====================================================

Anomaly detection plays a pivotal role in quantitative trading by identifying unusual patterns in financial data that could signal potential trading opportunities, market shifts, or risks. This article explores how anomaly detection can be integrated into quantitative trading strategies, discusses various techniques, and provides practical advice for implementing these methods. We will also compare different strategies, evaluate their effectiveness, and discuss the future of anomaly detection in the financial markets.

Understanding Anomaly Detection in Quantitative Trading

Anomaly detection refers to the process of identifying rare events or observations that deviate significantly from the expected behavior in data. In quantitative trading, anomaly detection methods are used to spot irregular market movements, price spikes, or other unusual patterns that can impact trading strategies.

These anomalies can manifest as price movements that don’t align with historical patterns, volume spikes, or other outliers that could indicate a change in market dynamics. Detecting these anomalies in real-time enables traders to make quicker decisions, improve risk management, and potentially capitalize on profitable opportunities.

The Role of Anomaly Detection in Trading Algorithms

The integration of anomaly detection into trading algorithms is essential for improving their accuracy and effectiveness. Traditional trading algorithms rely on statistical models and technical indicators to make buy or sell decisions. However, these models may fail to identify sudden, unexpected market shifts or unusual behavior, which is where anomaly detection comes in.

By incorporating anomaly detection, trading systems can better detect sudden price movements, news-based events, or market inefficiencies. This can lead to more refined strategies that adapt dynamically to market changes.

Anomaly Detection for Risk Management

Anomaly detection is critical for risk management in trading. By identifying abnormal patterns early on, traders can mitigate the risks associated with sudden market changes. This is especially crucial in volatile markets, where swift responses are necessary to prevent large losses. Anomaly detection techniques help identify situations where a security or asset behaves unpredictably, allowing traders to adjust their positions accordingly.

Common Techniques for Anomaly Detection in Quantitative Trading

There are several techniques for anomaly detection in quantitative trading. The most commonly used methods include:

- Statistical Methods

Statistical anomaly detection techniques assume that most data points follow a specific distribution. By comparing new data points to this distribution, traders can identify those that fall outside of the expected range. Common statistical techniques include Z-scores, Tukey’s fences, and Grubbs’ test.

Pros: Simple to implement, widely understood, and interpretable.

Cons: May not perform well with non-normal data distributions or highly complex market environments.

- Machine Learning-Based Methods

Machine learning (ML) algorithms, such as decision trees, support vector machines (SVM), and neural networks, can be used to detect anomalies in large, multidimensional datasets. These algorithms are capable of learning complex patterns in data and adapting to evolving market conditions.

Pros: Can handle complex, non-linear relationships in data, and improve over time with more data.

Cons: Requires significant computational resources and expertise to implement.

Anomaly Detection in Algorithmic Trading Systems

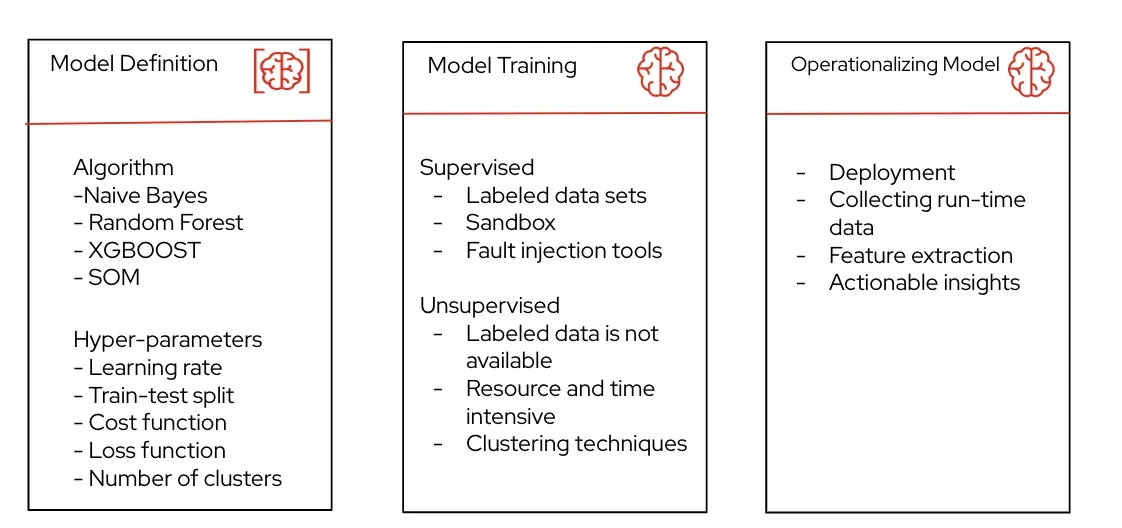

Algorithmic trading systems that incorporate anomaly detection can adapt more effectively to unpredictable market conditions. The integration process typically involves the following steps:

- Data Collection and Preprocessing

High-frequency trading systems collect vast amounts of market data. Preprocessing steps, such as normalization and filtering, are necessary to prepare the data for anomaly detection algorithms.

- Model Training and Testing

Machine learning models are trained on historical market data to learn the typical behavior of assets. Once trained, these models are tested against real-time data to evaluate their effectiveness in detecting anomalies.

- Integration into Trading Strategies

Once the model is optimized, it can be integrated into the overall trading strategy. Anomaly detection can serve as a trigger for buy/sell decisions, or it can be used to adjust risk parameters dynamically.

Case Study: Anomaly Detection in High-Frequency Trading

A notable example of anomaly detection in action is its use in high-frequency trading (HFT). In HFT, milliseconds can make a significant difference in profitability, so detecting anomalies quickly is crucial. By using real-time data streams and sophisticated anomaly detection models, HFT algorithms can react to sudden market events or price changes, executing trades within a fraction of a second.

The key advantage of using anomaly detection in HFT is its ability to identify price movements that fall outside of established patterns, even before traditional indicators can react.

Comparing Anomaly Detection Strategies for Quantitative Traders

Different anomaly detection strategies come with their own set of benefits and limitations. Below, we compare two commonly used strategies:

1. Statistical Anomaly Detection: Advantages and Disadvantages

Statistical methods like Z-scores are widely used because they are relatively simple and easy to interpret. These methods work well when data follows a normal distribution. They can be highly effective in scenarios where market behavior is stable and predictable.

Advantages:

- Easy to implement

- Quick to calculate

- Provides clear results

Disadvantages:

- Limited to simple, linear relationships

- Struggles with noisy data or complex market patterns

- Not adaptive to changing market conditions

2. Machine Learning-Based Anomaly Detection: Advantages and Disadvantages

Machine learning models, such as deep learning networks, can learn more complex and non-linear patterns, making them suitable for more volatile and unpredictable markets. These models can adapt over time as more data becomes available, making them highly flexible.

Advantages:

- Can detect complex, non-linear patterns

- Adaptable to changing market conditions

- Can process large datasets efficiently

Disadvantages:

- Requires large amounts of data

- High computational cost

- Requires expertise to implement and fine-tune

Best Approach: Combining Both Methods

In practice, many quantitative traders find success in combining statistical methods with machine learning techniques. By using statistical methods as a first layer of filtering to identify potential anomalies, and then applying machine learning models to refine and verify the detected anomalies, traders can benefit from the strengths of both approaches.

How Anomaly Detection Improves Trading Performance

Integrating anomaly detection into a trading strategy can significantly improve performance by identifying profitable opportunities, reducing risk, and improving decision-making processes. Some key benefits include:

- Improved Accuracy

By identifying anomalies early, traders can make more informed decisions about when to buy or sell assets. This leads to better trade execution and improved profitability.

- Enhanced Risk Management

Anomaly detection systems can identify unexpected market movements, giving traders more time to adjust their positions and manage risk effectively.

- Faster Decision-Making

In fast-paced markets, the ability to detect anomalies in real-time gives traders a competitive edge, allowing them to react faster than compe*****s who rely on traditional models.

Frequently Asked Questions (FAQs)

1. What is the best anomaly detection method for quantitative trading?

The best method depends on the specific needs of the trading strategy. Statistical methods are effective for simple, predictable markets, while machine learning-based methods work well for more complex and volatile environments. A hybrid approach that combines both methods often provides the best results.

2. How can anomaly detection help with risk management?

Anomaly detection can identify unexpected events in the market, such as sudden price spikes or unusual trading volumes. By detecting these anomalies early, traders can adjust their positions to mitigate potential losses, helping to manage risk more effectively.

3. How do I integrate anomaly detection into my existing trading system?

To integrate anomaly detection into your trading system, you need to gather and preprocess historical market data, train a suitable anomaly detection model (either statistical or machine learning-based), and then implement the model within your trading strategy. It’s crucial to test the model thoroughly before using it in live trading.

Conclusion

Anomaly detection is a powerful tool in quantitative trading, enabling traders to identify unusual market events that can lead to profitable opportunities or signal potential risks. By understanding the different methods available, integrating them into trading algorithms, and leveraging their capabilities to improve risk management and decision-making, traders can enhance their overall performance. As the financial markets evolve, incorporating advanced anomaly detection techniques will continue to be a key factor in successful trading strategies.

Don’t forget to share this article with fellow traders, and feel free to leave a comment below about your experience with anomaly detection in quantitative trading!

0 Comments

Leave a Comment