============================================

Institutional trading is the engine that drives liquidity, price discovery, and market efficiency in today’s global financial ecosystem. Unlike retail investors, institutional traders operate with far larger volumes, complex strategies, and advanced technologies. Mastering institutional trading requires not only theoretical knowledge but also deep market experience, strong risk management practices, and access to the right tools.

This article provides comprehensive institutional trading tips for professionals, integrating personal insights, real-world examples, and the latest industry trends. We will explore proven strategies, compare different institutional trading approaches, and highlight practical best practices for achieving long-term performance.

Understanding Institutional Trading

Institutional trading refers to large-volume transactions executed by entities such as hedge funds, pension funds, mutual funds, insurance companies, and investment banks. These organizations often trade securities in millions of dollars at a time, using specialized strategies and technologies to optimize execution and minimize market impact.

Key characteristics include:

- High volume: Institutional trades can involve thousands or millions of shares.

- Algorithmic execution: Algorithms help reduce slippage and market disruption.

- Risk management: Institutions prioritize capital preservation alongside returns.

- Access to liquidity: Exclusive networks and dark pools are often used.

For professionals, understanding these dynamics is crucial to gaining an edge in execution and strategy selection.

Institutional Trading Tips for Professionals

1. Prioritize Execution Quality Over Speed

In institutional trading, execution is everything. A poorly executed trade can wipe out margins. Professionals must balance speed, liquidity access, and price stability. Tools such as VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price) algorithms help optimize execution.

2. Incorporate Data-Driven Decision Making

Modern institutional trading thrives on data. Traders use real-time analytics, sentiment analysis, and historical backtesting to refine strategies. Machine learning models now play a significant role in predicting short-term price movements and liquidity shifts.

3. Diversify Execution Venues

Professionals should not rely on a single trading venue. Instead, they should explore multiple platforms, including dark pools, electronic communication networks (ECNs), and crossing networks. Understanding where can institutions trade securities is essential to achieving better pricing and liquidity.

4. Stay Compliant with Regulations

Compliance is a non-negotiable aspect of institutional trading. Regulatory frameworks such as MiFID II, Dodd-Frank, and Basel III require firms to maintain transparency, proper reporting, and ethical execution practices. Traders must ensure compliance systems are embedded into their workflows.

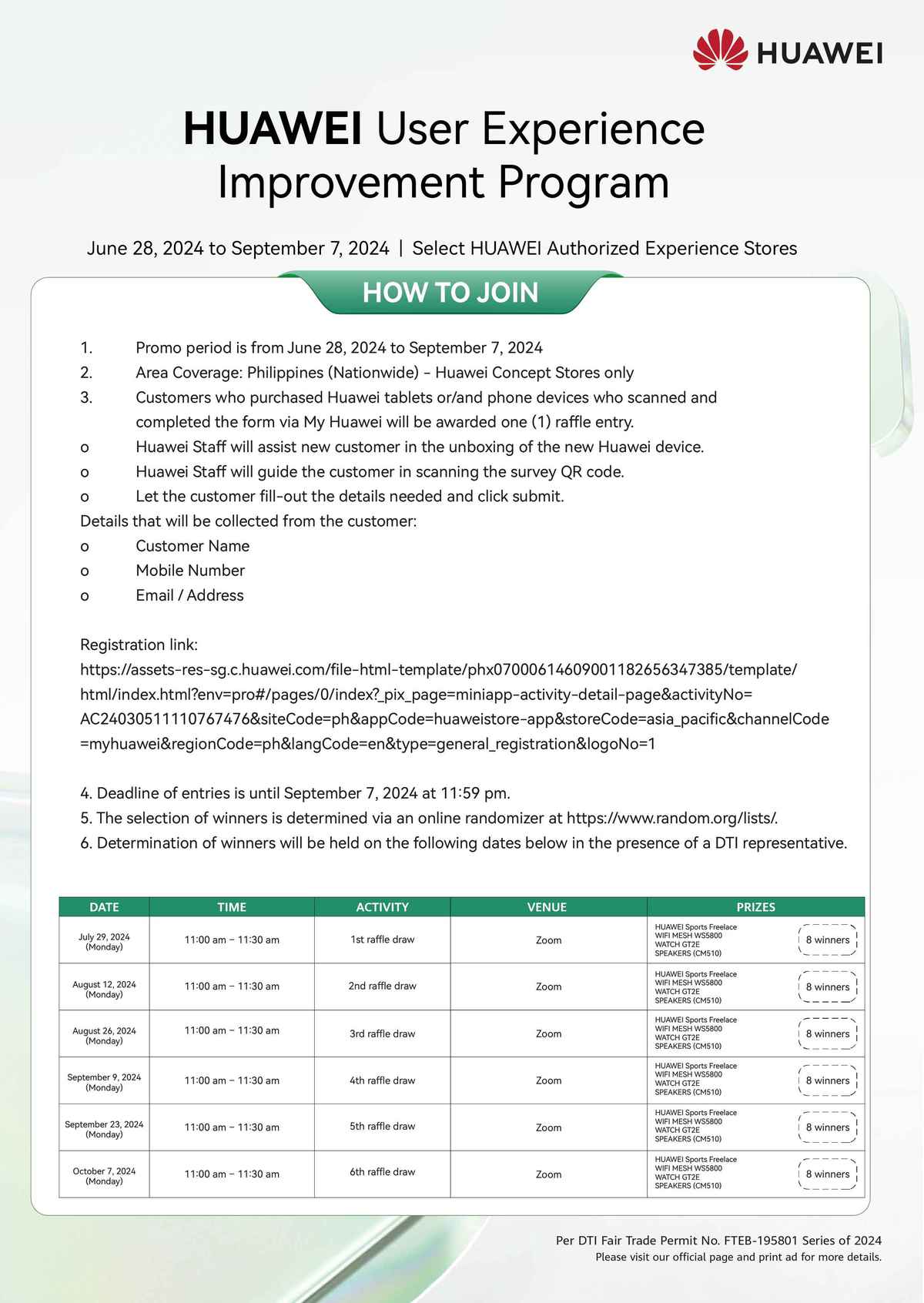

Comparing Two Core Institutional Trading Approaches

1. Algorithmic Trading

Algorithmic trading leverages pre-programmed instructions to execute trades. Common strategies include VWAP, TWAP, and iceberg orders.

Pros:

- Efficient execution of large trades.

- Reduces emotional bias.

- Minimizes market impact.

Cons:

- Over-reliance on technology can cause system failures.

- Vulnerable to high-frequency trading competition.

- Requires significant infrastructure investment.

2. Block Trading

Block trading involves large, privately negotiated trades conducted outside the open market, often through dark pools or brokers.

Pros:

- Minimizes visible market impact.

- Provides confidentiality.

- Allows negotiation for better pricing.

Cons:

- Reduced transparency.

- Limited liquidity in certain securities.

- Higher counterparty risk.

Recommendation: For most professionals, a hybrid strategy that combines algorithmic execution with selective block trading offers the best balance. This ensures both efficiency and discretion, while reducing costs and risks.

Best Practices for Professionals in Institutional Trading

1. Risk Management Is Key

Institutional traders must use tools like Value at Risk (VaR), stress testing, and scenario analysis to anticipate worst-case outcomes. Understanding institutional trading risk management strategies ensures long-term survival in volatile markets.

2. Leverage Technology for an Edge

Advanced order management systems (OMS), execution management systems (EMS), and AI-driven analytics platforms provide a competitive advantage. Automation reduces manual errors and enhances execution precision.

3. Build Strong Networks

Relationships with brokers, liquidity providers, and institutional trading networks allow traders to gain access to exclusive opportunities and reduce slippage.

4. Focus on Continuous Learning

Markets evolve rapidly. Professionals should keep updated through institutional trading courses for analysts, industry research, and hands-on experience with emerging tools.

Real-World Case: Algorithm vs. Human Judgment

During the 2020 market volatility, institutions using rigid algorithms sometimes faced execution challenges when liquidity dried up. However, firms combining algorithmic strategies with human oversight outperformed, as experienced traders could adjust parameters and negotiate block trades when algorithms faltered.

This highlights the need for experience-driven flexibility in professional institutional trading.

Institutional trading workflow combines algorithms, human oversight, and risk management systems.

Advanced Tips for Institutional Trading Professionals

1. Optimize Trade Timing

Trade execution should align with periods of optimal liquidity, often at market open or close. However, in less liquid markets, off-peak hours may reduce competition.

2. Monitor Market Impact Metrics

Tracking metrics such as implementation shortfall allows traders to evaluate how well execution aligns with intended outcomes.

3. Understand How Institutional Trading Differs from Retail Trading

Unlike retail, institutions must navigate order size constraints, market impact, and advanced compliance. Professionals should adopt an institutional mindset by focusing on long-term portfolio optimization, not just short-term gains.

4. Hedge with Derivatives

Using futures, options, and swaps allows institutions to hedge large positions effectively, minimizing downside risks.

Common institutional trading algorithms: VWAP, TWAP, Iceberg, and Implementation Shortfall strategies.

FAQ: Institutional Trading Tips for Professionals

1. What are the most effective institutional trading strategies today?

The most effective strategies are algorithmic execution (VWAP, TWAP) and block trading through dark pools. A hybrid approach is recommended, allowing professionals to balance efficiency and discretion.

2. How can institutional traders reduce execution costs?

Traders can reduce costs by:

- Using smart order routing (SOR) systems.

- Diversifying trading venues.

- Monitoring slippage and implementation shortfall.

- Negotiating broker fee structures.

3. Why do institutional traders use algorithms?

Algorithms allow institutions to execute large trades without disrupting markets, improve execution precision, and reduce emotional biases. They also enable faster reaction to real-time data and liquidity changes.

4. How can professionals improve their institutional trading skills?

By combining theoretical knowledge with practical exposure, enrolling in institutional trading courses for analysts, and staying updated with market research and compliance changes.

5. What role does compliance play in institutional trading?

Compliance ensures transparency, prevents manipulation, and aligns with global regulations. Professionals must integrate compliance and regulatory solutions into their trading infrastructure to avoid legal and reputational risks.

Institutional risk management process: Identify, assess, mitigate, and monitor.

Conclusion

For professionals, mastering institutional trading tips involves more than just execution—it requires data-driven decision-making, regulatory compliance, risk management, and adaptive strategies. The best results come from combining algorithmic precision with human expertise, ensuring trades are both efficient and strategically aligned with institutional objectives.

As institutional trading evolves, staying ahead requires constant learning, adoption of cutting-edge tools, and building robust networks. By following these strategies, professionals can maximize returns, minimize risks, and strengthen their competitive edge in global markets.

If you found this guide valuable, share it with your colleagues, leave a comment with your insights, and join the conversation. Together, we can shape smarter, more resilient institutional trading practices for the future.

Would you like me to also generate an SEO meta title + description for this article so it’s ready for Google ranking?

0 Comments

Leave a Comment