Why Traders Need Machine Learning for Anomaly Detection

======================================================= Financial markets are inherently unpredictable, full of sudden price swings, unusual trading patterns, and rare market shocks. For traders,

Why Trade Execution is Critical in Quantitative Trading

======================================================= In the fast-paced world of quantitative trading, trade execution plays a pivotal role in the success of trading strategies. While many traders

Why Stop Loss Fails in Some Quantitative Strategies

=================================================== Stop loss orders are among the most widely used tools in trading, designed to limit downside risk and preserve capital. However, in the context of

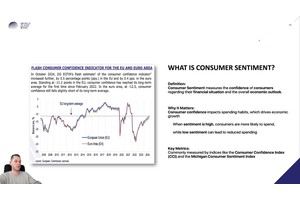

Why Tick Size Matters in Trading

================================ Tick size might seem like a small detail in financial markets, but it plays a significant role in how trades are executed, how liquid markets become, and how much

Why Tick Size Changes Over Time: A Complete Guide for Traders and Investors

=========================================================================== Introduction In financial markets, tick size refers to the minimum price movement by which a financial instrument can

Why Stop Loss Fails in Some Quantitative Strategies

=================================================== Stop loss is a well-established risk management tool used by traders to limit potential losses in a trade by automatically closing positions once a

Why Slippage Matters in High-Frequency Trading

============================================== Slippage is a critical factor that affects trading performance in high-frequency trading (HFT), a strategy that relies on speed, automation, and

Why Reuters Is Trusted by Quant Analysts

======================================== Introduction In the fast-moving world of quantitative finance, data accuracy, timeliness, and reliability are the cornerstones of every successful strategy.

Why Sell-Side Firms Matter in Quantitative Trading

================================================== In the world of quantitative trading, sell-side firms play an essential role in the development and execution of trading strategies. These firms

Why Reuters is Trusted by Quant Analysts

======================================== Quantitative analysts, also known as “quants,” rely on data to drive their trading strategies and research. In the world of finance, data is