====================================

Trading can be both exciting and overwhelming, especially for beginners navigating volatile markets. One of the most essential skills for success is learning how to secure profits before they vanish. That’s where take profit strategies for beginners come into play. A take profit (TP) order allows traders to lock in gains at a predefined price, ensuring that emotional decisions don’t undermine a good trade. In this guide, we’ll break down practical strategies, compare methods, and explore tools that help beginners create consistent results.

Understanding Take Profit in Trading

What Is a Take Profit Order?

A take profit order is a preset instruction that closes your trade once the price reaches a certain target. Unlike a stop loss, which limits downside risk, TP ensures you exit at the right time to secure gains.

For example, if you buy a stock at \(100 and set your TP at \)110, your position automatically closes once the price hits \(110, locking in a \)10 gain.

Why Take Profit Strategies Matter

Without a proper plan, traders often hold onto winning trades for too long, hoping for more gains, only to see profits disappear when the market reverses. That’s why why use take profit in trading is a question every beginner should answer early on. It enforces discipline, reduces emotional stress, and improves long-term consistency.

Common Take Profit Strategies for Beginners

1. Fixed Percentage Targets

This method involves setting a TP level based on a predetermined percentage gain (e.g., 2% or 5%).

Advantages:

- Simple and easy for beginners

- Clear profit expectations before entering a trade

- Prevents overtrading and chasing gains

Disadvantages:

- Too rigid—markets don’t always move in neat percentages

- May leave money on the table if the trend continues strongly

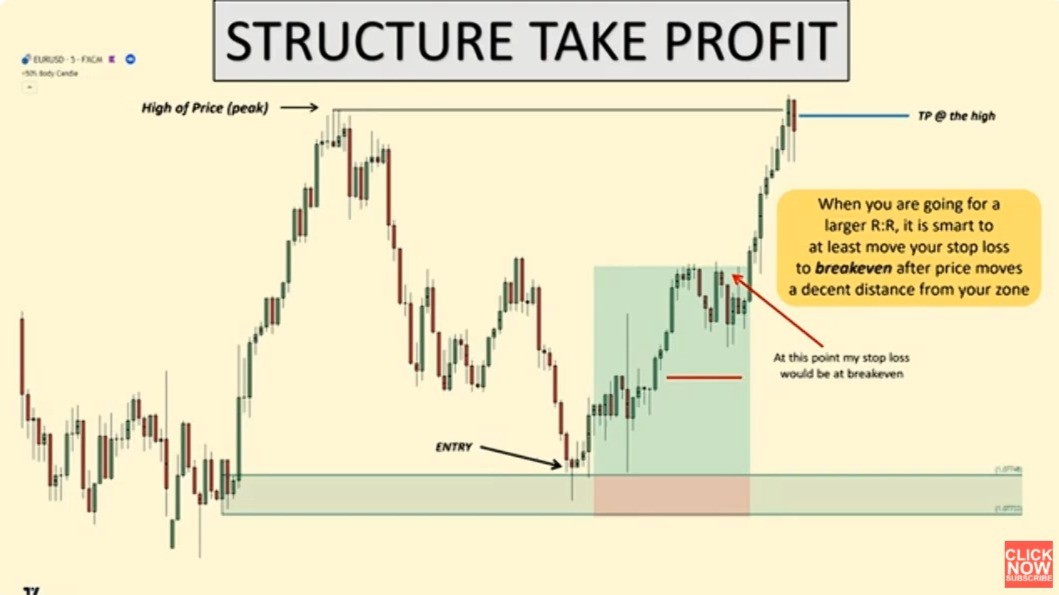

2. Risk-to-Reward Ratio Strategy

Here, traders set TP based on their stop loss. For example, if your stop loss is \(50, you might aim for a \)100 profit, following a 1:2 risk-to-reward ratio.

Advantages:

- Ensures logical, consistent profit targets

- Helps beginners manage risk effectively

- Works across forex, stocks, and crypto

Disadvantages:

- Requires discipline to respect ratios

- Market volatility may hit stop losses before reaching TP

3. Technical Indicator-Based Targets

Many traders use indicators like Fibonacci retracement, moving averages, or Bollinger Bands to set TP levels.

Advantages:

- Adapts to market conditions

- Offers precise targets based on historical data

- Useful in trending markets

Disadvantages:

- Requires learning technical analysis

- Not always effective in choppy or sideways markets

4. Scaling Out of Positions

Instead of closing the entire trade at one level, traders can take partial profits at multiple stages. For example, sell half at 2% profit and the rest at 5%.

Advantages:

- Reduces risk of missing profits

- Allows participation in extended trends

- Great for emotional control

Disadvantages:

- More complex execution for beginners

- Requires careful planning of position size

Comparing the Strategies

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Fixed Percentage | Absolute beginners | Easy to implement, clear exit | Too rigid, may cut profits early |

| Risk-to-Reward Ratio | Beginners–intermediate | Risk control, consistent | May hit stop losses prematurely |

| Technical Indicators | Analytical learners | Data-driven, trend friendly | Requires technical knowledge |

| Scaling Out | Risk-averse traders | Flexible, emotion control | Complex, reduces max profit |

Recommendation: For most beginners, starting with a risk-to-reward ratio strategy and gradually integrating technical indicator-based targets is the most balanced approach.

Practical Applications for Beginners

How to Set Take Profit in Trading

When setting a TP, always align it with your entry strategy. For example, if your trade is based on a breakout, place TP near the next resistance level rather than picking an arbitrary number. This ensures your exit makes sense within the market context.

Where to Apply Take Profit Strategy

TP strategies work across multiple asset classes—stocks, forex, crypto, and even options. However, volatility levels differ. In forex, small TP levels may work due to high liquidity, while in crypto, larger TPs may be required to account for big swings.

Tools and Platforms That Help with Take Profit

- TradingView: Excellent for chart-based TP analysis using technical indicators.

- Broker Platforms: Most brokers offer built-in TP and SL order types.

- Take Profit Calculators: Useful for calculating levels based on account size, risk percentage, and market volatility.

A clear risk-to-reward setup ensures disciplined exits for beginners.

Industry Trends in Take Profit Strategies

- Algorithmic Take Profit Tools: Many platforms now allow automated TP adjustments as the trade moves in your favor.

- AI-Enhanced Analysis: Machine learning can suggest optimized TP levels based on historical data.

- Mobile Integration: Real-time alerts help beginners adjust TP levels while on the go.

FAQs About Take Profit Strategies for Beginners

1. Should beginners always use take profit orders?

Yes. Beginners should always use TP orders as they provide structure and prevent emotional mistakes. Even experienced traders rely on TPs to maintain consistency.

2. How do I choose the right take profit level?

The best TP level depends on your strategy. If you use risk-to-reward ratios, aim for at least 1:2. If you rely on technical analysis, align your TP with resistance levels or Fibonacci targets.

3. Can I adjust my take profit once a trade is live?

Yes, many traders adjust TPs if the market continues trending in their favor. However, beginners should avoid frequent adjustments unless they are based on clear technical signals.

Final Thoughts

For beginners, mastering take profit strategies is as important as learning when to enter trades. A disciplined TP plan protects gains, reduces stress, and builds long-term trading consistency. Whether you start with fixed percentages, ratios, or technical setups, the key is sticking to your plan and refining it as you gain experience.

If this article gave you clarity, share it with fellow traders or drop a comment below—what take profit strategy has worked best for you so far? Your insights could inspire other beginners on their trading journey.

0 Comments

Leave a Comment