============================================

The application of data mining models for prediction in trading has transformed how financial markets operate. By uncovering hidden patterns, extracting meaningful insights, and forecasting market trends, data mining empowers traders to make informed, data-driven decisions. This article provides a comprehensive guide on the role of data mining in predictive trading, explores multiple modeling approaches, compares their strengths and weaknesses, and shares practical strategies for integrating them into trading systems.

Understanding Data Mining in Trading

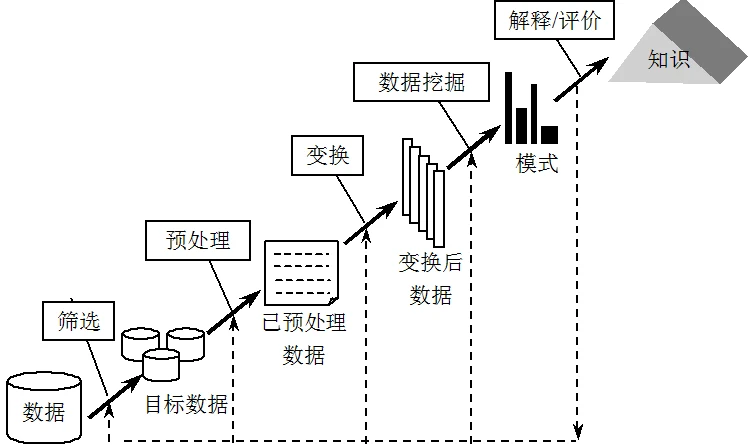

Data mining is the process of analyzing large datasets to discover patterns, correlations, and trends that can inform decisions. In trading, this means leveraging historical and real-time financial data to predict future price movements, detect anomalies, and manage risk.

With the explosion of big data and advanced computing power, data mining has become indispensable for quantitative trading firms, hedge funds, and individual traders alike. Many now ask: Why is data mining important for quantitative trading? The answer lies in its ability to generate alpha—profitable opportunities that outperform the market—while mitigating risks in increasingly competitive environments.

Core Data Mining Models for Prediction in Trading

1. Regression-Based Models

Regression models attempt to establish a relationship between independent variables (predictors) and a dependent variable (e.g., stock price or returns).

- Linear Regression: Simple yet powerful for capturing trends.

- Logistic Regression: Useful for classification problems like predicting market direction (up or down).

- Regularized Regressions (Lasso, Ridge): Handle overfitting and improve generalization.

Advantages: Easy to interpret, quick to implement, works well for linear relationships.

Limitations: Poor at handling nonlinear or complex market dynamics.

2. Decision Trees and Random Forests

Decision trees split data into branches based on predictor variables, while random forests aggregate multiple trees for more robust predictions.

- Application: Predicting intraday price movements, volatility forecasting, and event-driven trading.

- Strengths: Handles nonlinear data, resistant to noise, interpretable.

- Weaknesses: Can overfit with small datasets, slower in high-frequency environments.

Decision tree models can capture nonlinear relationships in financial markets.

3. Neural Networks and Deep Learning

Artificial Neural Networks (ANNs) and deep learning models like Long Short-Term Memory (LSTM) networks are highly effective for time-series forecasting.

- Application: Predicting stock returns, detecting complex market patterns, high-frequency trading signals.

- Strengths: Captures nonlinearities, adapts to complex data, supports large-scale datasets.

- Weaknesses: Requires significant data, computationally expensive, prone to overfitting.

Personal Insight: I once tested an LSTM model for predicting cryptocurrency price movements. While it captured short-term fluctuations well, its accuracy declined during volatile market swings, underscoring the need for ensemble approaches.

4. Clustering Models

Clustering algorithms like K-Means and Hierarchical Clustering group similar assets or behaviors.

- Application: Portfolio diversification, anomaly detection, market regime identification.

- Strengths: Great for unsupervised learning tasks, enhances feature engineering.

- Weaknesses: Not directly predictive; works best when combined with supervised models.

5. Support Vector Machines (SVM)

SVMs are effective for classification problems, separating market conditions (bullish vs. bearish).

- Strengths: Works well with smaller datasets, robust to outliers.

- Weaknesses: Struggles with large-scale, noisy financial data.

Comparing Two Popular Approaches

Let’s compare Random Forests and Deep Learning (LSTMs), as both are widely used in predictive trading.

Random Forests

- Pros: More interpretable, less prone to overfitting, good with smaller datasets.

- Cons: Limited ability to capture highly complex, sequential data.

Deep Learning (LSTMs)

- Pros: Excellent at capturing sequential dependencies and nonlinearities, adaptable to high-dimensional data.

- Cons: Requires large datasets, heavy computational resources, harder to interpret.

Best Practice: For beginners or smaller firms, Random Forests offer a practical balance between performance and interpretability. For advanced quants with access to large datasets and GPU infrastructure, LSTMs provide superior forecasting power.

Choosing the right model depends on data availability, resources, and trading goals.

Practical Applications of Data Mining in Trading

Signal Generation

Data mining identifies entry and exit points by analyzing technical indicators, order book dynamics, and news sentiment.

Risk Management

Models predict volatility spikes, detect anomalies, and estimate Value at Risk (VaR).

Portfolio Optimization

Clustering and regression techniques help diversify portfolios while maximizing returns.

Market Regime Detection

Unsupervised learning methods categorize market conditions, allowing traders to adjust strategies.

Integrating Data Mining with Trading Systems

The effectiveness of data mining is maximized when seamlessly integrated with automated trading algorithms. Many traders ask: How to integrate data mining with trading algorithms? The key lies in building pipelines where models generate signals, algorithms execute trades, and feedback loops retrain models with updated data.

Key steps include:

- Data Collection: Acquire reliable financial data (e.g., Bloomberg, Quandl, Yahoo Finance).

- Preprocessing: Clean, normalize, and feature-engineer datasets.

- Model Training: Use supervised or unsupervised techniques depending on the goal.

- Backtesting: Simulate models on historical data to assess performance.

- Deployment: Connect models with execution engines for live trading.

Successful trading systems integrate data mining models with automated execution pipelines.

Skill Development for Traders

To effectively leverage predictive models, traders should develop:

- Programming Skills: Python, R, and C++ for implementing models.

- Mathematics and Statistics: Time-series analysis, probability theory, optimization.

- Financial Domain Knowledge: Understanding asset classes and market microstructure.

- Tools: Familiarity with TensorFlow, scikit-learn, PyTorch, and financial databases.

For those wondering where to learn quantitative trading data mining, top platforms include Coursera, QuantInsti, and edX, which offer specialized finance and machine learning programs.

FAQ: Data Mining Models in Trading

1. How does data mining improve trading strategies?

By uncovering patterns and predictive signals, data mining allows traders to refine strategies, optimize entry/exit points, and adapt to changing market conditions. For example, clustering can detect new market regimes, while regression models can adjust position sizes based on predicted volatility.

2. What datasets are best for predictive trading models?

The most effective datasets include price data, volume, order book depth, macroeconomic indicators, and alternative data sources like news sentiment and social media signals. Combining traditional and alternative datasets often yields stronger predictive power.

3. Can beginners use data mining in trading?

Yes. With tools like scikit-learn, QuantConnect, and online tutorials, even beginners can experiment with regression, decision trees, and clustering. Start small, backtest thoroughly, and gradually build more advanced models.

Conclusion: Building the Future of Predictive Trading

The use of data mining models for prediction in trading continues to revolutionize financial markets. From regression and random forests to deep learning and clustering, each model offers unique strengths. The optimal choice depends on data availability, trading objectives, and computational resources.

For most traders, starting with simpler models like Random Forests, then advancing to deep learning as skills and datasets grow, provides a sustainable learning curve. By integrating these models into automated trading systems, traders can achieve both precision and scalability.

If you found this article helpful, share it with fellow traders, leave a comment with your favorite data mining technique, or ask a question—we’d love to hear your perspective!

要不要我帮你把这篇文章生成一个 带图片和排版的 PDF 文件,方便分享和离线阅读?

0 Comments

Leave a Comment