======================================================

In today’s data-driven markets, detecting unusual patterns and outliers has become a critical edge for traders and quantitative analysts. Knowing where to apply anomaly detection in trading algorithms can drastically improve performance, reduce risks, and uncover hidden opportunities that traditional models may miss. This comprehensive guide will explore the best applications of anomaly detection, compare strategies, and offer actionable insights for both beginners and advanced practitioners.

Understanding Anomaly Detection in Trading

Anomaly detection refers to identifying irregular patterns in data that deviate significantly from expected behavior. In trading, these anomalies could represent unusual price spikes, irregular order book activity, or rare volatility events.

- Definition: A systematic method to detect market behaviors outside the statistical norm.

- Purpose: To flag unusual events that could indicate trading opportunities or risks.

- Tools: Statistical models, machine learning techniques, and real-time monitoring systems.

Where to Apply Anomaly Detection in Trading Algorithms

1. Market Data Monitoring

Markets produce massive data streams, including prices, volumes, and spreads. Anomaly detection can highlight suspicious moves, such as sudden illiquidity or unusual spreads, helping traders anticipate risks.

2. Volatility Detection

Abnormal volatility spikes often signal critical events. Detecting these in real time allows for defensive actions, such as tightening stop-loss levels or hedging positions.

3. Order Flow and Execution Quality

In algorithmic execution, anomalies can reveal inefficiencies such as slippage or latency spikes. By detecting them early, firms can optimize execution algorithms.

4. Risk Management Systems

Risk models sometimes fail during extreme events. Integrating anomaly detection ensures early warnings for drawdowns, exposure breaches, or liquidity risks.

Two Approaches to Anomaly Detection in Trading

To fully understand where to apply anomaly detection in trading algorithms, let’s compare two common methodologies.

1. Statistical Rule-Based Detection

This method uses thresholds derived from historical data. For example, a z-score greater than 3 might flag unusual price movements.

Advantages:

- Easy to implement.

- Transparent and explainable.

- Easy to implement.

Disadvantages:

- Rigid thresholds may miss subtle patterns.

- Sensitive to data noise.

- Rigid thresholds may miss subtle patterns.

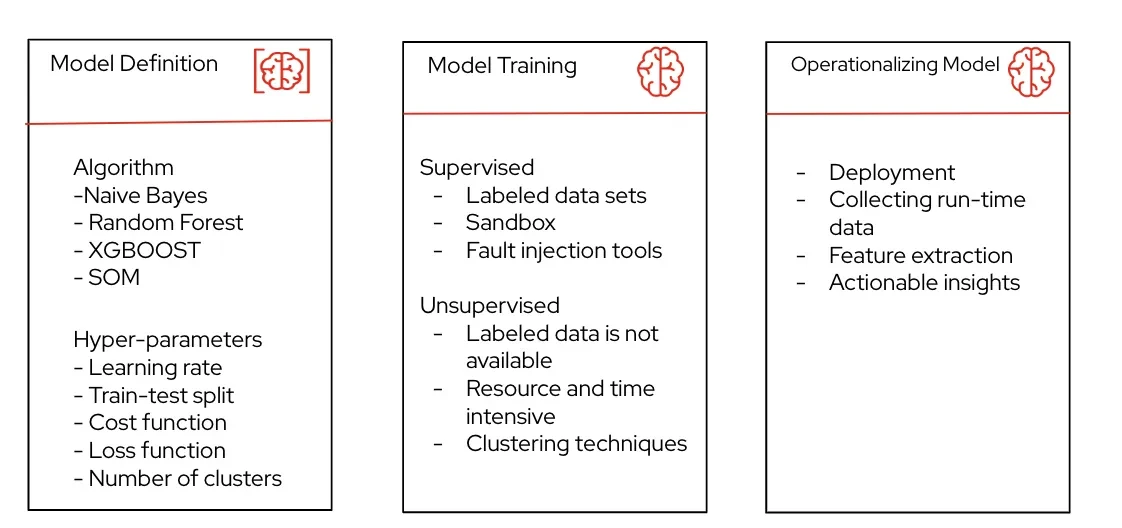

2. Machine Learning-Based Detection

Here, unsupervised or semi-supervised models (e.g., Isolation Forests, Autoencoders) learn from historical data to classify anomalies dynamically.

Advantages:

- More adaptive to complex patterns.

- Capable of handling multi-dimensional data.

- More adaptive to complex patterns.

Disadvantages:

- Requires expertise in model training.

- Risk of overfitting without proper validation.

- Requires expertise in model training.

Recommendation: For professional use, a hybrid model that combines statistical baselines with machine learning adaptability tends to provide the best balance of accuracy and robustness.

Why Anomaly Detection Matters in Modern Algo Trading

As algorithms dominate global markets, the ability to catch rare signals before others creates a competitive advantage. Knowing how to use anomaly detection in quantitative trading ensures strategies are not blindsided by unexpected events, from flash crashes to algorithmic manipulation.

Another critical reason is performance improvement: anomaly detection helps refine models by filtering out noise and focusing on high-probability events, making it essential for modern quant strategies.

Real-World Applications

High-Frequency Trading (HFT)

Detecting anomalies in millisecond order book updates can identify spoofing or layering by other participants.

Portfolio Risk Control

Anomaly detection in correlations between assets helps traders avoid unexpected co-movements, especially during crises.

Crypto and Emerging Markets

These markets are prone to manipulation and irregular liquidity. Real-time anomaly detection flags potential wash trades or pump-and-dump events.

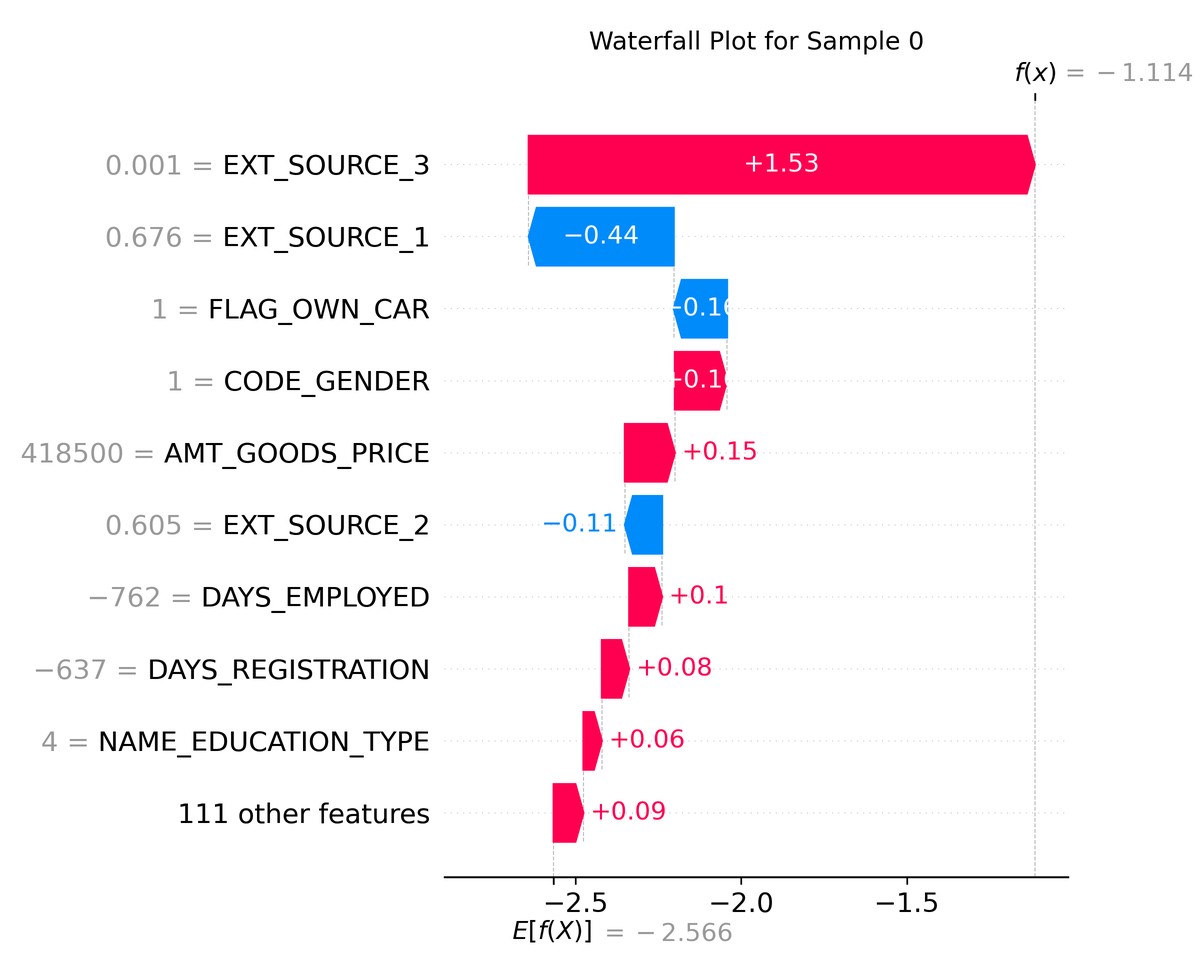

Visualization of unusual patterns flagged by anomaly detection in financial markets.

My Experience with Anomaly Detection in Trading

In my own work, anomaly detection proved most valuable in risk monitoring. A machine learning-based anomaly detection system flagged unusual correlations in my multi-asset portfolio during the COVID-19 market crash. While my baseline risk model underestimated exposure, the anomaly detection system provided an early warning that allowed me to reduce positions ahead of major drawdowns.

This experience reinforced that anomaly detection isn’t just about finding opportunities—it’s a critical defense mechanism.

Best Practices for Implementing Anomaly Detection

- Combine Multiple Techniques: Use both statistical baselines and machine learning.

- Validate Thoroughly: Avoid overfitting by testing on multiple market regimes.

- Integrate with Risk Systems: Make anomaly detection part of broader risk management, not a standalone tool.

- Monitor in Real-Time: Batch processing is too slow for modern markets; real-time alerts are essential.

FAQ: Where to Apply Anomaly Detection in Trading Algorithms

1. Is anomaly detection only for advanced quants?

Not necessarily. While advanced methods use machine learning, simple statistical techniques like moving averages or Bollinger Band deviations are accessible for beginners. Many platforms now offer built-in anomaly detection tools.

2. Can anomaly detection guarantee profits?

No. Anomaly detection highlights unusual events, but interpreting them correctly is key. Some anomalies signal opportunities, others indicate risks. It improves decision-making but doesn’t replace sound strategy and discipline.

3. How does anomaly detection improve trading performance?

It filters out noise, flags rare opportunities, and provides early warnings for risks. This reduces drawdowns, enhances execution quality, and improves risk-adjusted returns over time.

Conclusion: The Future of Anomaly Detection in Trading

As financial markets become increasingly complex and fast-moving, anomaly detection is no longer optional—it’s essential. From risk management to strategy refinement, knowing where to apply anomaly detection in trading algorithms separates average strategies from high-performance systems.

For traders, the best path forward is integrating anomaly detection with machine learning and risk management frameworks. Whether you’re building automated systems or refining manual approaches, anomaly detection can serve as both a shield and a sword.

Final Thoughts

What’s your experience with anomaly detection in trading? Have you used it primarily for opportunities or for risk control? Share your thoughts below and spread this article with your trading community to help others explore the power of anomaly detection.

Machine learning-based anomaly detection improving trading performance.

0 Comments

Leave a Comment