======================================================

Introduction

Institutional investors—such as pension funds, mutual funds, hedge funds, and insurance companies—manage vast amounts of capital. With billions at stake, even the smallest inefficiency in analysis or decision-making can lead to missed opportunities or significant losses. In this high-stakes environment, data visualization methods for institutional investors have become indispensable. By transforming raw financial data into intuitive visual narratives, decision-makers gain clarity, improve risk management, and enhance portfolio strategies.

This article explores the most effective data visualization techniques for institutional investors, compares strategies, integrates industry insights, and provides actionable recommendations. It will also cover advanced visualization tools, real-world use cases, and best practices to ensure scalability and accuracy.

Why Data Visualization Matters for Institutional Investors

Turning Complexity Into Clarity

Institutional investors deal with multiple data streams: equity prices, credit spreads, derivatives, macroeconomic indicators, ESG metrics, and alternative data sources like sentiment or satellite imagery. Without visualization, such data often overwhelms even experienced analysts. Charts, dashboards, and interactive plots bring order to chaos.

Enhancing Decision-Making

Clear visuals allow portfolio managers to recognize patterns, detect anomalies, and make data-driven decisions. Knowing how data visualization improves trading decision making is not optional; it directly impacts performance in volatile markets.

Communicating Insights to Stakeholders

Institutional investors must frequently present results to boards, regulators, and clients. A strong visualization framework ensures that complex quantitative findings are accessible and persuasive.

Core Data Visualization Methods

1. Heatmaps for Portfolio Risk

Heatmaps allow investors to see sector exposure, correlations, and risk clusters at a glance. For example, a pension fund can instantly spot if too much capital is allocated to interest rate-sensitive assets.

Pros:

- Intuitive, easy to communicate to non-technical stakeholders.

- Highlights hidden concentrations or dependencies.

Cons:

- May oversimplify relationships.

- Ineffective with too many variables.

2. Time-Series Visualization

Institutional investors rely heavily on time-series data—stock prices, yield curves, volatility indexes. Visualizing them with rolling averages, Bollinger bands, or anomaly detection lines provides immediate insight.

Pros:

- Crucial for trend and cycle detection.

- Flexible for both short-term trading and long-term analysis.

Cons:

- Requires context; isolated charts may mislead.

- Noise may obscure signals in volatile markets.

3. Network Graphs for Correlation Analysis

Correlation and causality matter greatly for multi-asset investors. Network graphs show how assets move in relation to each other. For instance, in times of stress, correlations between equities and credit instruments often spike.

Pros:

- Excellent for stress testing and risk contagion analysis.

- Visualizes relationships not visible in tables.

Cons:

- Complex to interpret without expertise.

- Computationally heavy for large datasets.

4. Scenario-Based Dashboards

Interactive dashboards simulate “what if” scenarios. Hedge funds often model different interest rate regimes or inflation shocks and visualize their portfolio’s response.

Pros:

- Enables proactive strategy adjustments.

- Offers flexibility to test multiple hypotheses.

Cons:

- Requires robust back-end data pipelines.

- Can mislead if assumptions are unrealistic.

Financial heatmap used by institutional investors to track portfolio exposure and sector risks.

Comparing Two Leading Strategies

Strategy A: Static Visualization (Traditional Reports)

Traditional reporting relies on bar charts, line graphs, and pie charts in monthly or quarterly reports.

- Advantages: Cost-effective, requires less training, suitable for compliance.

- Disadvantages: Limited interactivity, risk of outdated insights, poor scalability for real-time decisions.

Strategy B: Interactive Dashboards with AI Integration

Modern systems use interactive dashboards, often powered by AI/ML, to analyze data in real time. Platforms such as Bloomberg Terminal add interactive elements, while custom dashboards leverage Python libraries like Plotly or institutional-grade tools such as Tableau.

- Advantages: Real-time insights, predictive analytics, customizable to portfolio needs.

- Disadvantages: High implementation costs, steep learning curve, requires IT infrastructure.

Recommendation: While static visualizations remain useful for compliance, institutional investors should prioritize interactive, AI-enhanced dashboards. They combine scalability, speed, and predictive accuracy—critical in today’s fast-moving markets.

Where Data Visualization Fits in Quantitative Workflows

In quantitative research and trading, institutional investors use visualization for:

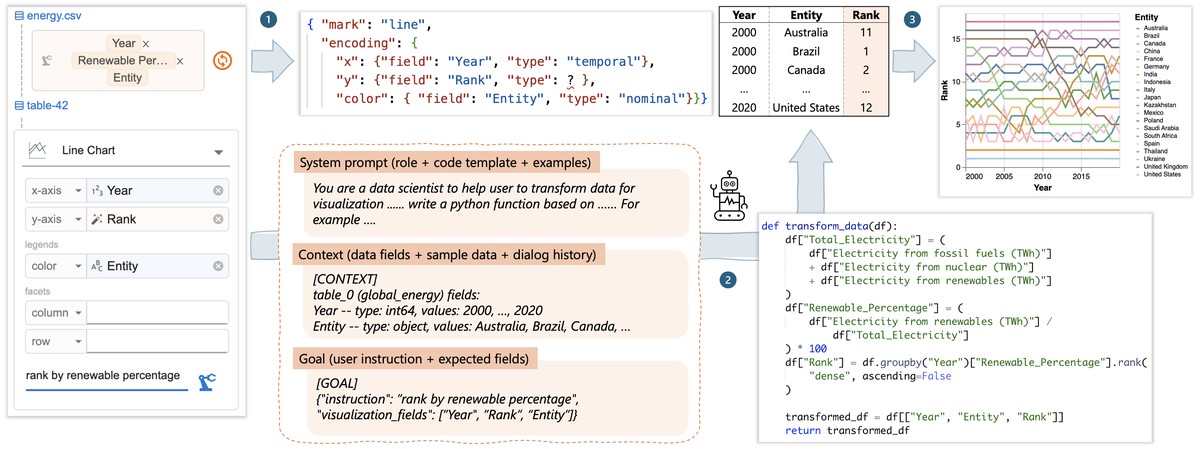

- Exploratory Data Analysis (EDA): Identifying trends before applying models.

- Backtesting Strategies: Visualizing drawdowns, Sharpe ratios, and slippage.

- Risk Management: Stress-testing scenarios using dashboards.

For deeper exploration, see how data visualization enhances quantitative trading strategies, especially when paired with algorithmic models.

Interactive dashboards transform raw financial data into actionable insights.

Advanced Visualization Methods for Institutional Investors

1. Predictive Heatmaps

Using machine learning, predictive heatmaps anticipate shifts in market volatility or sector performance.

2. 3D Visualization for Multi-Factor Models

3D scatter plots or surfaces illustrate how multiple risk factors (e.g., interest rates, inflation, FX rates) interact.

3. Sentiment-Enhanced Charts

Integrating alternative data like news or social sentiment into visual dashboards allows funds to anticipate market reactions.

4. Custom APIs for Integration

Some funds prefer custom data visualization solutions for trading firms to maintain competitive advantage, enabling tailored risk dashboards.

Industry Trends and Best Practices

- Real-Time Monitoring: As data pipelines become faster, real-time dashboards are the new standard.

- Cloud Integration: Scalable data visualization solutions for institutional investors rely on AWS, Azure, or GCP.

- Compliance-Driven Visualization: Regulations demand transparency; clear visualizations simplify audits.

- Customization: One-size-fits-all dashboards fail; institutional investors need tailored, customizable data visualization tools for trading.

FAQ: Data Visualization for Institutional Investors

1. What are the best visualization tools for institutional investors?

Leading platforms include Tableau, Power BI, Bloomberg Terminal dashboards, and Python-based libraries (Plotly, Seaborn, Matplotlib). Choosing depends on integration needs, scalability, and compliance.

2. How does data visualization improve risk management for institutions?

It highlights correlations, stress scenarios, and real-time risk exposure. For example, correlation heatmaps help identify when diversification benefits collapse in market crises.

3. Can institutional investors use open-source visualization tools?

Yes. Python libraries and R packages offer flexibility and customization. However, open-source tools may lack enterprise-grade compliance and security features.

Institutional investors rely on dashboards for portfolio monitoring, compliance, and communication.

Conclusion

Data visualization is no longer an optional add-on—it is the foundation of institutional investing in the data-driven era. From risk management heatmaps to interactive dashboards enhanced by AI, visualization ensures clarity, speed, and precision.

Institutional investors must embrace scalable, customizable visualization frameworks to remain competitive in a landscape where milliseconds and clarity define success.

👉 If you found this article insightful, share it with your network or comment with your own experiences using data visualization in institutional investing.

Would you like me to also create a sample interactive dashboard design mock-up (in code or diagram form) to visually demonstrate how institutional investors can integrate these methods?

0 Comments

Leave a Comment