===========================================

Introduction

In the world of investing, the concept of intrinsic value plays a central role in separating speculative trading from disciplined, research-driven investing. While stock prices fluctuate daily based on market sentiment, intrinsic value represents the “true worth” of a business based on its future cash-generating ability. Among the various valuation methods, the Discounted Cash Flow (DCF) model is one of the most widely used approaches to estimate intrinsic value.

In this article, we will explore how to find intrinsic value using the DCF model, discuss its key components, compare different strategies, share practical tips, and address frequently asked questions. Whether you are a retail investor or a professional analyst, mastering DCF is an essential skill for making informed investment decisions.

Understanding the Basics of Intrinsic Value

What Is Intrinsic Value?

Intrinsic value refers to the perceived or calculated value of an asset based on objective financial analysis, rather than its current market price. It captures the company’s fundamentals—revenues, expenses, growth prospects, and risks.

Why Intrinsic Value Matters

- It helps investors avoid emotional trading.

- It provides a benchmark to determine whether a stock is undervalued or overvalued.

- It aligns investment decisions with long-term financial performance.

For beginners, it is crucial to understand why intrinsic value is important before committing capital. Without this foundation, investors risk making decisions purely based on speculation.

What Is the DCF Model?

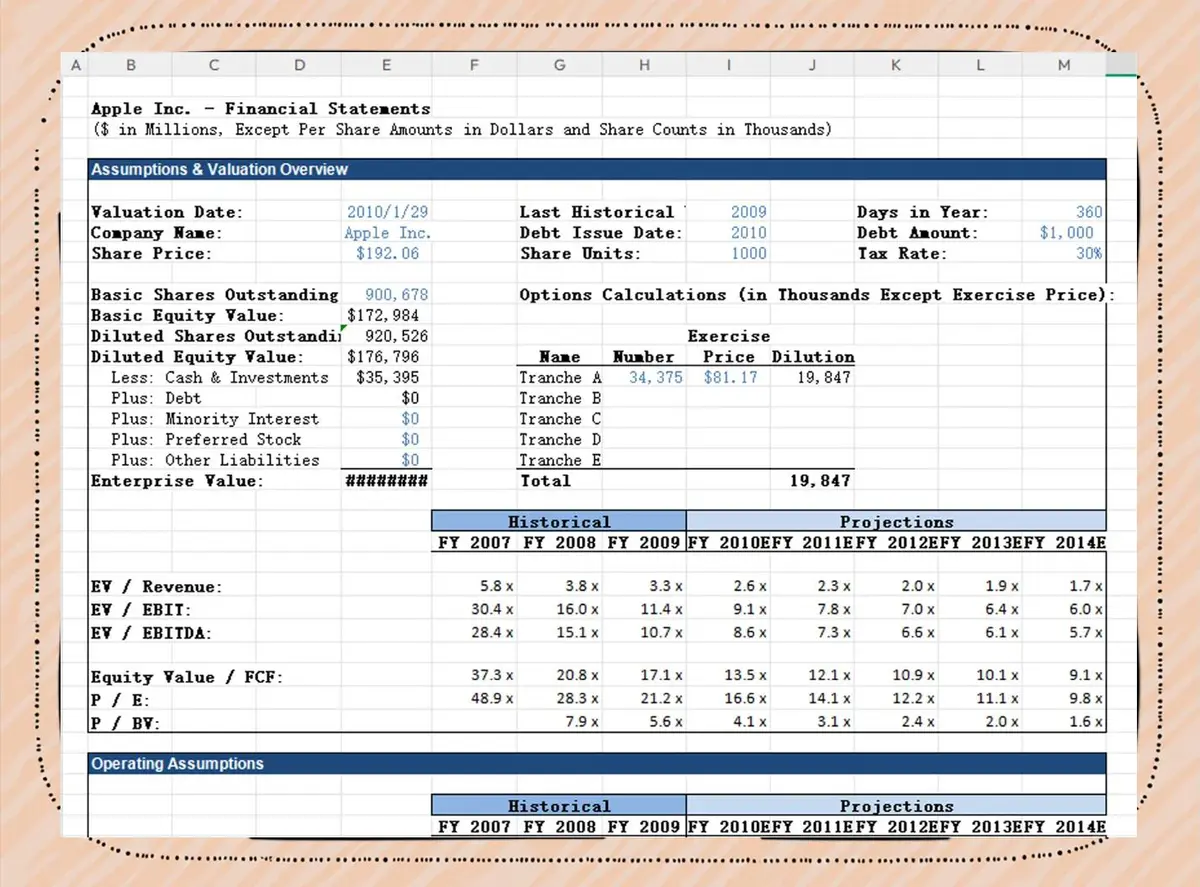

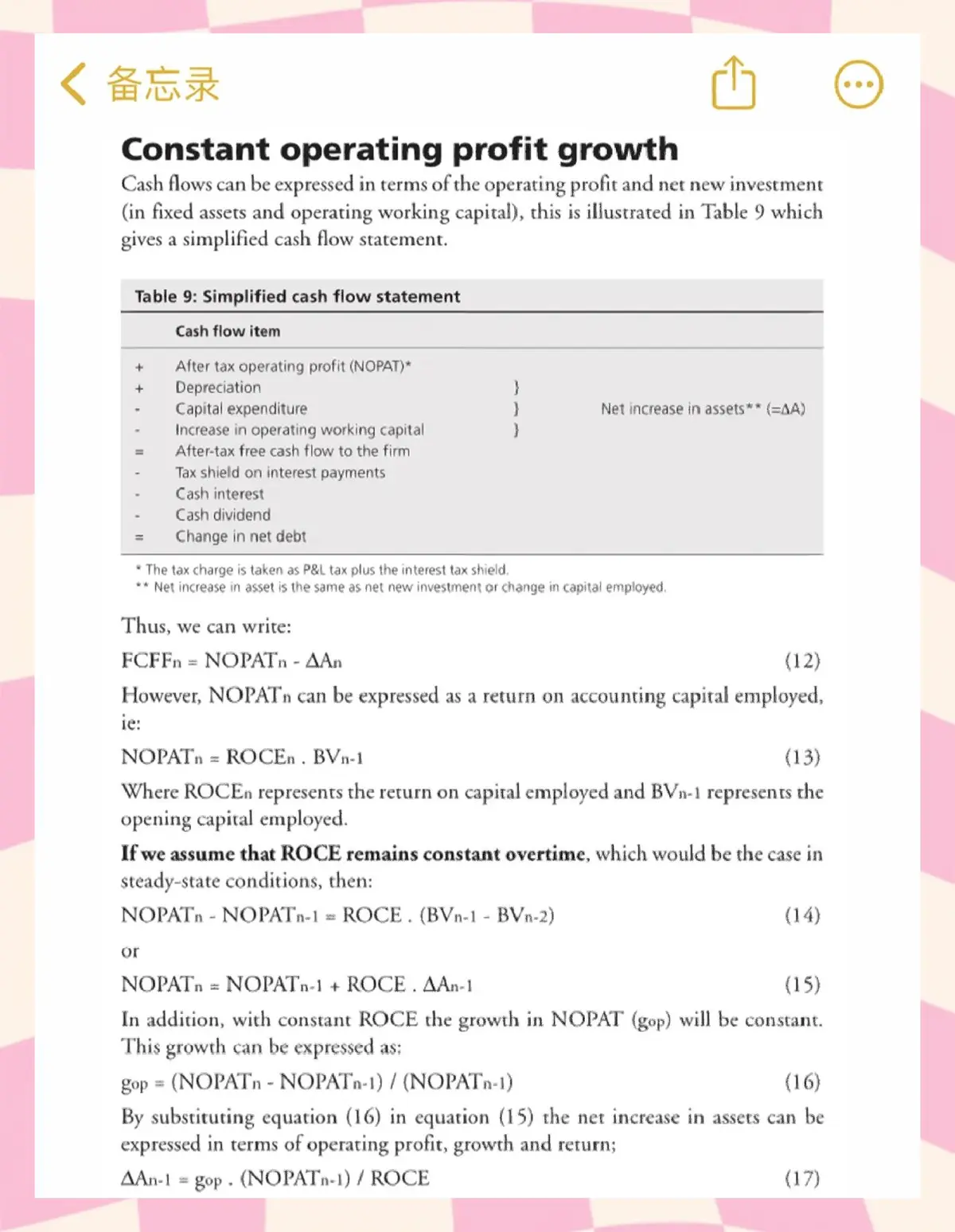

The Discounted Cash Flow (DCF) model is a financial valuation method used to estimate the intrinsic value of an asset by forecasting its future free cash flows (FCFs) and discounting them back to present value using a discount rate, typically the weighted average cost of capital (WACC).

Key Components of the DCF Model

- Forecasted Cash Flows – Projecting the company’s revenue, expenses, and net cash generation.

- Discount Rate – Reflecting the time value of money and investment risks.

- Terminal Value – Accounting for the company’s value beyond the explicit forecast period.

- Present Value Calculation – Converting future estimates into today’s dollar terms.

Step-by-Step Guide: How to Find Intrinsic Value Using DCF Model

Step 1: Project Free Cash Flows

Estimate the company’s free cash flows for 5–10 years. This involves analyzing revenue growth, margins, taxes, and capital expenditures.

Step 2: Determine the Discount Rate

Typically, investors use WACC to capture both debt and equity costs. A higher discount rate reduces intrinsic value due to higher perceived risks.

Step 3: Estimate the Terminal Value

Two popular methods exist:

- Perpetuity Growth Method – Assuming a stable long-term growth rate.

- Exit Multiple Method – Using comparable valuation multiples (e.g., EV/EBITDA).

Step 4: Discount Future Cash Flows

Use the formula:

PV=FCF(1+r)tPV = \frac{FCF}{(1 + r)^t}PV=(1+r)tFCF

Where:

- PVPVPV = Present Value

- FCFFCFFCF = Free Cash Flow at time ttt

- rrr = Discount rate

- ttt = Year

Step 5: Add Terminal Value

The terminal value is discounted back to present and added to the sum of discounted cash flows.

Step 6: Divide by Shares Outstanding

The final intrinsic value per share is derived by dividing enterprise value (EV) by the number of outstanding shares.

Two Common DCF Strategies and Their Trade-offs

Strategy 1: Conservative DCF (Low Growth, High Discount Rate)

Advantages

- Provides a margin of safety.

- Protects against overestimation of cash flows.

Disadvantages

- May undervalue strong growth companies.

- Can lead to missed opportunities in innovative sectors.

Strategy 2: Aggressive DCF (High Growth, Lower Discount Rate)

Advantages

- Captures upside potential in high-growth companies.

- Suitable for tech and emerging industries.

Disadvantages

- Higher risk of overvaluation.

- Sensitive to small input changes.

Best Approach: A blended strategy works best. Use conservative assumptions for uncertain businesses and more optimistic assumptions for established growth companies. This balance reduces bias and improves reliability.

Practical Example of DCF in Action

Let’s assume a company is expected to generate $100M in free cash flow next year, growing at 5% annually for 10 years. With a discount rate of 8%, the intrinsic value can be calculated step by step.

This process helps investors understand how to calculate intrinsic value of a stock with real numbers rather than abstract concepts.

Common Mistakes to Avoid in DCF Analysis

- Overestimating Growth Rates: Small changes in assumptions can inflate valuations.

- Ignoring Risk Factors: A stable discount rate may not reflect real business risks.

- Overreliance on Terminal Value: In many cases, terminal value accounts for 60–80% of the valuation, creating potential distortions.

- Not Updating Models Regularly: Market conditions and business fundamentals evolve.

Images to Illustrate Key Concepts

DCF model workflow showing the steps from cash flow projections to intrinsic value estimation

Industry Trends in Intrinsic Value Analysis

- AI-Powered Valuation Tools – Algorithms now automate cash flow projections.

- Scenario-Based DCF Models – Multiple growth paths are modeled to assess different risk outcomes.

- Integration with ESG Metrics – Investors increasingly factor in environmental, social, and governance considerations.

Some platforms even provide where to find intrinsic value calculator tools that help retail investors simplify this process without advanced spreadsheets.

FAQ: Intrinsic Value and DCF Model

1. How reliable is the DCF model for valuing companies?

The DCF model is highly reliable when used with realistic assumptions. However, it is sensitive to input changes, especially discount rates and growth estimates. Investors should combine it with other valuation methods for a more balanced perspective.

2. Should I always use DCF when valuing stocks?

Not always. While DCF is powerful, it may not be the best tool for cyclical businesses, startups, or firms with unpredictable cash flows. In such cases, relative valuation (e.g., P/E multiples) may be more appropriate.

3. What tools can simplify DCF calculations?

Software like Excel, financial modeling platforms, and online intrinsic value calculators are widely available. Professional investors also use proprietary models with scenario simulations for accuracy.

Conclusion

Mastering how to find intrinsic value using DCF model equips investors with a disciplined, research-based approach to equity analysis. While no model is perfect, DCF provides an invaluable framework for estimating the worth of a company based on future performance rather than market noise.

By combining conservative and aggressive approaches, avoiding common mistakes, and using modern tools, investors can enhance decision-making and improve portfolio performance.

Call to Action

Have you tried calculating intrinsic value using the DCF model? What challenges did you face—projecting growth, choosing a discount rate, or estimating terminal value? Share your experiences in the comments below, and don’t forget to share this article with fellow investors who want to refine their valuation skills.

0 Comments

Leave a Comment