=================================================================

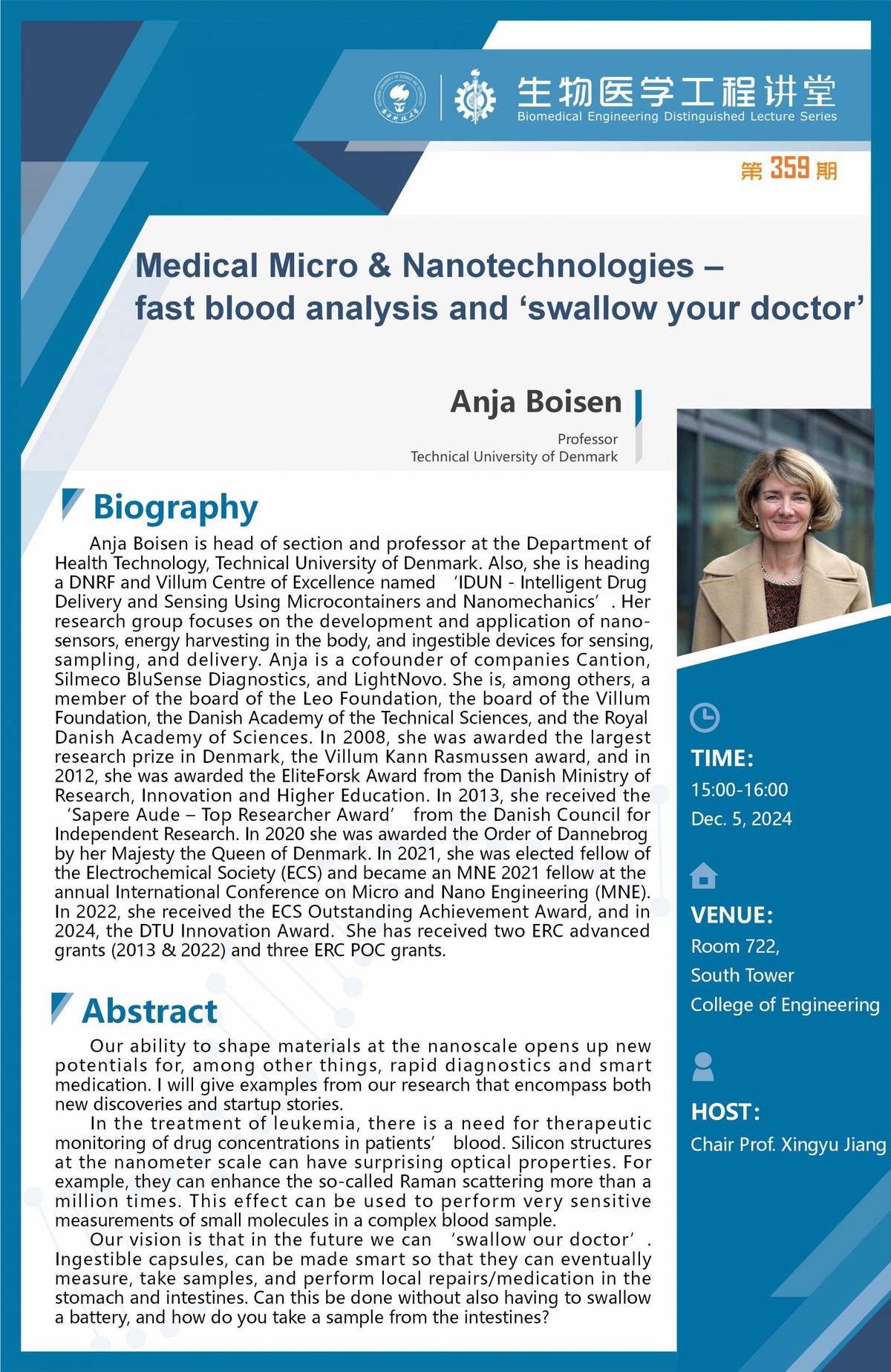

Understanding market microstructure for quantitative analysts is essential for designing trading algorithms, analyzing liquidity, and managing execution costs. While price movements may seem random on the surface, market microstructure research uncovers the mechanics of order flow, transaction costs, and how information travels within financial markets. For quants, this knowledge provides a critical edge in both alpha generation and risk management.

This guide explores the foundations of market microstructure, compares practical strategies, and outlines how quantitative analysts can incorporate these insights into trading models.

What Is Market Microstructure?

Market microstructure refers to the study of how trading mechanisms, order types, and participants affect price formation and liquidity in financial markets. It examines the fine-grained details of how trades are executed, rather than just the broad supply-and-demand principles.

Key aspects include:

- Order book dynamics (limit orders vs. market orders).

- Bid-ask spreads and liquidity measurement.

- Transaction costs (explicit and implicit).

- Information asymmetry between informed and uninformed traders.

- Market impact of large orders.

For quantitative analysts, market microstructure serves as both a research field and a practical toolkit for refining trading strategies.

Why Market Microstructure Matters for Quants

- Alpha Extraction

Microstructure analysis allows quants to detect short-lived opportunities from order flow or liquidity imbalances.

- Transaction Cost Optimization

Knowing how trades affect execution quality improves algorithm design and reduces slippage.

- Risk Management

Market microstructure insights help predict volatility spikes and liquidity shocks.

- Algorithmic Trading Design

Many execution algorithms (VWAP, TWAP, POV) rely on microstructure principles.

👉 This ties directly into How does market microstructure impact trading?, where execution cost and liquidity are crucial to long-term profitability.

Core Components of Market Microstructure Analysis

1. Order Book Dynamics

The order book reveals supply and demand at different price levels. Quants monitor:

- Depth: volume available at each price level.

- Order imbalance: skew between buy and sell orders.

- Market resiliency: how quickly prices recover after large trades.

2. Transaction Costs

Beyond visible fees, traders face hidden costs:

- Bid-ask spread: the immediate cost of crossing the market.

- Market impact: how much a trade moves the price.

- Opportunity cost: losses from unexecuted orders.

3. Information Flow

Microstructure also studies who knows what and when. For example, institutional traders may disguise large orders to reduce signaling risk.

Strategies Based on Market Microstructure

Strategy 1: Liquidity Provision (Market Making)

Quantitative analysts can design algorithms that post limit orders to capture the bid-ask spread.

- Pros: Generates consistent profits in stable markets, provides liquidity.

- Cons: High risk during volatility; exposed to adverse selection when trading against informed participants.

Strategy 2: Optimal Execution (Cost Minimization)

Another approach is execution algorithms designed to minimize costs when trading large blocks.

Common methods:

- VWAP (Volume Weighted Average Price): spreads trades across time to match market volume.

- TWAP (Time Weighted Average Price): executes evenly over time.

- POV (Participation of Volume): trades a percentage of market volume.

- Pros: Reduces slippage and impact.

- Cons: May miss opportunities if the market moves away rapidly.

👉 This relates closely to How to analyze market microstructure?, since execution optimization requires deep analysis of order flow and spreads.

Comparing the Two Approaches

| Strategy | Best For | Advantages | Risks |

|---|---|---|---|

| Liquidity Provision | Market makers, HFT firms | Captures spreads, stable profits | Adverse selection, volatility losses |

| Optimal Execution | Institutional block trades | Low cost, risk-controlled | Opportunity loss if market trends strongly |

👉 For most quantitative analysts, combining both—providing liquidity in stable conditions while using smart execution during large trades—creates the most balanced approach.

Latest Trends in Market Microstructure Research

- AI-driven Execution Algorithms

Machine learning models analyze order flow in real time to adapt execution strategies dynamically.

- Market Microstructure in Crypto Trading

Decentralized exchanges (DEXs) create new microstructure challenges such as AMM (automated market maker) liquidity pools.

- Regulatory Impacts

Changes like MiFID II and SEC rules influence transparency and data availability, reshaping microstructure analysis.

- Simulation Tools

Quants increasingly use agent-based models and Monte Carlo simulations to replicate microstructure dynamics before live deployment.

Practical Applications for Quantitative Analysts

- Designing Alpha Models

By detecting microstructure inefficiencies, quants can predict short-term price moves.

- Building Execution Algorithms

Incorporating order book depth, volatility, and spreads improves execution quality.

- Risk Monitoring

Microstructure models detect liquidity crises early by tracking spread widening and order imbalance.

- Cross-Market Strategies

Quants apply microstructure concepts across equities, futures, FX, and crypto to compare relative liquidity.

Visual Insights

Order Book Depth and Liquidity Impact

Bid-Ask Spread and Execution Cost Breakdown

FAQ: Market Microstructure for Quantitative Analysts

1. What data sources are most useful for market microstructure analysis?

Quantitative analysts rely on tick-level data, order book snapshots, and trade execution reports. Many use commercial providers (Bloomberg, Refinitiv) or exchange APIs. Some also build custom feeds from co-location servers for high-frequency trading.

2. How does market microstructure affect pricing models?

Microstructure introduces short-term deviations from fundamental pricing. While macro models explain long-term value, microstructure explains why short-term prices deviate due to liquidity, spreads, or order flow. This makes it crucial for traders working on intraday or high-frequency horizons.

3. Can retail traders benefit from market microstructure knowledge?

Yes. Even though retail traders lack institutional resources, understanding concepts like spreads, slippage, and liquidity timing improves execution quality. Many brokers now provide market microstructure for retail traders resources, helping individuals avoid costly mistakes.

Conclusion: Building a Quant Edge with Market Microstructure

For quantitative analysts, market microstructure is more than theory—it’s a practical edge. By analyzing order books, execution costs, and liquidity, quants can design smarter algorithms, lower trading costs, and predict price dynamics more effectively.

The most effective approach blends liquidity provision with cost-optimized execution, supported by cutting-edge tools such as AI and simulation models.

If this article helped you, share it with your network of traders and analysts. Let’s build a community of quants who understand not just the what of price moves, but the why behind them.

Would you like me to also draft a market microstructure statistical model example in Python (using order book data) so quants can see how theory translates into code?

0 Comments

Leave a Comment