Overcoming Anchoring in Technical Analysis: Strategies for Smarter Trading Decisions

Anchoring bias is one of the most pervasive cognitive traps affecting traders and investors. In technical analysis , anchoring occurs when traders fixate on specific price points, historical highs or

Overcoming Anchoring in Technical Analysis: Strategies for Smarter Trading Decisions

Anchoring bias is a pervasive cognitive pitfall in trading, particularly in technical analysis. Traders often fixate on specific reference points—like historical highs, lows, or arbitrary price

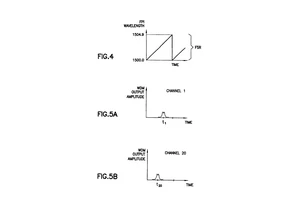

Optimizing Line Break Charts for Performance

============================================ Line break charts are an essential tool in the arsenal of technical analysts and quantitative traders. They provide a clear and concise representation of

Mitigating Asymmetrical Risk Through Data Analysis

================================================== Introduction In financial markets, risk is rarely distributed equally. Traders, investors, and businesses often face asymmetrical risk , where

Optimization Techniques for Tick Charts

======================================= Tick charts are increasingly popular in quantitative trading and day trading due to their ability to provide a more granular view of market activity. Unlike

Mitigating Asymmetrical Risk Through Data Analysis

================================================== In the modern landscape of financial markets, asymmetrical risk has emerged as a critical concern for traders, investors, and portfolio managers

Measuring Line Break Chart Accuracy: Techniques and Insights for Quantitative Trading

===================================================================================== Line break charts are powerful tools for quantitative traders, algorithm developers, and financial analysts

Methods to Mitigate FOMO Impact in Trading

========================================== The fear of missing out (FOMO) is a psychological phenomenon that can significantly affect traders’ decision-making processes, often leading to

Measuring Line Break Chart Accuracy

=================================== Introduction Line break charts are a lesser-known but powerful tool in technical analysis, offering traders an alternative to traditional candlestick and bar

Measuring Line Break Chart Accuracy: A Comprehensive Guide for Traders

====================================================================== Line break charts are powerful tools in technical analysis, particularly for quantitative and algorithmic traders seeking to