=================================================

The Bloomberg Terminal is one of the most powerful tools for financial professionals, providing real-time market data, analytics, and news. It is widely used for market analysis, portfolio management, quantitative research, and trading. This article explores how to use the Bloomberg Terminal for market analysis, the key features it offers, and strategies for integrating it into your trading workflow.

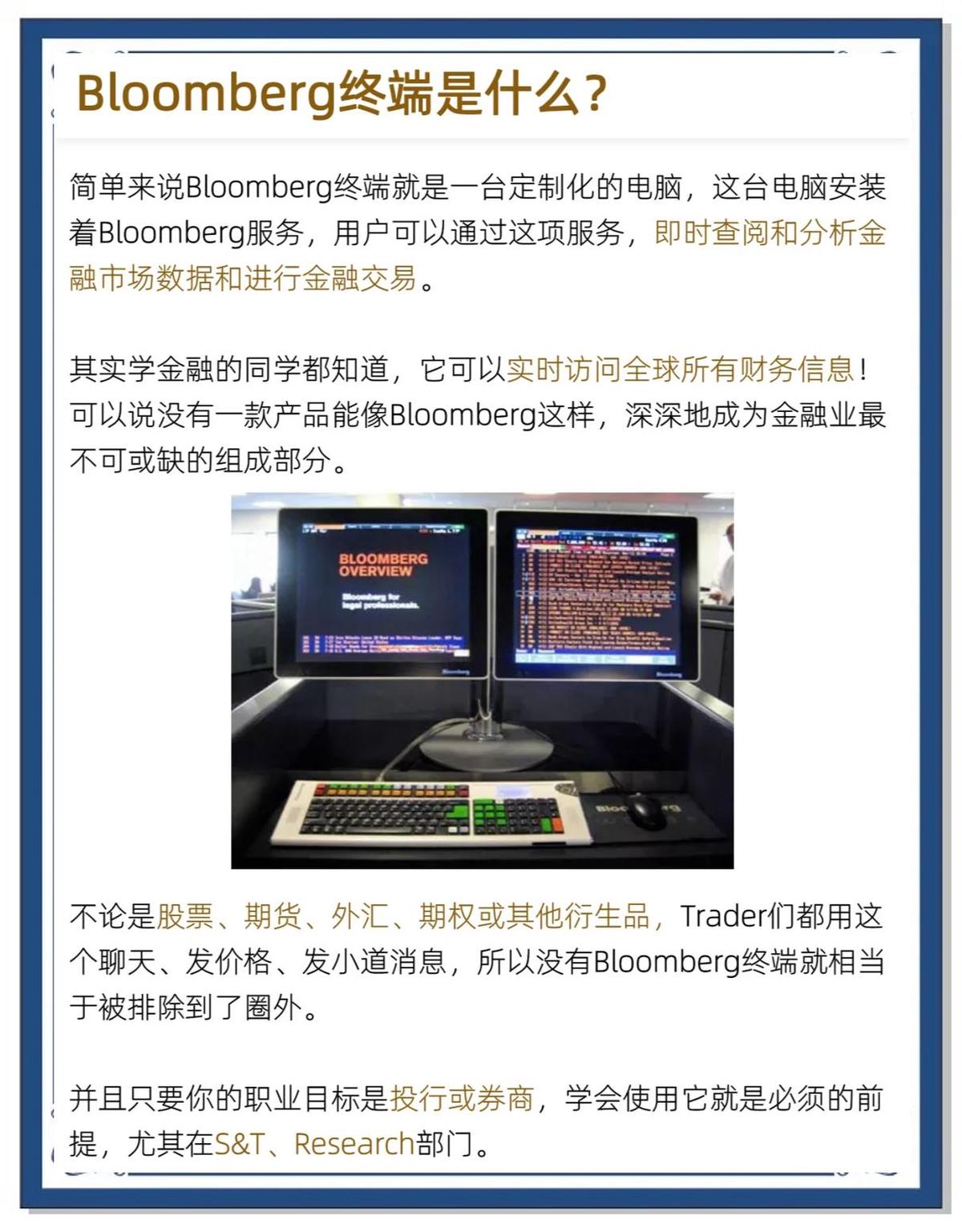

What is the Bloomberg Terminal?

The Bloomberg Terminal is a subscription-based service that offers access to a wide range of financial information, including real-time data on equities, fixed income, commodities, currencies, and more. It also provides powerful tools for market analysis, including charting, technical analysis, and advanced data analytics.

Bloomberg Terminal offers several features such as:

- Real-time market data: Provides up-to-the-minute financial data across all asset classes.

- News and analytics: Access to global news and market sentiment, as well as proprietary Bloomberg research and analysis.

- Analytics and charting tools: Tools for visualizing data and developing custom indicators.

- Communication tools: Bloomberg Messaging System for communication with financial professionals globally.

It’s considered indispensable for institutional investors, hedge fund managers, and quantitative analysts, but also offers substantial benefits for independent traders and portfolio managers.

Key Features of Bloomberg Terminal for Market Analysis

1. Real-Time Data and Market Monitoring

Bloomberg Terminal provides real-time data for virtually every financial market globally. It covers multiple asset classes, including:

- Equities: Stock market prices, historical performance, financial ratios.

- Fixed Income: Bond prices, yields, spreads.

- Commodities: Prices of oil, gold, agricultural products, etc.

- Currencies: Real-time exchange rates, FX swaps, and derivatives.

- Derivatives: Options, futures, and swap contracts data.

This real-time data is essential for market analysis because it allows you to spot trends, monitor prices, and make quick decisions based on market movements.

2. Bloomberg Analytics Tools

Bloomberg Terminal has a range of analytics tools that allow users to perform deep financial analysis on a variety of securities. Some notable tools include:

a) Bloomberg Excel Add-In

The Bloomberg Excel Add-In integrates Bloomberg data directly into Excel, allowing you to create custom reports, models, and charts. This is particularly useful for quantitative analysis, as you can automate data retrieval and perform advanced analysis without leaving your spreadsheet.

b) Bloomberg Charting Tools

Bloomberg offers powerful charting tools to visualize historical data, trends, and price movements. With these tools, you can perform:

- Technical analysis: Apply technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI).

- Fundamental analysis: Plot financial ratios, earnings, and growth metrics against stock prices.

- Time series analysis: Compare multiple securities across different time frames for correlation and trend analysis.

These visualizations help traders and analysts to quickly spot trends and make data-driven decisions.

3. Screeners and Data Filters

Bloomberg Terminal offers several screeners that allow you to filter assets based on specific criteria. These include:

- Equity Screeners: Screen stocks based on financial ratios, performance, and technical factors.

- Fixed Income Screeners: Filter bonds by yield, rating, and maturity date.

- Forex Screeners: Filter currencies based on liquidity, volatility, and other factors.

- Commodity Screeners: Look for commodities based on price trends, supply and demand factors.

These screeners are essential for narrowing down large amounts of data and finding the most relevant opportunities for market analysis.

4. Bloomberg News and Sentiment Analysis

Bloomberg News provides comprehensive coverage of global financial markets, including breaking news, market reports, earnings releases, and economic data. Sentiment analysis tools on the Bloomberg Terminal use natural language processing (NLP) to analyze the tone of news articles and social media posts. This feature helps traders assess market sentiment and make predictions about price movements based on the prevailing mood in the market.

How to Use Bloomberg Terminal for Market Analysis: Step-by-Step Guide

Step 1: Setting Up the Terminal

The first step is to set up your Bloomberg Terminal and ensure that you are familiar with its interface. The Terminal uses a dual-monitor setup, which is designed to display multiple data feeds, charts, and news articles at once.

- Login: Use your Bloomberg credentials to log in.

- Workspace Setup: Customize your workspace to display relevant data, charts, and news feeds.

Step 2: Accessing Market Data

The core function of Bloomberg Terminal is its ability to provide access to real-time market data. Here’s how to use it for market analysis:

- Enter a Security Ticker: Type the ticker symbol (e.g., MSFT for Microsoft) to pull up real-time data for the stock.

- Use the

DESCommand: This command provides a description and key statistics for any given security.

- Market Activity: Use the

WEI(World Equity Index) andFX(Foreign Exchange) commands to see market performance globally.

Bloomberg’s global reach and speed ensure that you’re always up to date with real-time data, making it an indispensable tool for accurate market analysis.

Step 3: Utilizing Bloomberg Analytics

Once you have market data, you can use Bloomberg’s analytics tools to assess the data and analyze trends. Here’s how:

- Technical Analysis: Use the charting feature (

GP) to view historical price data and overlay technical indicators such as moving averages and RSI.

- Fundamental Analysis: Use the

FA(Financial Analysis) command to access a company’s financials, including income statements, balance sheets, and ratios.

- Excel Integration: Download data to Excel using the Bloomberg Excel Add-In. This allows you to perform custom calculations and advanced analysis on historical data.

Step 4: Screening and Filtering Opportunities

With the screeners on Bloomberg Terminal, you can identify stocks or securities that meet your criteria for further analysis. Here’s how to do it:

- Launch the Screener: Use the appropriate screener, such as the Equity Screening Tool or Fixed Income Screening Tool.

- Set Filters: Define your filters based on factors like price-to-earnings ratio, volatility, and other key metrics.

- Analyze Results: Once you have a list of securities, you can dive deeper into each one using Bloomberg’s detailed reports.

Step 5: Tracking News and Sentiment

Bloomberg’s comprehensive news feed provides you with access to real-time market news. Here’s how to use this feature effectively:

- Monitor Real-Time News: Use the

Ncommand to access breaking news and updates that can impact markets.

- Track Market Sentiment: Use Bloomberg’s sentiment analysis tools to gauge whether market sentiment is bullish, bearish, or neutral.

Bloomberg Terminal for Quantitative Trading

The Bloomberg Terminal is also widely used in quantitative trading. It integrates seamlessly with quantitative models and provides access to data used for backtesting and model validation. By incorporating Bloomberg’s data feeds into quantitative models, traders can build, test, and execute sophisticated trading algorithms.

To integrate Bloomberg Terminal with quantitative trading, follow these steps:

- Use the Bloomberg API to pull data into quantitative models.

- Leverage Bloomberg data feeds for backtesting trading strategies.

- Use the Excel Add-In to automate data retrieval for your algorithmic trading models.

FAQ (Frequently Asked Questions)

1. What is the Bloomberg Terminal used for in market analysis?

The Bloomberg Terminal is primarily used for accessing real-time market data, conducting technical and fundamental analysis, tracking market news, and implementing trading strategies. It provides traders with comprehensive tools for decision-making and risk management.

2. How can I integrate the Bloomberg Terminal with quantitative trading models?

Bloomberg offers an API and Excel Add-In that allow you to integrate real-time market data into quantitative trading models. This integration enables traders to backtest, optimize, and implement algorithmic trading strategies with up-to-date information.

3. What are the key features of Bloomberg Terminal for market analysis?

Key features include real-time market data, advanced charting tools, screeners for asset selection, fundamental and technical analysis, and news sentiment analysis. These tools allow traders to analyze and interpret data quickly, making informed decisions in fast-moving markets.

Conclusion

The Bloomberg Terminal is an invaluable tool for anyone involved in market analysis, from institutional investors to individual traders. With its comprehensive data feeds, analytical tools, and integration capabilities, it helps traders make data-driven decisions, stay updated on market movements, and implement effective trading strategies. Whether you are performing technical analysis, analyzing financial statements, or building quantitative trading models, Bloomberg Terminal offers the tools and resources to gain a competitive edge in the markets.

0 Comments

Leave a Comment