=====================================================

The financial markets have always been driven by data, but in recent years, the explosion of computational power and artificial intelligence has dramatically reshaped trading strategies. How machine learning algorithms revolutionize trading is no longer just a research question—it is an ongoing reality for hedge funds, institutional investors, and even retail traders.

Machine learning (ML) allows traders to uncover hidden patterns, optimize execution, and build adaptive strategies that outperform traditional models. In this article, we will explore the impact of machine learning in trading, analyze key strategies, compare methodologies, and provide insights on practical applications for professionals and beginners alike.

Understanding the Role of Machine Learning in Trading

Machine learning refers to algorithms that can learn from data and improve predictions without explicit programming. In trading, these algorithms can:

- Predict asset price movements using historical data.

- Detect anomalies, such as unusual order flow or market manipulation.

- Optimize portfolio allocations dynamically.

- Improve risk management by forecasting volatility.

Unlike rule-based systems, ML-driven models adapt over time, making them ideal for highly dynamic environments like stock, forex, and crypto markets.

Why Machine Learning Is Transforming Trading

1. Data Explosion in Finance

With millions of trades executed daily and vast alternative data sources (news, social media sentiment, satellite imagery), traders can no longer rely on linear statistical models alone. Machine learning thrives in high-dimensional, complex datasets.

2. Speed and Automation

Machine learning enables automated trading systems that operate in microseconds. These systems can evaluate thousands of factors simultaneously, something no human trader can match.

3. Predictive Power

Through advanced methods such as predictive analytics using machine learning models, traders gain an edge by identifying leading indicators of price action, rather than reacting after trends emerge.

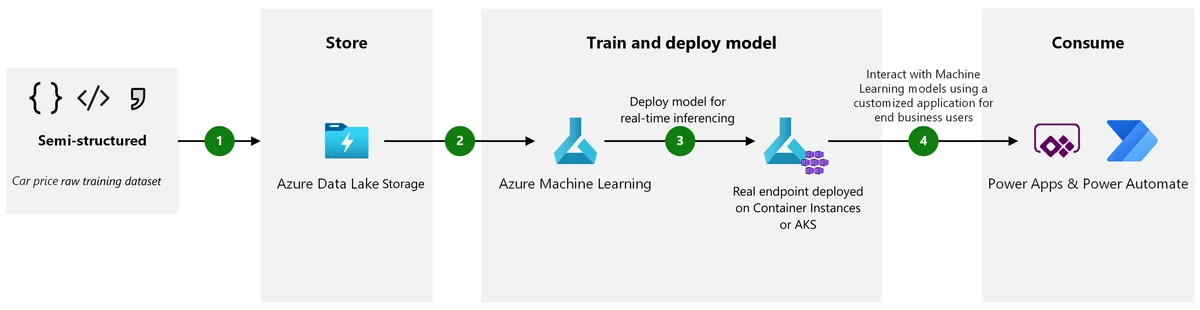

How raw data is transformed into actionable trading insights using machine learning

Core Machine Learning Strategies in Trading

1. Supervised Learning for Price Prediction

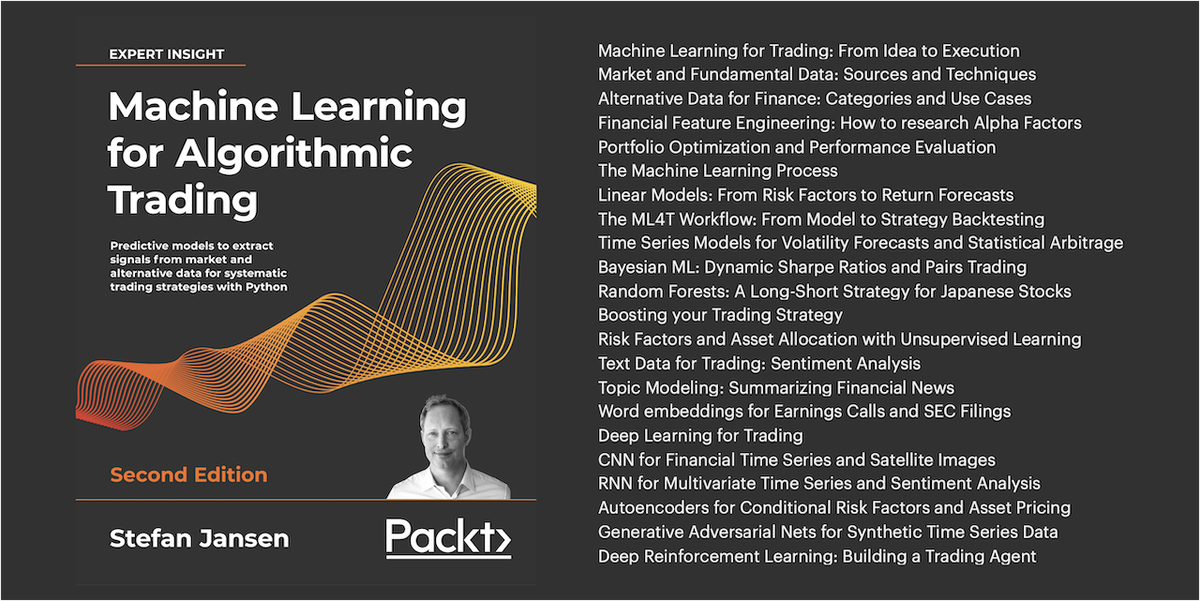

Supervised learning algorithms, such as regression models, random forests, and gradient boosting machines, are trained on historical price and volume data.

Advantages:

- Clear interpretability when using linear models.

- Works well with structured financial time series data.

- Clear interpretability when using linear models.

Disadvantages:

- Struggles with sudden market regime shifts.

- Requires labeled datasets (e.g., past prices and returns).

- Struggles with sudden market regime shifts.

2. Reinforcement Learning for Execution and Strategy Optimization

Reinforcement learning (RL) is increasingly applied in automated trading systems using machine learning. In RL, the algorithm acts as an “agent” that interacts with the market environment, learning optimal actions (buy/sell/hold) through trial and error.

Advantages:

- Adaptability in fast-changing environments.

- Optimizes execution strategies (e.g., minimizing slippage).

- Adaptability in fast-changing environments.

Disadvantages:

- Computationally expensive.

- Risk of overfitting simulated environments that don’t reflect reality.

- Computationally expensive.

3. Unsupervised Learning for Pattern Recognition

Unsupervised methods like clustering and principal component analysis (PCA) uncover hidden relationships between assets or detect anomalies in market behavior.

Advantages:

- Useful for portfolio diversification and risk clustering.

- Helps identify market regimes and structural breaks.

- Useful for portfolio diversification and risk clustering.

Disadvantages:

- Lack of clear labels makes validation challenging.

- Interpretability is often limited.

- Lack of clear labels makes validation challenging.

4. Deep Learning for Sentiment and Alternative Data

Neural networks, particularly deep learning architectures, are widely used in analyzing unstructured data such as financial news, earnings call transcripts, and social media sentiment.

Advantages:

- Captures complex nonlinear relationships.

- Processes massive datasets beyond traditional financial indicators.

- Captures complex nonlinear relationships.

Disadvantages:

- High “black box” risk—traders may not understand how predictions are made.

- Requires substantial computational resources.

- High “black box” risk—traders may not understand how predictions are made.

Comparing ML-Based Trading Strategies

| Strategy Type | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Supervised Learning | Price trend prediction | Simplicity, interpretability | Vulnerable to regime shifts |

| Reinforcement Learning | Execution & adaptive trading | Dynamic adaptability, high potential | Complex, expensive, data-hungry |

| Unsupervised Learning | Market clustering & anomaly detection | Hidden pattern discovery | Limited predictive accuracy |

| Deep Learning | Sentiment & alternative data | Nonlinear modeling, flexibility | Lack of transparency, costly |

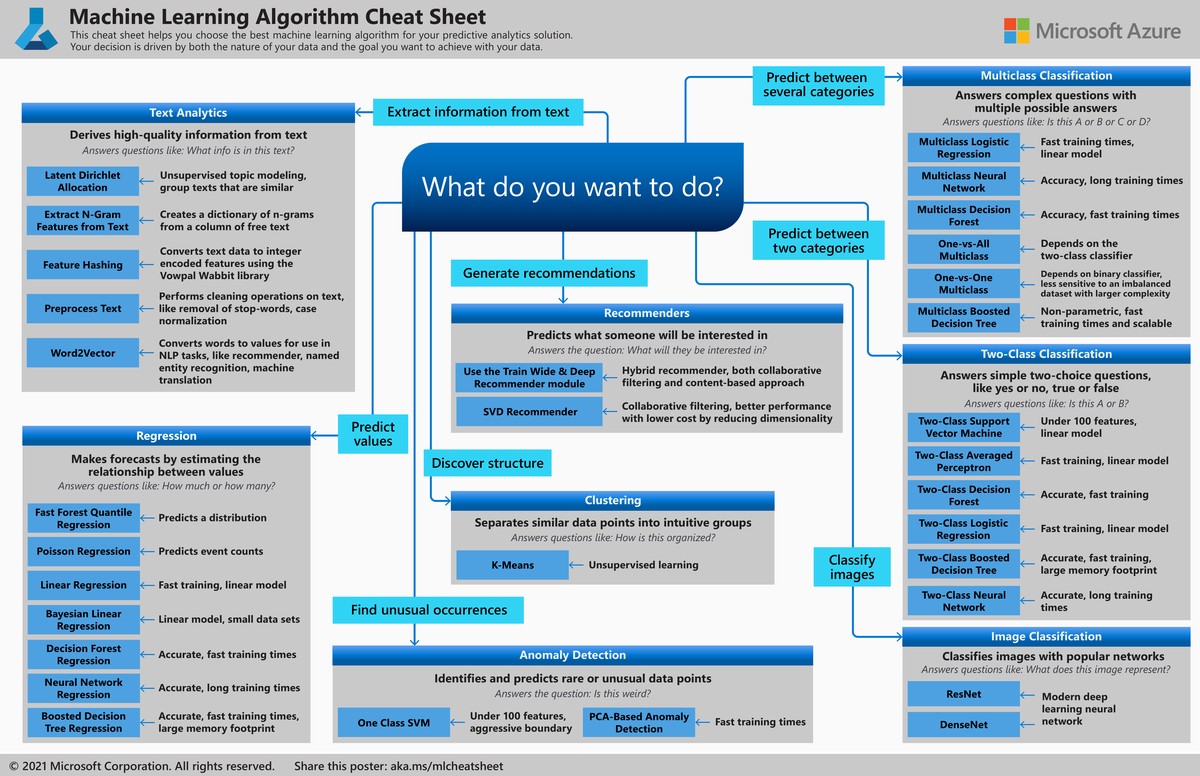

A comparison of supervised, unsupervised, and reinforcement learning in financial trading

Practical Applications of ML in Trading

Portfolio Management

Machine learning solutions for portfolio management enable traders to rebalance assets dynamically, identifying diversification opportunities and reducing risk exposure.

Quantitative Analysis

Professionals stress why machine learning in quantitative analysis is important—because it allows for deeper pattern detection, anomaly identification, and predictive insights beyond traditional econometric models.

Algorithmic Execution

By using reinforcement learning, traders can improve order execution by minimizing slippage and transaction costs while maximizing execution speed.

Personal Insights and Industry Trends

From my experience working with ML-driven trading models, one of the biggest challenges is data quality. Many novice traders assume that more data guarantees better models. In reality, poorly curated datasets can cause overfitting, leading to catastrophic results in live markets.

Recent industry trends include:

- Increased adoption of transformer-based architectures for natural language processing in trading.

- Greater emphasis on explainable AI (XAI), especially for compliance in regulated markets.

- Hybrid models that combine supervised and reinforcement learning to maximize adaptability.

FAQ: Machine Learning in Trading

1. How can I start using machine learning in trading strategies?

Start with simple supervised models such as logistic regression or decision trees. Gradually move to advanced methods like reinforcement learning after gaining confidence in handling financial datasets. Consider exploring resources on how to implement machine learning in trading strategies for step-by-step guidance.

2. What are the risks of using machine learning in trading?

The main risks include overfitting, model drift (when market conditions change), and lack of interpretability in deep learning models. Traders should always test algorithms with out-of-sample data before deploying in real markets.

3. Where to apply machine learning in quantitative finance most effectively?

Machine learning is highly effective in:

- Short-term price prediction.

- Risk management and volatility forecasting.

- Sentiment analysis of financial news.

- Portfolio optimization.

Conclusion: The Future of Trading Is Machine Learning

Machine learning has already revolutionized trading by unlocking predictive power, automation, and adaptability. From supervised learning for forecasting to reinforcement learning for execution, ML is pushing the boundaries of what’s possible in financial markets.

The best approach is not to rely on one method but to integrate multiple techniques, combining interpretability with adaptability. Traders who embrace machine learning today will be best positioned for tomorrow’s increasingly competitive financial landscape.

👉 Did you find this article insightful? Share it with colleagues, leave a comment with your experiences using machine learning in trading, and join the conversation about the future of AI in finance.

Would you like me to also create a step-by-step learning roadmap for traders who want to master machine learning—from beginner to advanced—so you can integrate it into your workflow more effectively?

0 Comments

Leave a Comment