=======================================================

Financial markets are inherently unpredictable, full of sudden price swings, unusual trading patterns, and rare market shocks. For traders, detecting these irregularities—commonly called anomalies—can be the difference between profit and loss. Traditional methods often fail to spot hidden signals in noisy data, but with the advancement of machine learning for anomaly detection, traders now have a powerful tool to manage risks, uncover opportunities, and improve decision-making accuracy.

In this article, we’ll explore why traders need machine learning for anomaly detection, compare different methods, highlight practical applications, and provide actionable insights for both beginners and advanced professionals.

Understanding Anomaly Detection in Trading

An anomaly refers to any unusual data point or event that deviates significantly from expected behavior. In trading, anomalies could include:

- Unusual price spikes or crashes

- Sudden shifts in trading volume

- Outlier order book activities

- Abnormal correlations between assets

Anomaly detection is particularly valuable in quantitative trading, where algorithms rely on consistent patterns. Identifying deviations early allows traders to avoid losses or exploit profitable inefficiencies.

Machine learning models detect hidden irregularities in market data that traditional systems often miss.

Why Traders Need Machine Learning for Anomaly Detection

1. Financial Data Is Complex and High-Dimensional

Markets generate massive volumes of multi-dimensional data: prices, volumes, sentiment, macroeconomic indicators, and more. Traditional statistical models struggle to process this complexity, while machine learning excels at handling large, high-dimensional datasets.

2. Market Conditions Are Non-Stationary

Unlike stationary systems, financial markets change constantly. A strategy that worked yesterday may fail tomorrow. Machine learning algorithms, especially adaptive models, can adjust to evolving market dynamics and detect anomalies in real time.

3. Traditional Models Fail in Extreme Scenarios

Events like flash crashes or liquidity shocks often fall outside the scope of classical models. Machine learning is better at identifying nonlinear relationships and rare events that standard statistical techniques miss.

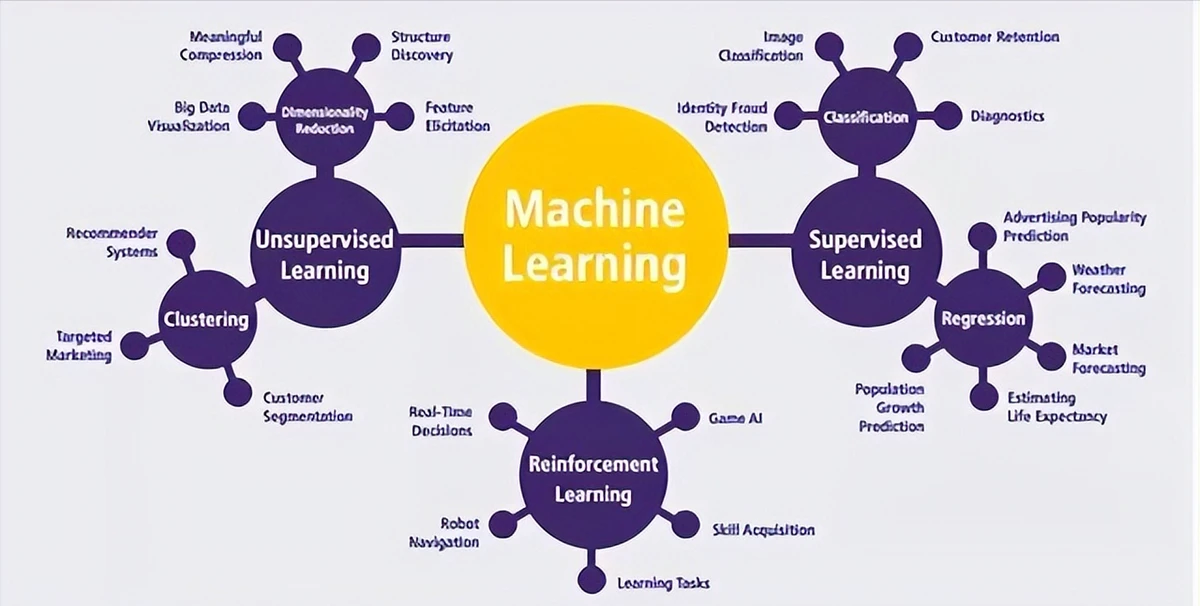

Two Core Machine Learning Methods for Anomaly Detection in Trading

1. Unsupervised Learning for Pattern Recognition

Unsupervised algorithms such as K-means clustering, Isolation Forests, and Autoencoders are often used to detect irregularities without prior labeling.

How it works: The model learns the “normal” behavior of financial data. Any deviation from this baseline is flagged as an anomaly.

Pros:

- Does not require labeled data (ideal for trading, where anomalies are rare and labels are scarce).

- Flexible across multiple markets and instruments.

- Does not require labeled data (ideal for trading, where anomalies are rare and labels are scarce).

Cons:

- May generate false positives.

- Requires fine-tuning to avoid overfitting.

- May generate false positives.

2. Supervised Learning for Predictive Anomaly Detection

Supervised methods (e.g., Random Forest, Gradient Boosting, Deep Neural Networks) rely on labeled datasets of past anomalies and normal trading behavior.

How it works: The model is trained to distinguish anomalies from regular data points based on historical events.

Pros:

- High accuracy when quality labeled data is available.

- Can learn complex relationships between multiple indicators.

- High accuracy when quality labeled data is available.

Cons:

- Requires large amounts of high-quality labeled data.

- Models may fail to generalize to new, unseen anomaly types.

- Requires large amounts of high-quality labeled data.

Comparing supervised vs unsupervised anomaly detection methods in trading.

Comparing the Two Approaches

| Feature | Unsupervised Learning | Supervised Learning |

|---|---|---|

| Data Requirement | No labels required | Needs labeled anomalies |

| Adaptability | Flexible across new markets | Strong for known patterns |

| Accuracy | Risk of false positives | Higher accuracy with good data |

| Best For | Traders lacking labeled anomaly datasets | Advanced traders with historical event data |

Recommendation: For most traders, a hybrid approach works best. Use unsupervised methods to explore unknown anomalies and supervised models to refine detection for known risks.

How Anomaly Detection Improves Trading Performance

Machine learning-based anomaly detection enhances trading in multiple ways:

- Risk Management: Early warnings about unusual price moves reduce drawdowns.

- Alpha Generation: Spotting hidden opportunities (e.g., arbitrage or mispricing).

- Operational Efficiency: Preventing execution errors or manipulation by detecting unusual order book activity.

To dive deeper into implementation details, explore how anomaly detection improves trading performance for systematic strategies.

Real-World Applications of Machine Learning Anomaly Detection in Trading

- Detecting Market Manipulation

Traders can identify spoofing or wash trading by analyzing unusual order flows.

- Flash Crash Prevention

Algorithms detect rapid liquidity drops, allowing traders to cut losses early.

- Portfolio Risk Alerts

Detect correlations that break suddenly (e.g., stocks diverging from indices).

- Execution Monitoring

Ensure algorithmic orders are executed correctly by identifying unusual slippage.

Common Challenges in Applying Machine Learning for Anomaly Detection

- Data Quality Issues: Noisy, incomplete, or biased data can mislead models.

- Overfitting Risks: Models may learn past noise instead of general patterns.

- Interpretability: Complex deep learning models often act as “black boxes,” making it hard for traders to trust signals.

- Computational Costs: Real-time anomaly detection requires significant computing resources.

Where to Apply Anomaly Detection in Trading Algorithms

Anomaly detection is not just for backtesting; it plays a role in live execution too. Key application areas include:

- Pre-trade analysis: Screening for unusual conditions before opening positions.

- In-trade monitoring: Adjusting stop-loss or leverage in response to detected anomalies.

- Post-trade review: Identifying unusual performance deviations for strategy refinement.

For a deeper understanding, check out where to apply anomaly detection in trading algorithms to see practical use cases across different trading styles.

Machine learning anomaly detection applied at different stages of trading lifecycle.

Frequently Asked Questions (FAQ)

1. Can anomaly detection eliminate trading risks completely?

No. While anomaly detection improves awareness and risk control, it cannot fully eliminate risk. It should be used alongside other risk management strategies like hedging and diversification.

2. What data sources are best for anomaly detection in trading?

High-frequency price data, order book depth, news sentiment feeds, and macroeconomic releases are common inputs. The richer and cleaner the data, the more effective anomaly detection becomes.

3. Is anomaly detection only useful for institutional traders?

Not at all. Retail traders can benefit from anomaly detection too, especially with the rise of accessible cloud-based tools and plugins integrated into trading platforms.

Conclusion

Traders face markets full of unpredictability, hidden risks, and rare but devastating events. By adopting machine learning for anomaly detection, traders can not only protect themselves from unexpected losses but also uncover hidden alpha opportunities.

Both unsupervised and supervised methods have unique strengths, and the most effective strategies combine them to create adaptive, real-time anomaly detection systems.

For anyone serious about trading in today’s fast-moving markets, machine learning anomaly detection isn’t optional—it’s essential.

Encourage Social Sharing

Did this guide help you understand why anomaly detection is crucial for traders? Share it with your trading network, and comment below with your experiences using machine learning for anomaly detection!

Machine learning anomaly detection: powering the next generation of trading strategies.

0 Comments

Leave a Comment