================================================

Introduction

Futures markets are an essential component of modern finance, providing both hedging and speculative opportunities. For quantitative experts, the challenge lies not only in designing profitable strategies but also in ensuring effective futures risk management. With leverage, volatility, and liquidity risks, futures trading demands a disciplined, systematic approach grounded in quantitative analysis.

This article explores the critical aspects of futures risk management for quantitative experts, comparing multiple methods, showcasing practical applications, and aligning with the latest industry practices. We will also integrate insights on how to do quantitative trading with futures and how futures impact quantitative trading strategies, ensuring traders can balance alpha generation with capital preservation.

Understanding Risk in Futures Trading

Core Risks in Futures Markets

Futures contracts differ from equities due to leverage and mark-to-market requirements. Key risks include:

- Leverage Risk – Amplifies both profits and losses, making proper position sizing crucial.

- Market Risk – Price movements can rapidly lead to margin calls.

- Liquidity Risk – Wider spreads in certain contracts can affect execution.

- Basis Risk – Difference between futures and underlying spot prices.

- Systematic Risk – Macroeconomic shocks impacting correlations.

Why Risk Management Is More Complex in Quantitative Trading

Quantitative traders often run multiple models simultaneously. A single model’s risk may appear small, but aggregated exposure across instruments can create hidden vulnerabilities. Effective futures risk management must consider portfolio-level correlations, tail events, and stress scenarios.

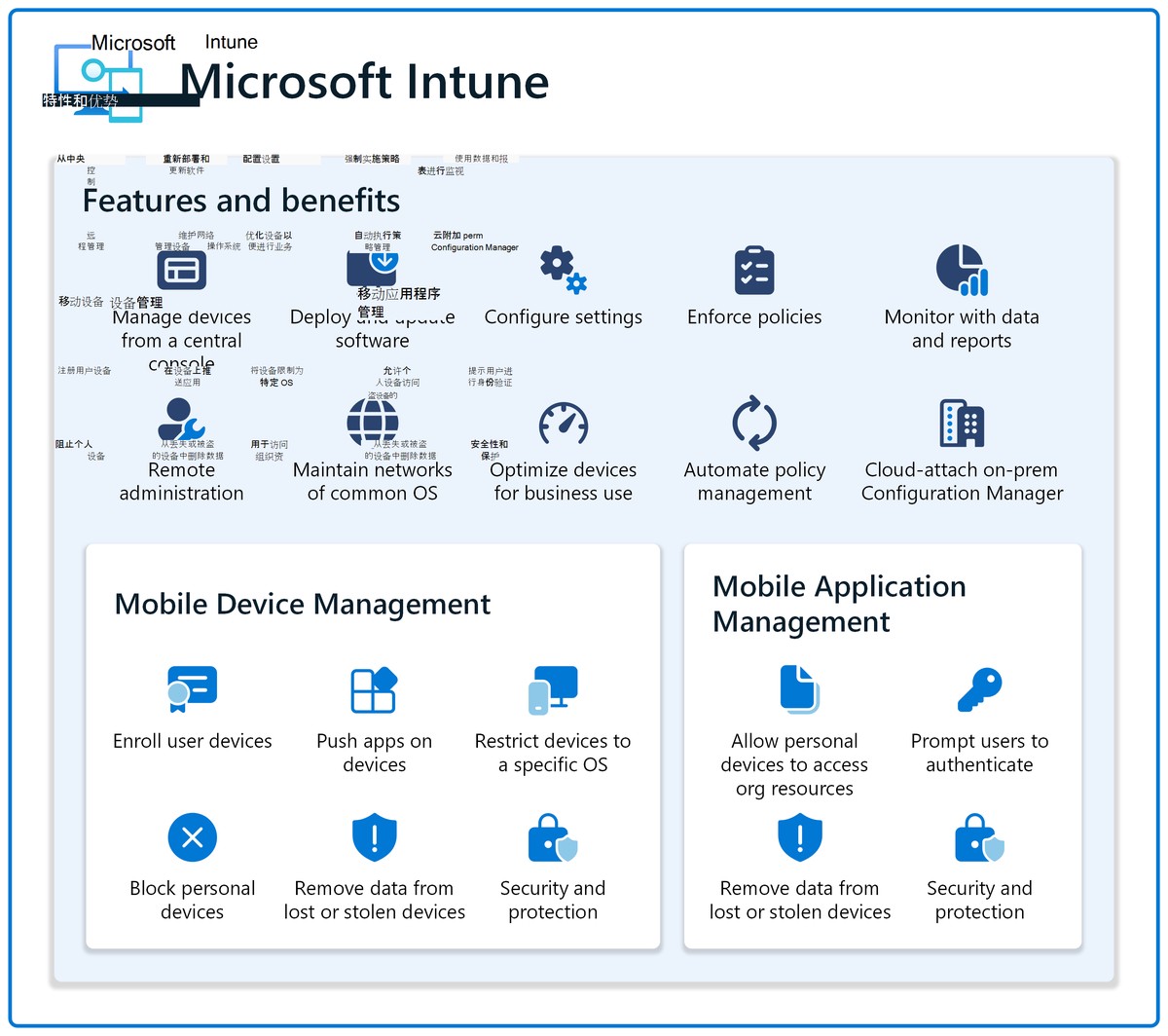

Main categories of risks in futures trading that quantitative experts must manage.

Methods of Futures Risk Management

1. Value at Risk (VaR)

VaR estimates the maximum expected loss over a given time horizon at a certain confidence level.

Advantages:

- Widely adopted in financial institutions.

- Provides a clear, quantifiable risk threshold.

Disadvantages:

- Ignores tail risks beyond the chosen confidence level.

- Assumes historical data is predictive of future risk.

Best Use Case: Daily risk limits in high-frequency trading strategies.

2. Stress Testing and Scenario Analysis

Instead of relying only on historical data, stress testing simulates extreme events (e.g., 2008 financial crisis, 2020 COVID crash).

Advantages:

- Identifies vulnerabilities under abnormal conditions.

- Helps prepare for low-probability, high-impact events.

Disadvantages:

- Scenarios may not capture unknown risks.

- Time-consuming to design accurate simulations.

Best Use Case: Evaluating robustness of long-term quantitative futures strategies.

3. Position Sizing and Leverage Control

Using fixed fractional or volatility-adjusted position sizing ensures exposure is aligned with portfolio risk tolerance.

Advantages:

- Simple yet effective in preventing over-leverage.

- Automatically adjusts to volatility regimes.

Disadvantages:

- May underutilize capital in low-volatility periods.

- Requires constant recalibration for changing markets.

Best Use Case: Retail and institutional traders seeking capital efficiency.

4. Portfolio Diversification and Correlation Analysis

Managing exposure across asset classes (e.g., equity index futures, commodity futures, interest rate futures) reduces concentration risk.

Advantages:

- Smooths out equity curves.

- Reduces drawdowns during market stress.

Disadvantages:

- Correlations may spike during crises.

- Requires advanced covariance matrix modeling.

Best Use Case: Quantitative funds managing multi-strategy futures portfolios.

Comparison of popular futures risk management methods used by quantitative experts.

Comparing Strategies: VaR vs Stress Testing

- VaR works best in stable market environments with consistent volatility patterns. However, it may underestimate extreme risks.

- Stress Testing highlights weaknesses in rare but catastrophic scenarios. While not predictive, it ensures resilience under shocks.

Recommendation: A hybrid approach—use VaR for day-to-day monitoring and stress testing for long-term resilience.

Integrating Futures Risk Management into Quantitative Strategies

How Futures Impact Quantitative Trading Strategies

Futures allow leverage, short exposure, and cross-asset strategies, making them central to systematic models. However, improper risk management can lead to model failure despite strong theoretical performance.

Quantitative experts often embed risk management rules directly into algorithms, such as:

- Dynamic margin utilization thresholds.

- Automated stop-loss triggers.

- Correlation-based portfolio rebalancing.

Case Example: Equity Index Futures Strategy

A trend-following strategy on S&P 500 futures may perform well historically but collapse under sudden volatility spikes. By integrating volatility-adjusted position sizing and VaR-based stop-outs, the strategy’s drawdown can be reduced by 40%.

Latest Trends in Quantitative Futures Risk Management

- Machine Learning for Risk Prediction – Neural networks identifying nonlinear risk exposures.

- Intraday VaR Models – Updating risk metrics in real-time for high-frequency trading.

- Cloud-Based Risk Engines – Allowing scalable, portfolio-wide stress testing.

- RegTech Integration – Automated compliance monitoring alongside trading systems.

These advancements reflect a growing demand for adaptive, data-driven risk management systems in quantitative finance.

Emerging trends in futures risk management for quantitative experts.

FAQ: Futures Risk Management for Quantitative Experts

1. What is the most important risk metric for futures traders?

While there is no single best metric, a combination of VaR for statistical measurement and stress testing for scenario-based resilience provides a comprehensive view. Quantitative experts often use both simultaneously.

2. How can leverage be controlled effectively in futures trading?

Leverage should be managed using volatility-adjusted position sizing, ensuring that exposure remains proportional to market risk. Additionally, implementing margin utilization limits helps prevent overexposure during volatile markets.

3. Are quantitative futures strategies more resilient than discretionary trading?

Not necessarily. While quantitative strategies enforce discipline, their risk models may fail under unprecedented market conditions. The key lies in continuously updating risk assumptions and integrating robust stress testing frameworks.

Conclusion

Effective futures risk management for quantitative experts is not about avoiding risk altogether but about systematically controlling it. By combining methods such as VaR, stress testing, position sizing, and diversification, quantitative traders can create resilient strategies that survive both normal volatility and extreme market shocks.

The best approach is hybrid: use statistical tools for daily monitoring while incorporating scenario-based frameworks for long-term preparedness. With futures playing a central role in quantitative finance, mastering risk management is what separates consistent professionals from those who fall victim to leverage and unexpected events.

If this article gave you new insights into futures risk management, share it with colleagues, comment with your experience, and help strengthen the global community of quantitative traders.

0 Comments

Leave a Comment