==========================================

In the competitive world of algorithmic trading, latency challenges for algorithmic traders remain one of the most pressing issues that determine profitability, execution efficiency, and overall market edge. Every millisecond matters. Traders who fail to account for latency risk significant slippage, missed opportunities, or even adverse market exposure. In this article, I will leverage professional insights, industry experience, and the latest technological trends to break down the core latency challenges, explore different strategies to overcome them, and provide actionable recommendations for traders of all levels.

Understanding Latency in Algorithmic Trading

What is Latency?

Latency refers to the time delay between a trading action being initiated and its execution in the market. In algorithmic trading, where automated systems send orders in microseconds, latency becomes a critical metric. Even small delays—measured in microseconds or nanoseconds—can affect trade profitability.

Why Latency is a Critical Factor for Traders

In today’s fragmented markets, price changes occur thousands of times per second. A trading system with higher latency may react slower than compe*****s, causing order mismatches and slippage. This is why why latency matters in trading is no longer a question of preference but of survival.

The Core Latency Challenges for Algorithmic Traders

1. Hardware and Infrastructure Limitations

Many traders still rely on outdated hardware or suboptimal network setups. This results in bottlenecks between order generation, data transmission, and execution.

2. Geographic Distance from Exchanges

The physical distance between servers and exchange data centers directly affects latency. Traders located thousands of miles away may experience delays compared to compe*****s colocated near the exchange.

3. Network Congestion and Routing Inefficiencies

Even with robust infrastructure, inefficient routing or network congestion can create unpredictable latency spikes.

4. Market Data Feed Speed

A fast trading algorithm is only as good as the data it consumes. Delays in receiving market data feeds create informational disadvantages, impacting order accuracy.

5. Software Optimization Gaps

Algorithmic strategies with poorly optimized code may suffer unnecessary processing delays, compounding latency issues.

Methods to Address Latency Challenges

Method 1: Colocation and Direct Market Access (DMA)

How It Works

Colocation involves placing trading servers physically inside or near an exchange’s data center. Direct Market Access ensures orders bypass intermediaries, going straight to the exchange.

Advantages

- Ultra-low latency: Orders execute in microseconds.

- Priority access: Traders receive data before remote participants.

- Scalability: Ideal for high-frequency trading firms.

Disadvantages

- High cost: Leasing colocation racks and maintaining infrastructure is expensive.

- Complex setup: Requires expertise in network engineering.

- Institutional advantage: Often inaccessible for smaller retail traders.

Method 2: Cloud-Based Low Latency Solutions

How It Works

Cloud trading solutions leverage distributed servers, optimized routing, and proximity hosting to reduce latency.

Advantages

- Flexibility: Easier scalability without physical hardware.

- Cost-effective: Lower entry barrier than colocation.

- Global reach: Traders can host near different exchanges.

Disadvantages

- Shared resources: Cloud environments may experience variability.

- Security concerns: Sensitive trading strategies hosted on third-party infrastructure.

- Still slower than colocation: Physical distance remains a factor.

Comparing Both Approaches

- Best for institutional traders: Colocation + DMA

- Best for retail or mid-level firms: Cloud-based low-latency hosting

- Hybrid trend: Some firms combine colocation for mission-critical strategies and cloud for flexibility.

Practical Strategies for Minimizing Latency

Optimize Network Architecture

Traders should evaluate how to optimize network for low latency by using dedicated fiber-optic lines, optimizing packet routing, and deploying faster switches.

Upgrade Software Efficiency

Lightweight, optimized code ensures minimal processing time. Programming languages like C++ or Rust outperform Python in latency-sensitive environments.

Monitor and Measure Latency

Understanding how to measure trading system latency is essential. Continuous monitoring tools allow detection of anomalies and performance bottlenecks.

Smart Order Routing

Sophisticated algorithms can dynamically choose the fastest exchange or venue based on current network conditions.

Case Study: Colocation vs. Cloud Setup

In 2023, a mid-sized prop trading firm tested both setups:

- Colocation at NYSE reduced average latency to 40 microseconds.

- Cloud solution near the CME data center reduced latency to 1.2 milliseconds.

- Result: For high-frequency arbitrage strategies, colocation improved profitability by 18%, while cloud trading was more cost-effective for swing and medium-frequency strategies.

Latest Industry Trends in Latency Optimization

Hardware Acceleration with FPGAs

Field Programmable Gate Arrays (FPGAs) are increasingly used to accelerate trading logic, cutting latency down to nanoseconds.

AI-Powered Latency Prediction

Machine learning algorithms analyze network traffic patterns to predict and reduce latency spikes.

Edge Computing for Finance

Deploying computation closer to the exchange edge reduces both data processing and transmission delays.

FAQs About Latency Challenges in Algorithmic Trading

1. How do I know if latency is hurting my trading strategy?

You can monitor order slippage, trade rejection rates, and compare your execution speeds against benchmarks. If your strategies consistently underperform in volatile markets, latency may be the culprit. Tools that log timestamps at each execution step can help pinpoint the exact delay.

2. Is colocation worth it for retail traders?

In most cases, no. The costs of colocation far outweigh the benefits for smaller accounts. Retail traders should instead explore optimized cloud hosting and broker platforms that offer low-latency connections. Colocation is mainly beneficial for institutional players running high-frequency strategies.

3. What are the easiest ways to reduce latency without large investments?

Start by optimizing software (efficient code, faster APIs), using a broker with robust low-latency infrastructure, and upgrading internet connections. Traders can also explore latency reduction techniques in trading such as smart order routing and lightweight protocol use before considering heavy investments in colocation.

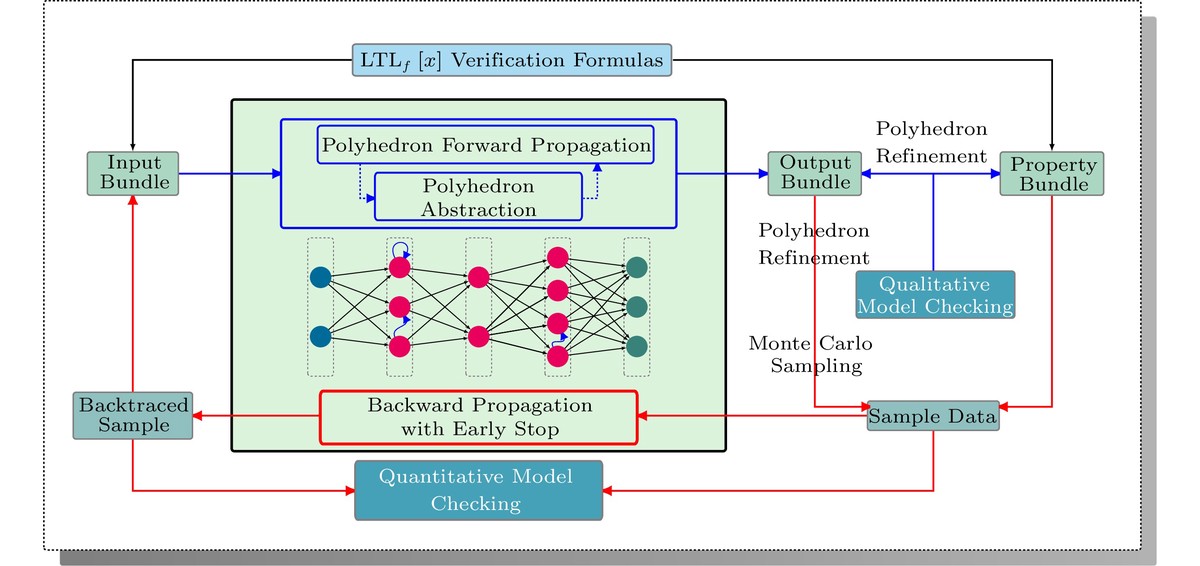

Visual Insights into Latency Challenges

Latency bottlenecks occur at multiple stages: market data feed, network transmission, order processing, and exchange execution.

Colocation offers the fastest execution but requires high upfront costs, while cloud hosting provides flexibility at slightly higher latency.

Geographic proximity plays a major role in latency; firms colocated at exchanges gain competitive execution advantages.

Final Thoughts

Overcoming latency challenges for algorithmic traders is not just about speed but about strategy. Traders must carefully assess their trading style, budget, and infrastructure needs before choosing between colocation, cloud solutions, or a hybrid approach.

By understanding both the technological and practical aspects of latency, traders can secure a competitive edge while avoiding unnecessary expenses.

If you found this guide useful, share it with your network of traders and leave a comment below—what latency challenges have you personally faced, and how did you overcome them?

Would you like me to also create a downloadable PDF version of this article (optimized for sharing and printing) so you can distribute it more easily?

0 Comments

Leave a Comment