In the world of investing, risk is an inherent part of the process. However, investors are often influenced by psychological factors that may lead them to make decisions that are not entirely rational. Behavioral finance, a field that combines psychological insights with financial theory, offers valuable solutions to help reduce investment risk. This article explores how behavioral finance can be leveraged to mitigate risk, examining specific strategies, tools, and techniques for improving investment decision-making.

TL;DR (Quick Summary)

Behavioral finance helps identify and address psychological biases in decision-making.

Behavioral finance solutions can reduce investment risk by providing tools to avoid common biases like loss aversion and overconfidence.

Two strategies for reducing risk: bias awareness and decision-making frameworks.

Frequently asked questions address real-world concerns for traders and investors looking to apply these concepts.

Table of Contents

What is Behavioral Finance?

The Impact of Behavioral Biases on Investment Risk

Behavioral Finance Strategies to Mitigate Risk

Awareness and Management of Biases

Decision-Making Frameworks for Investors

Practical Applications of Behavioral Finance in Investment

FAQ: Frequently Asked Questions

Conclusion and Recommendations

What is Behavioral Finance?

Behavioral finance is a field that seeks to understand how psychological factors influence financial decision-making. Traditional finance theory assumes that investors are rational and always make decisions that maximize utility. However, behavioral finance acknowledges that individuals often deviate from rational decision-making due to cognitive biases, emotions, and social influences.

Key principles of behavioral finance include:

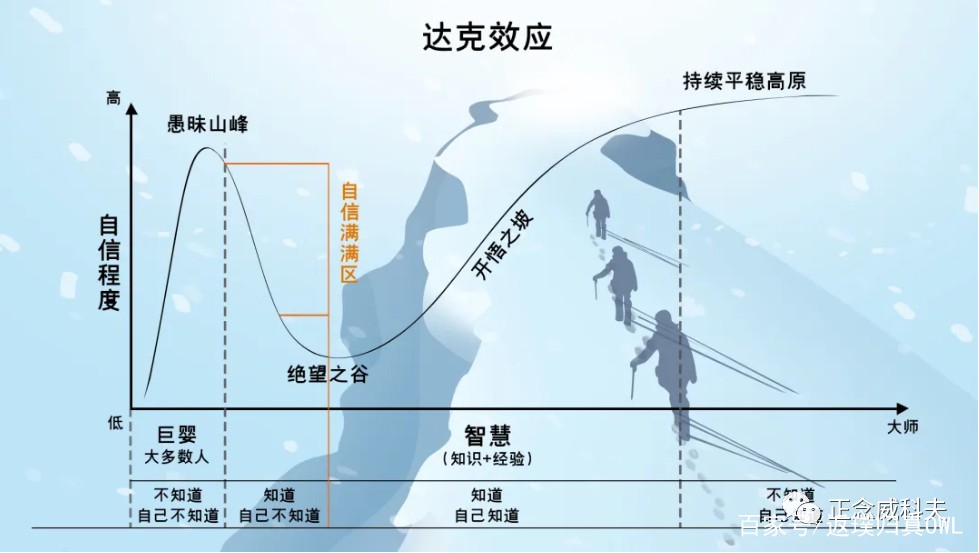

Overconfidence: The tendency to overestimate one’s abilities or the accuracy of one’s information.

Loss Aversion: The fear of losses often leads to risk-averse behavior, even in situations where taking risks could be beneficial.

Herd Behavior: Investors may follow the crowd, ignoring their own research and analysis.

By understanding these biases, investors can make more informed decisions and reduce unnecessary risks.

The Impact of Behavioral Biases on Investment Risk

Behavioral biases can have a significant impact on investment decisions, often leading to suboptimal outcomes. Let’s look at some common biases and how they can increase investment risk:

- Overconfidence Bias

Overconfident investors tend to overestimate their ability to predict market movements or select winning stocks. This leads to excessive risk-taking and can result in large losses. Overconfidence can cause investors to ignore valuable information or fail to properly diversify their portfolios.

- Loss Aversion

Loss aversion refers to the psychological phenomenon where the pain of losing money is felt more intensely than the pleasure of gaining money. This bias often causes investors to hold onto losing positions for too long or avoid taking risks that could potentially lead to higher returns, reducing the overall portfolio performance.

- Herd Behavior

Herd behavior occurs when investors follow the crowd, often driven by fear of missing out (FOMO) or the desire to conform. This can lead to asset bubbles or panic selling during market downturns, both of which can increase risk and lead to poor investment outcomes.

- Anchoring

Anchoring occurs when investors rely too heavily on the first piece of information they receive, even if it is irrelevant or outdated. This bias can cause investors to make poor decisions based on historical prices or past performance rather than evaluating the current market situation.

Behavioral Finance Strategies to Mitigate Risk

Several strategies in behavioral finance can help investors reduce risk by counteracting these biases. Let’s explore two of the most effective approaches: awareness and management of biases, and decision-making frameworks.

- Awareness and Management of Biases

The first step in reducing investment risk is recognizing the biases that influence decision-making. Behavioral finance teaches investors to be aware of common biases like overconfidence, loss aversion, and anchoring. Once recognized, these biases can be mitigated using the following strategies:

Regular self-assessment: Investors should periodically review their decisions and question whether they were influenced by emotions or biases.

Feedback loops: By seeking constructive feedback from others or using performance tracking tools, investors can identify and correct biased decision-making patterns.

Diversification: By diversifying investments, investors can avoid the emotional pressure that comes with placing too much faith in one particular asset or decision.

- Decision-Making Frameworks for Investors

Another key solution to reducing investment risk is adopting structured decision-making frameworks. These frameworks help investors make decisions based on data and logical reasoning rather than emotions or biases. Examples of such frameworks include:

Pre-determined risk tolerance: Establishing risk tolerance upfront and sticking to it helps investors avoid the temptation to chase high-risk opportunities driven by emotions.

Scenario planning: Investors can use scenario planning techniques to evaluate different market conditions and assess potential outcomes, ensuring that decisions are grounded in realistic expectations.

Behavioral nudges: Using positive reinforcement, setting default options, and other behavioral tools can help steer investors toward better decision-making practices.

Practical Applications of Behavioral Finance in Investment

Integrating behavioral finance into investment practices can lead to better decision-making and reduced risk. Here are some practical applications of behavioral finance that investors can apply to their own strategies:

Automated Investment Tools: Robo-advisors and algorithmic trading platforms often incorporate behavioral finance principles by providing personalized portfolio management that adjusts based on risk tolerance and goals, minimizing emotional decision-making.

Investor Education: Educational programs that focus on behavioral finance can teach investors how to recognize and mitigate their biases, fostering a more disciplined and rational approach to investing.

Behavioral Finance Tools: Tools that track emotional responses and decisions can provide insights into patterns of behavior that may be negatively affecting investment outcomes. These tools can be used to adjust strategies and improve long-term returns.

Example of Behavioral Finance in Action

Consider a retail investor who has been holding onto a stock for a long period, despite its declining value. The investor may be suffering from loss aversion, unable to sell the stock because the emotional pain of realizing a loss is too great. By introducing behavioral finance tools such as a clear sell strategy and pre-determined risk thresholds, the investor can reduce the emotional influence on their decision and minimize potential losses.

FAQ: Frequently Asked Questions

- How can I overcome the bias of overconfidence in my investment decisions?

To overcome overconfidence, investors should regularly review their performance and decisions. Seeking feedback from independent sources, such as financial advisors or peers, and diversifying investments can also help counter the tendency to overestimate one’s ability. It’s crucial to adopt a mindset of continuous learning and stay open to new information.

- What is the role of loss aversion in investment risk, and how can it be reduced?

Loss aversion can cause investors to avoid selling losing assets or taking necessary risks. To reduce its impact, investors should establish clear exit strategies and focus on long-term goals rather than short-term emotions. Techniques such as pre-determined risk tolerance and using a diversified portfolio can also help mitigate loss aversion.

- How can I apply behavioral finance in my quantitative trading strategies?

Behavioral finance can be integrated into quantitative trading by incorporating behavioral biases into models and algorithms. For instance, traders can use machine learning to identify patterns of overconfidence or herding behavior in the market. Combining traditional quantitative models with behavioral insights can enhance the effectiveness of trading strategies.

Conclusion and Recommendations

Behavioral finance offers powerful tools and insights to help investors reduce risk and make more rational decisions. By recognizing and addressing psychological biases such as overconfidence, loss aversion, and herd behavior, investors can improve their decision-making processes. Implementing structured decision-making frameworks and utilizing tools designed to counteract these biases can lead to better long-term outcomes.

Investors are encouraged to integrate behavioral finance strategies into their investment plans, whether through self-awareness, education, or the use of automated tools. By doing so, they can minimize emotional biases and create a more resilient investment strategy, ultimately reducing risk and enhancing returns.

| Category | Details |

|---|---|

| What is Behavioral Finance? | A field combining psychology and finance, examining how biases and emotions impact financial decision-making. |

| Common Behavioral Biases | Overconfidence: Overestimating ability. Loss Aversion: Fear of losses. Herd Behavior: Following the crowd. |

| Impact of Biases on Investment Risk | Biases lead to excessive risk-taking, poor diversification, and missed opportunities, resulting in suboptimal investment outcomes. |

| Strategies to Mitigate Risk | Bias Awareness: Recognizing biases. Decision-Making Frameworks: Using data and structured reasoning. |

| Awareness and Management of Biases | Self-assessments, feedback loops, and diversification help counteract biases. |

| Decision-Making Frameworks | Risk Tolerance: Pre-set and adhered to. Scenario Planning: Evaluating outcomes under different conditions. |

| Practical Applications | Automated Tools: Robo-advisors and algorithmic trading adjust for emotional decision-making. Investor Education: Teaching bias recognition. |

| Behavioral Finance Tools | Tools that track emotional decisions, offering insights to improve long-term returns. |

| Example of Bias in Action | Holding losing stocks due to loss aversion. Using predefined sell strategies can mitigate emotional decision-making. |

| FAQ on Overcoming Overconfidence | Regular performance reviews, feedback, and diversifying investments help counteract overconfidence. |

| FAQ on Loss Aversion | Establish clear exit strategies and focus on long-term goals to reduce loss aversion. |

| FAQ on Applying Behavioral Finance in Quantitative Trading | Integrate behavioral biases into models, using machine learning to detect market patterns like overconfidence or herd behavior. |

| Conclusion and Recommendations | Behavioral finance tools can enhance decision-making, reduce risk, and improve returns by addressing psychological biases. |

0 Comments

Leave a Comment