=======================================================

In modern financial markets, anomaly detection has become one of the most critical tools for traders and quantitative analysts. The ability to identify unusual market behaviors—such as sudden price spikes, abnormal volume surges, or irregular patterns in asset correlations—can be the difference between substantial profit and devastating loss. Traders today often ask: where to learn anomaly detection techniques for trading that are both practical and advanced enough to match the complexity of financial markets.

This comprehensive guide explores educational pathways, compares popular learning methods, and provides hands-on insights into strategies used by professional traders. We’ll also cover industry trends, highlight real-world applications, and recommend the best places to start your journey in anomaly detection.

Understanding Anomaly Detection in Trading

Anomaly detection refers to identifying data points or events that deviate significantly from expected patterns. In trading, anomalies might signal hidden risks, market manipulation, or profitable opportunities.

Common types of anomalies in financial markets include:

- Price Outliers: Sudden spikes or crashes without fundamental justification.

- Volume Surges: Abnormal trading activity indicating insider moves or algorithmic flows.

- Correlation Shifts: Unexpected changes in relationships between assets.

- Volatility Clusters: Unusual concentration of risk in specific time periods.

Learning anomaly detection involves both statistical methods (e.g., Z-score analysis, moving averages) and machine learning approaches (e.g., clustering, neural networks).

Where to Learn Anomaly Detection Techniques for Trading

1. Online Learning Platforms

Massive open online courses (MOOCs) provide structured, affordable, and flexible learning. Platforms like Coursera, Udemy, and edX offer specialized courses in anomaly detection, machine learning, and quantitative finance.

- Advantages: Structured curriculum, accessible to all levels, practical assignments.

- Disadvantages: Generic content not always tailored for financial markets.

2. University Programs in Quantitative Finance

Many top universities now include anomaly detection modules within their quantitative finance or data science degrees. For example, Carnegie Mellon, NYU, and LSE offer specialized finance programs that integrate data analytics with trading applications.

- Advantages: Deep theoretical grounding, strong research exposure.

- Disadvantages: Expensive and time-intensive, may lack immediate real-world application.

3. Trading-Focused Bootcamps and Workshops

Specialized bootcamps teach anomaly detection techniques in the context of financial trading systems. For instance, some fintech-focused academies cover how to use anomaly detection in quantitative trading through case studies, backtesting, and real-time algorithm design.

- Advantages: Practical, trading-specific, short duration.

- Disadvantages: Limited theoretical depth, cost can still be significant.

4. Research Papers and Financial Journals

For advanced traders and researchers, journals such as Quantitative Finance and Journal of Financial Data Science provide cutting-edge anomaly detection strategies.

- Advantages: Access to latest innovations.

- Disadvantages: Dense content, requires advanced math/statistics knowledge.

5. Open-Source Resources and GitHub Projects

GitHub repositories offer code for anomaly detection models, often pre-trained for financial datasets. This is ideal for algorithmic trading developers and quant analysts looking to experiment with real data.

- Advantages: Free, highly practical, community-driven.

- Disadvantages: Requires strong coding and data science skills.

Two Key Methods for Learning and Applying Anomaly Detection

Method 1: Statistical Anomaly Detection

Statistical methods rely on historical averages, standard deviations, and regression models. For example, a stock price exceeding 3 standard deviations from its moving average may signal an anomaly.

Advantages:

- Easy to implement and interpret.

- Works well in stable, liquid markets.

Disadvantages:

- Struggles in volatile or fast-changing conditions.

- May generate too many false signals.

Method 2: Machine Learning–Based Anomaly Detection

Machine learning models, such as autoencoders, isolation forests, or clustering techniques, detect complex anomalies across multi-dimensional datasets. These are particularly powerful in algorithmic trading, where patterns are subtle and nonlinear.

Advantages:

- Handles complex datasets effectively.

- Adaptive to evolving market conditions.

- Integrates seamlessly with algo trading platforms.

Disadvantages:

- Requires large datasets for training.

- Higher technical complexity.

Comparing the Two Methods

| Criteria | Statistical Methods | Machine Learning Methods |

|---|---|---|

| Ease of Learning | Beginner-friendly | Requires advanced skills |

| Accuracy | Moderate | High with enough data |

| Flexibility | Limited | Highly flexible |

| Cost of Application | Low | Higher (compute resources) |

Recommendation: Beginners should start with statistical methods to build intuition, then progress toward machine learning for deeper insights and scalability.

Practical Applications of Anomaly Detection

- Risk Management: By learning how anomaly detection helps risk management in trading, traders can avoid catastrophic losses caused by unexpected events.

- Market Surveillance: Detecting manipulative activities such as spoofing or wash trading.

- Alpha Generation: Identifying mispriced assets before the market adjusts.

- System Monitoring: Ensuring algorithmic trading systems behave as intended.

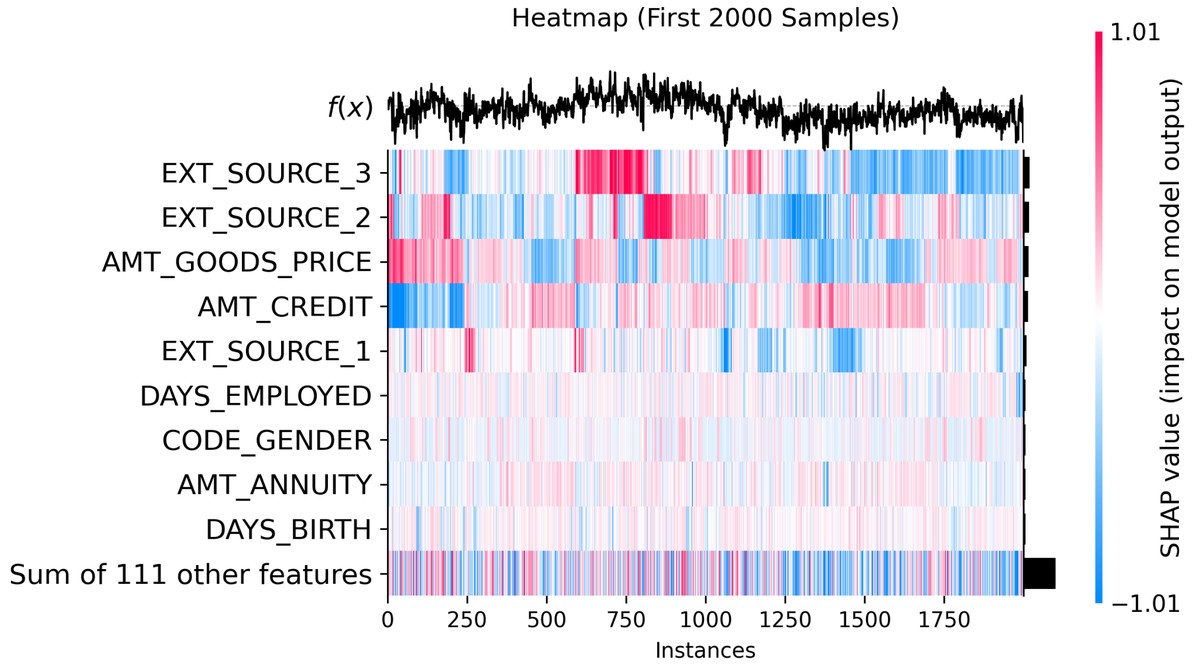

Anomaly detection models highlight unusual data points (red) that deviate significantly from market norms.

Latest Industry Trends in Learning

- Cloud-Based Labs: Platforms offer real-time financial datasets where traders can practice anomaly detection without local infrastructure.

- Integrated Trading Platforms: Brokers now provide anomaly detection plugins directly within trading dashboards.

- AI-Enhanced Learning: Adaptive platforms personalize learning paths based on a trader’s skill level.

- Community-Based Learning: Forums and Discord groups where quants share anomaly detection strategies.

FAQ: Where to Learn Anomaly Detection Techniques for Trading

1. What is the best way for beginners to start learning anomaly detection?

Beginners should start with statistical approaches using Excel or Python libraries like Pandas and Scikit-learn. From there, gradually progress to machine learning courses on platforms like Coursera or specialized trading workshops.

2. Do I need a background in programming to learn anomaly detection for trading?

Yes, a basic understanding of Python or R is highly recommended. Most advanced anomaly detection models, especially machine learning–based ones, require programming for data cleaning, feature engineering, and backtesting.

3. Where can professionals learn advanced anomaly detection techniques tailored to hedge funds?

Professionals should consider advanced finance programs, CFA Institute research papers, or dedicated fintech conferences. Hedge funds often use proprietary anomaly detection tools, but academic journals and workshops provide the necessary foundations.

Final Thoughts

Knowing where to learn anomaly detection techniques for trading is the first step toward building a successful quantitative trading career. Whether through structured university programs, online courses, or open-source resources, traders must balance theory with practice.

For long-term success, start with accessible statistical methods, then progress into machine learning. Remember that anomaly detection is not just about spotting unusual events—it’s about translating those signals into profitable, risk-managed trading strategies.

If this article helped you, share it with fellow traders, comment with your learning experience, and join the discussion on building smarter, anomaly-aware trading systems.

0 Comments

Leave a Comment