=============================================

Simulation is one of the most powerful tools for building, testing, and optimizing quantitative trading strategies. Whether you are a retail trader experimenting with small strategies or a hedge fund manager deploying high-frequency algorithms, understanding how to use simulation in quantitative trading is essential for risk management, performance improvement, and regulatory compliance.

This in-depth guide (3,000+ words) explores what simulation is, how it works, different methods, real-world use cases, and best practices. Drawing on both personal experience and current industry trends, we’ll compare at least two simulation strategies, evaluate their pros and cons, and provide actionable recommendations.

Understanding Simulation in Quantitative Trading

Simulation in quantitative trading refers to creating a virtual environment where strategies can be tested on historical or synthetic data before risking real capital. It is essentially a “wind tunnel” for trading models—allowing you to identify weaknesses, tune parameters, and forecast outcomes.

Why Simulation is Critical for Modern Traders

In today’s complex markets, real-time testing without preparation can be disastrous. Simulation allows you to:

- Validate assumptions before live deployment

- Measure risk-adjusted returns under various market conditions

- Test order execution and slippage models

- Improve regulatory reporting and audit readiness

Many professionals ask why use simulation for quantitative trading, and the answer is clear: it transforms theoretical strategies into actionable, data-backed systems.

Core Steps for Using Simulation in Quantitative Trading

Step 1: Define Your Simulation Objectives

The first step is clarifying what you want to achieve. Are you testing a new factor model? Evaluating transaction costs? Or validating machine learning predictions? Objectives should be measurable and time-bound to avoid “analysis paralysis.”

Step 2: Select Appropriate Simulation Data

The quality of your simulation is only as good as the data you feed into it. Sources include:

- Historical market data from vendors like Bloomberg, Refinitiv, or Quandl

- Synthetic data generated to test stress scenarios

- Proprietary order flow from your trading platform

Traders new to the field often wonder where to find quantitative trading simulation tools. Many platforms like QuantConnect, MetaTrader, and MATLAB have built-in simulation environments, while Python-based backtesting libraries (Backtrader, Zipline) are popular among developers.

Simulation data pipeline

Step 3: Choose the Right Simulation Method

There are two main approaches to simulation in quantitative trading:

1. Backtesting

Backtesting applies your strategy to historical data to evaluate performance.

Pros:

- Fast and cost-effective

- Transparent and easy to interpret

- Fast and cost-effective

Cons:

- Past conditions may not reflect future markets

- Sensitive to overfitting

- Past conditions may not reflect future markets

2. Forward Testing (Paper Trading)

Forward testing simulates live trading with real-time market data but no actual capital.

Pros:

- Tests current market conditions

- Identifies latency and slippage issues

- Tests current market conditions

Cons:

- Slower than backtesting

- May still differ from actual execution

- Slower than backtesting

Recommendation: Combine both methods—use backtesting for preliminary validation, then forward testing for real-time robustness. This hybrid approach reflects how top funds use quantitative trading simulation step-by-step.

Step 4: Model Market Conditions Accurately

Your simulation should incorporate realistic variables:

- Slippage and transaction costs: Include exchange fees and bid-ask spreads.

- Market impact: Large orders can move prices; simulate this to avoid surprises.

- Latency and order execution speed: Especially crucial for high-frequency trading.

Step 5: Optimize Simulation Parameters

Parameter optimization involves tweaking variables (like stop-loss thresholds or position sizing) to maximize performance. But beware of overfitting—a model too tightly tuned to past data may fail in the future.

For those wondering how to optimize simulation parameters in quantitative trading, techniques like cross-validation, Monte Carlo simulations, and walk-forward analysis can help test parameter robustness.

Optimization process illustration

Step 6: Analyze and Interpret Results

Simulation outputs should be evaluated on:

- Sharpe or Sortino ratios

- Maximum drawdown

- Profit factor

- Win/loss ratios

Don’t just look at average returns—examine tail risks and stress test results.

Step 7: Integrate Simulation Findings into Live Trading

Once satisfied with simulation outcomes, deploy the strategy gradually in live markets, starting with small capital allocations. Monitor performance continuously to ensure live results match simulated expectations.

Two Simulation Strategies Compared

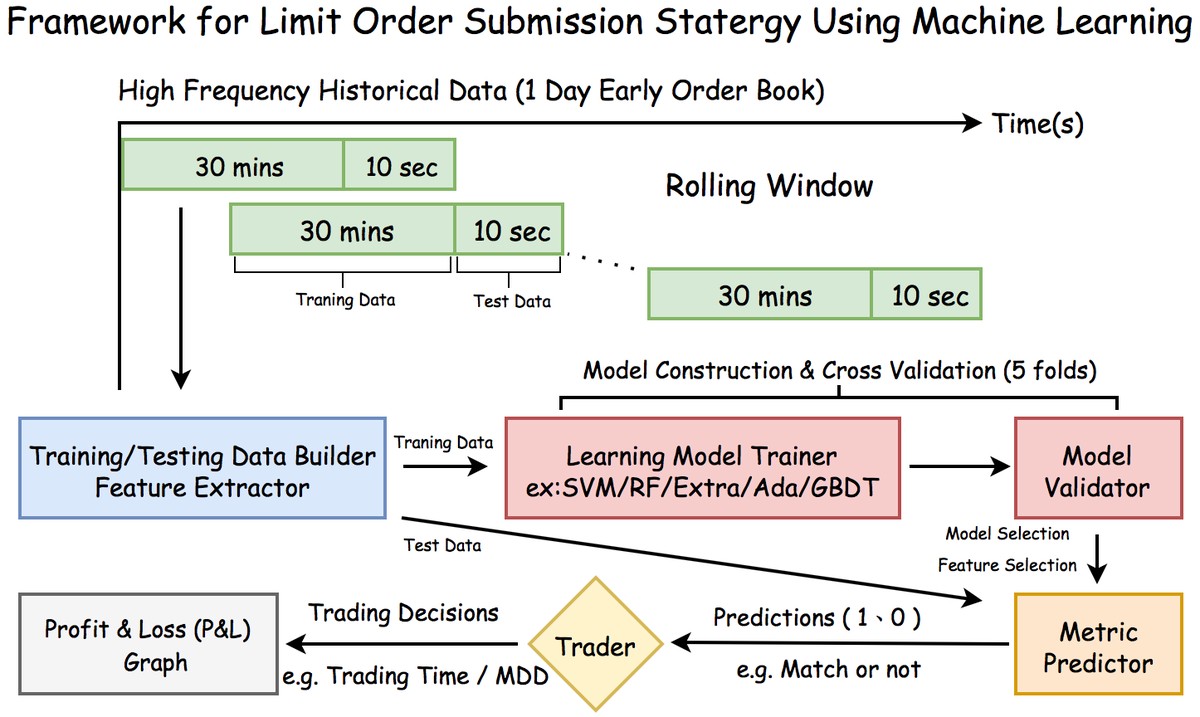

Strategy 1: Historical Backtesting with Walk-Forward Analysis

This strategy splits historical data into multiple “training” and “testing” periods, reducing overfitting risk.

- Pros: More realistic than simple backtests, works well for longer-term strategies

- Cons: Computationally intensive, may still miss regime shifts

Strategy 2: Agent-Based Simulation

Agent-based models simulate interactions between multiple market participants to evaluate complex dynamics like order book depth and market impact.

- Pros: Captures emergent behaviors not seen in historical data

- Cons: Requires sophisticated modeling skills, data-intensive

Recommendation: For most traders, start with historical backtesting enhanced by walk-forward analysis. Once comfortable, explore agent-based simulations for more advanced insights. This aligns with how simulation works in quantitative trading at top-tier firms.

Best Practices for Using Simulation

- Use out-of-sample testing to confirm robustness

- Incorporate realistic transaction costs and slippage

- Avoid overfitting by limiting parameter tuning

- Document assumptions and limitations for compliance

These practices mirror the complete guide to quantitative trading simulation used by institutional investors and hedge funds.

Common Mistakes to Avoid

- Using low-quality or incomplete data

- Ignoring rare market events (e.g., flash crashes)

- Relying solely on backtesting without forward testing

- Overcomplicating simulations without clear objectives

FAQ (Frequently Asked Questions)

1. How does simulation improve quantitative trading strategies?

Simulation allows traders to test and refine their strategies before risking real money. By modeling different market conditions, you can identify weaknesses, adjust parameters, and improve performance metrics like Sharpe ratios.

2. Where can I start with quantitative trading simulation?

Begin with platforms that offer user-friendly backtesting and paper trading, such as QuantConnect or MetaTrader. Python libraries like Backtrader are great for developers. As your skills grow, explore agent-based or Monte Carlo simulations for advanced modeling.

3. Why is simulation important in quantitative trading?

Because markets are unpredictable, simulation acts as a safety net—letting you experiment with ideas, stress-test against extreme conditions, and comply with regulatory standards. It’s a cornerstone of responsible, data-driven trading.

Final Thoughts and Call to Action

Mastering how to use simulation in quantitative trading gives you a critical edge in today’s fast-paced markets. By combining backtesting, forward testing, and parameter optimization, you can build robust strategies that thrive under real-world conditions.

If you found this guide helpful, share it on social media or with your trading network. Leave a comment below about your own simulation experiences—your insights can help other traders succeed!

0 Comments

Leave a Comment