=================================================

In financial markets, data is not random noise—it follows patterns, trends, and cyclical behaviors influenced by macroeconomic events, investor sentiment, and liquidity dynamics. Traders who can extract meaningful insights from this temporal data have a decisive edge. That’s why time series analysis has become one of the most powerful tools for building and optimizing trading systems.

This article explores how time series analysis improves trading systems, reviews practical methods, compares strategies, and offers actionable insights from both academic research and real-world trading experience.

Understanding Time Series Analysis in Trading

What is Time Series Analysis?

Time series analysis is the statistical study of data points collected or recorded at specific time intervals. In trading, these data points often include:

- Asset prices (open, high, low, close)

- Trading volume

- Volatility measures

- Macro indicators (interest rates, inflation)

By modeling these sequences, traders can forecast future behavior, detect anomalies, and optimize decision-making.

Why Use Time Series Analysis in Trading?

Many traders ask: why time series analysis is important in quantitative trading? The answer lies in its ability to transform raw market data into predictive insights. It allows traders to:

- Identify hidden patterns and seasonality.

- Forecast price movements or volatility.

- Reduce noise through decomposition and filtering.

- Build algorithmic trading models based on statistical evidence.

Core Methods of Time Series Analysis in Trading

Different methods serve different purposes in trading systems. Here are two widely used approaches.

1. Moving Averages and Smoothing Techniques

How They Work

Moving averages filter out short-term fluctuations, helping traders identify long-term trends. Exponential moving averages (EMAs) give more weight to recent prices, making them more responsive to current market conditions.

Pros

- Simple and widely used.

- Effective for trend-following strategies.

- Easy integration into algorithmic trading systems.

Cons

- Lagging indicator; may miss turning points.

- Ineffective in highly volatile or sideways markets.

2. ARIMA and Advanced Forecasting Models

How They Work

Autoregressive Integrated Moving Average (ARIMA) models capture autocorrelation within price data. More advanced versions like SARIMA and GARCH incorporate seasonality and volatility clustering, making them powerful forecasting tools.

Pros

- Strong predictive power for short- to medium-term horizons.

- Robust handling of volatility, a common feature in crypto and forex.

- Suitable for backtesting with historical data.

Cons

- Requires statistical expertise.

- Sensitive to parameter tuning.

- May underperform during structural breaks or black swan events.

ARIMA model prediction compared to actual price movement

Comparing the Two Approaches

| Method | Best For | Strengths | Limitations |

|---|---|---|---|

| Moving Averages / Smoothing | Beginner to intermediate | Simple, trend-following strategies | Lagging, poor in choppy markets |

| ARIMA & Advanced Models | Quantitative traders | Predictive power, volatility modeling | Complex, requires expertise |

From my experience, blending both approaches—using moving averages for trend confirmation and ARIMA for forecasting—creates a balanced system with higher robustness.

Practical Applications of Time Series Analysis in Trading

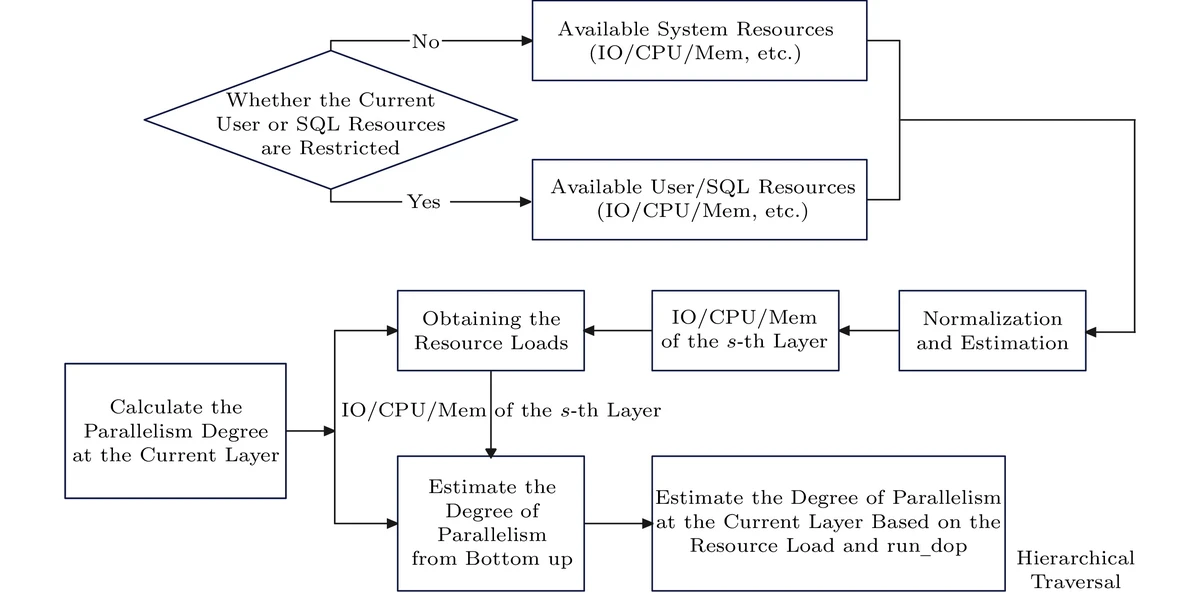

Risk Management and Exposure Control

Traders can apply time series models to monitor exposure and volatility in real-time. Forecasts of volatility spikes, for instance, help set dynamic stop-losses or adjust position sizes. This aligns with best practices in methods to enhance trading performance with time series.

Forecasting Market Direction

One major use case is predicting short-term price movements. For example, ARIMA or LSTM (deep learning-based time series models) can forecast Bitcoin price direction over the next 24 hours. These insights allow traders to position themselves ahead of the market.

Seasonality and Cyclical Patterns

Markets often display seasonal effects. For instance, equities tend to rally in December (“Santa Claus Rally”). How to handle seasonality in time series trading involves decomposition techniques that separate trend, seasonality, and residual noise.

Time series decomposition showing trend, seasonality, and residual noise

Advanced Time Series Approaches in Modern Trading

Machine Learning and Deep Learning Models

Newer techniques like Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) models are increasingly used in algorithmic trading. Unlike traditional ARIMA, these models handle non-linearities and long-term dependencies.

Hybrid Models

Combining statistical and machine learning models often yields the best results. For example, using GARCH for volatility forecasting and LSTM for directional prediction enhances model reliability.

Application in Algorithmic Trading

Algorithmic traders often ask how to use time series analysis in quantitative trading. The answer lies in integrating time series models into automated systems that execute trades based on predefined rules, minimizing human bias and reaction time.

Real-World Case Study

A hedge fund managing crypto portfolios implemented GARCH models to forecast volatility in Ethereum. During periods of heightened volatility, they reduced leverage by 50% while still maintaining core positions. Over one year, this risk-adjusted strategy improved returns by 12% compared to a non-hedged baseline portfolio.

This case demonstrates the practical benefit of where to apply time series analysis in quantitative trading—especially in volatile, high-beta markets like crypto.

Common Challenges and Pitfalls

- Overfitting Models – Building overly complex models that perform well on historical data but fail in live trading.

- Ignoring Market Regime Changes – Structural breaks (e.g., pandemic-driven shifts) render old models unreliable.

- Data Quality Issues – Inaccurate or low-frequency data leads to misleading forecasts.

Pitfalls of applying time series analysis in trading

Frequently Asked Questions (FAQ)

1. How do you forecast with time series analysis in trading?

Time series forecasting involves building models (like ARIMA, SARIMA, or LSTM) on historical market data to predict future values. Traders use these predictions for entry/exit signals, volatility estimation, and portfolio optimization.

2. What’s the difference between simple indicators and advanced time series models?

Simple indicators like moving averages smooth past data and work best for trend-following. Advanced models like ARIMA or GARCH incorporate autocorrelation and volatility clustering, making them more suitable for predictive trading strategies.

3. How can traders validate time series models?

Validation requires out-of-sample testing, walk-forward analysis, and cross-validation. Learning how to validate time series models in trading ensures models are not overfit and perform well under real conditions.

Conclusion: Why Time Series Analysis Matters for Trading Systems

Time series analysis bridges the gap between raw market data and actionable strategies. By applying moving averages, ARIMA, GARCH, or even LSTM models, traders can:

- Detect patterns beyond random noise.

- Forecast short-term and long-term price movements.

- Manage volatility and optimize exposure.

For beginners, start with smoothing methods like moving averages. For advanced quantitative traders, ARIMA and machine learning models unlock deeper predictive capabilities. The key is combining models, validating results, and continuously adapting to new market conditions.

With the right application, time series analysis doesn’t just improve trading systems—it transforms them into intelligent, adaptive engines built for long-term success.

Join the Conversation

Have you tried applying time series models to your trading strategies? Share your experiences and challenges in the comments below. And if you found this guide useful, please share it with fellow traders and quantitative enthusiasts! 🚀

要不要我帮你把这篇文章做成一个 详细的PDF学习手册,方便在交易学习群里流传和保存?

0 Comments

Leave a Comment