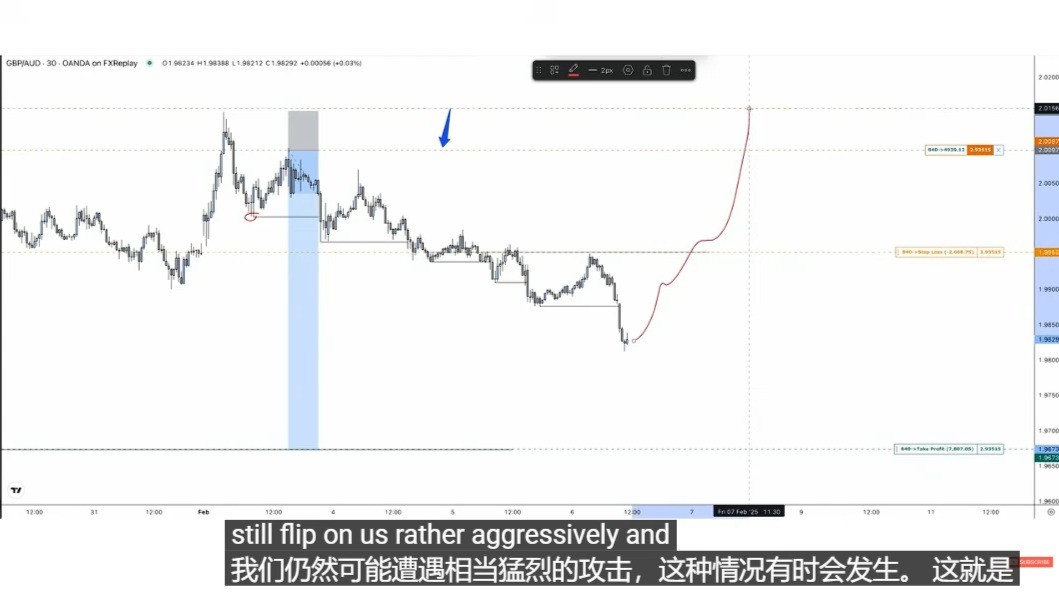

2. Volatility and Whipsaw Movements

Market volatility can trigger stop losses during short-term fluctuations or “whipsaws,” where prices rapidly reverse after triggering a stop loss, causing traders to exit positions unnecessarily.

Volatility and its Impact:

- High Volatility: In markets with high volatility, prices can swing back and forth across stop loss levels, triggering premature exits.

- Whipsaw: A sudden reversal in price after a stop loss has been triggered leads to missed opportunities for profit recovery.

3. Incorrect Stop Loss Placement

Setting a stop loss too close to the entry point can lead to premature exits during normal price fluctuations. Conversely, placing it too far from the entry point increases the potential for larger losses before the stop loss is activated.

Best Practices for Stop Loss Placement:

- Optimal Distance: An optimal stop loss should be placed based on historical volatility, rather than a fixed percentage.

- ATR (Average True Range): The ATR indicator is commonly used to set stop loss levels that adjust dynamically based on market volatility.

4. Overreliance on Stop Loss in Complex Strategies

In highly complex quantitative strategies that incorporate multiple risk management tools, relying solely on stop loss can result in overlooking other critical risk factors. This overreliance can lead to poor decision-making during high-risk scenarios.

When Stop Loss Isn’t Enough:

- Complex algorithms often require additional layers of risk management, such as dynamic position sizing or volatility-based adjustments.

- A stop loss alone does not account for changing market conditions or correlations between multiple assets in a portfolio.

5. Market Manipulation and Flash Crashes

Certain market conditions, such as flash crashes or market manipulation, can create rapid price movements that bypass stop loss orders entirely. These events can cause large, unexpected losses before the stop loss has a chance to trigger.

Example:

During the 2010 Flash Crash, several stocks experienced sudden and extreme price drops that overwhelmed stop loss mechanisms, causing traders to incur significant losses before any action could be taken.

6. Latency and Execution Delay

In algorithmic trading, execution latency—the time delay between the signal generation and trade execution—can cause stop loss orders to be executed later than intended, particularly in high-frequency trading environments.

Latency in Execution:

- High-frequency trading: In ultra-low latency environments, even a few milliseconds of delay can lead to discrepancies between stop loss orders and actual execution prices.

- Connectivity Issues: Poor connectivity between the algorithm and the exchange can also contribute to execution delays, reducing the reliability of stop loss orders.

How to Mitigate the Failure of Stop Loss in Quantitative Strategies

Given the limitations of stop loss in certain scenarios, traders and quant developers can take several steps to mitigate the failure of stop loss and enhance their overall risk management framework.

1. Use Trailing Stop Loss Orders

A trailing stop loss moves with the market price, ensuring that the stop loss is adjusted as the market moves in favor of the trade. This helps lock in profits while still allowing for some flexibility in case of short-term fluctuations.

Benefits of Trailing Stop Loss:

- Profit Lock-In: Captures profits as the price moves in the trader’s favor.

- Dynamic Adjustment: Unlike fixed stop losses, trailing stops adjust automatically to favorable price movements.

2. Combine Stop Loss with Other Risk Management Tools

Incorporating stop loss with other risk management strategies, such as dynamic position sizing, diversification, or volatility filtering, helps reduce reliance on stop loss alone. These techniques can help adjust capital allocation and risk exposure in real-time, providing a more comprehensive risk management system.

Example:

Use volatility-based position sizing to adjust how much capital is allocated to trades based on recent price movements, reducing the impact of volatility-induced stop loss failures.

3. Employ Advanced Order Types (e.g., Stop Limit Orders)

Using advanced orders, such as stop limit orders, can help mitigate slippage by specifying a price at which the stop loss is to be executed. This ensures that the trade is only executed at the specified price or better, reducing the chances of significant slippage.

4. Enhance System Performance with Low-Latency Infrastructure

Improving the speed and efficiency of the algorithm’s execution can help reduce latency issues. Employing low-latency systems and colocating servers near exchanges can help execute stop loss orders more reliably, especially in high-frequency environments.

5. Implement Multi-Layered Risk Management

Multi-layered risk management systems, which combine stop loss with other triggers (such as max drawdown limits, profit-taking strategies, and volatility adjustments), can provide a more robust risk control framework, helping reduce the likelihood of stop loss failures.

FAQ: Common Questions About Stop Loss in Quantitative Trading

1. What are the best ways to set a stop loss in quantitative trading?

The best way to set a stop loss is based on market volatility and historical data. Using indicators like the Average True Range (ATR) helps set stop loss levels dynamically. Avoid using fixed percentages, as they often don’t account for market conditions.

2. Why do stop losses fail in volatile markets?

In volatile markets, prices can move rapidly, causing slippage and triggering whipsaw movements, where a stop loss is triggered prematurely, only for the price to reverse shortly after. It’s crucial to adjust stop loss levels based on volatility to mitigate this risk.

3. How can I reduce the risk of stop loss failure in my algorithm?

You can reduce the risk of stop loss failure by combining stop loss with other risk management tools like position sizing, trailing stops, and volatility-based adjustments. Additionally, using advanced order types (such as stop limit orders) and improving your system’s latency can further enhance the reliability of your stop loss.

Conclusion

While stop loss is a vital component of risk management in quantitative strategies, it is not infallible. Understanding its limitations and incorporating complementary risk management techniques can significantly improve the robustness of your algorithm. By using trailing stops, combining stop loss with other tools, and optimizing execution infrastructure, you can reduce the likelihood of stop loss failure and protect your capital effectively.

0 Comments

Leave a Comment