==========================================

Electronic trading has revolutionized global financial markets, replacing manual processes with algorithm-driven execution. Yet, with this evolution comes complexity: traders now face the challenge of constantly refining strategies to maximize efficiency, profitability, and risk-adjusted returns. In this comprehensive guide, we explore optimization guides for electronic trading, review proven strategies, analyze their pros and cons, and provide practical solutions for different types of traders.

Why Optimization is Crucial in Electronic Trading

The Competitive Edge of Optimization

Modern markets are fast-paced and saturated with institutional and retail participants. Without optimization, even a sound trading strategy risks underperformance. Optimization fine-tunes execution, reduces latency, and improves order fills, creating a decisive edge.

Risk Management Benefits

Optimization is not just about maximizing profits—it’s also about minimizing losses. Understanding how to optimize risk management in trading allows traders to dynamically adjust position sizes, stop losses, and portfolio allocations based on market conditions.

Data-Driven Decisions

With access to vast datasets, traders can refine models using statistical, machine learning, and AI-driven optimization techniques. This ensures trading models remain relevant in evolving market environments.

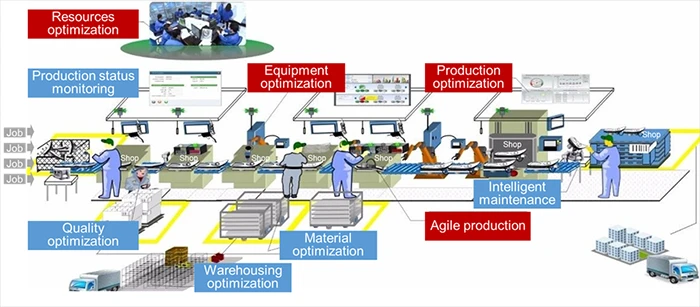

Core Areas of Optimization in Electronic Trading

Strategy Optimization

Fine-tuning algorithmic strategies, including entry/exit rules, parameter calibration, and risk thresholds.

Execution Optimization

Improving trade execution via smart order routing, reducing slippage, and minimizing latency.

Portfolio Optimization

Balancing risk and return across multiple assets using advanced models like mean-variance or Black-Litterman.

Infrastructure Optimization

Upgrading network, hardware, and software systems for faster execution and reduced downtime.

Main components of optimization in electronic trading

Strategy 1: Algorithm Parameter Optimization

Description

This involves calibrating parameters (e.g., moving average lengths, volatility thresholds, leverage ratios) to maximize profitability. Techniques include grid search, walk-forward optimization, and Monte Carlo simulations.

Pros

- Straightforward implementation.

- Can significantly boost returns if parameters align with market conditions.

Cons

- Risk of overfitting.

- Performance may deteriorate in out-of-sample data.

Strategy 2: Machine Learning and AI-Based Optimization

Description

Advanced traders increasingly apply machine learning models (random forests, gradient boosting, deep learning) to dynamically optimize strategy parameters, execution, and risk exposure.

Pros

- Adapts to changing markets.

- Handles complex, non-linear relationships.

- Supports real-time optimization for algo traders.

Cons

- Requires significant computational resources.

- Potential for model bias if training data is poor.

Recommended Approach

While parameter optimization remains valuable for simpler strategies, machine learning-based optimization provides superior adaptability in dynamic markets. For example, institutions often deploy reinforcement learning algorithms to adjust execution in real-time. Retail traders, however, may prefer simpler parameter optimization combined with robust backtesting to avoid overfitting.

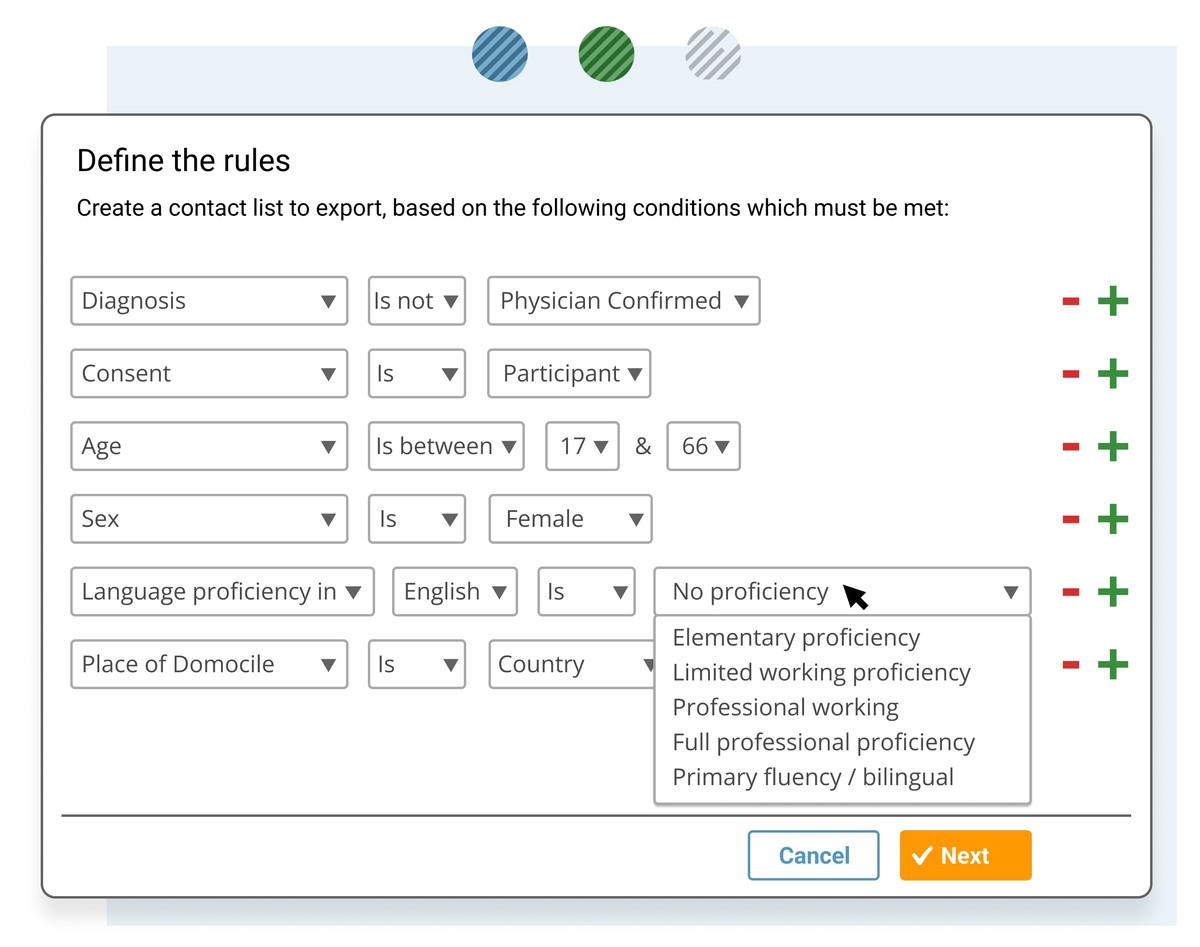

How to Implement Effective Optimization

Step 1: Define Clear Objectives

Profit maximization, risk-adjusted returns, or execution efficiency? Each requires different optimization methods.

Step 2: Backtesting and Validation

Learn how to optimize backtesting for trading strategies by incorporating out-of-sample tests, walk-forward analysis, and Monte Carlo stress testing.

Step 3: Leverage Tools and Software

Knowing where to find optimization tools for trading is crucial. Popular platforms include:

- QuantConnect (cloud-based quantitative trading).

- MetaTrader with genetic algorithm optimizers.

- MATLAB and Python libraries (SciPy, PyTorch, scikit-learn).

Step 4: Monitor and Adjust

Optimization is an ongoing process. Continuous monitoring ensures strategies remain profitable under changing market dynamics.

Backtesting and optimization cycle in electronic trading

Advanced Optimization Strategies

Portfolio Risk Optimization

Portfolio managers use optimization models to balance diversification and maximize Sharpe ratios. Incorporating how to improve portfolio optimization allows for dynamic allocation across asset classes.

Multi-Objective Optimization

Balancing multiple goals such as minimizing transaction costs, controlling volatility, and maximizing profits.

Adaptive and Real-Time Optimization

Algo traders rely on real-time optimization for algo traders to adjust order routing, risk exposure, and leverage in milliseconds.

Common Mistakes in Optimization

- Overfitting to historical data: Creates strategies that fail in live markets.

- Ignoring transaction costs: Leads to inflated backtest results.

- Insufficient sample size: Reduces statistical validity.

- Failure to update models: Causes degradation in performance over time.

FAQ: Optimization in Electronic Trading

1. What’s the difference between parameter optimization and machine learning optimization?

Parameter optimization tweaks pre-defined variables (like moving averages), while machine learning can adaptively learn from data to improve strategies. The latter is more powerful but also more resource-intensive.

2. How often should I re-optimize my trading system?

This depends on market conditions. High-frequency traders may re-optimize daily, while portfolio managers might adjust quarterly. The key is balancing adaptability with stability.

3. Can beginners apply optimization effectively?

Yes. Beginners should start with simple optimization techniques for beginner traders, such as adjusting stop-loss levels or risk-per-trade percentages. Advanced methods like machine learning should be introduced gradually.

Conclusion: Building a Smarter Trading Future

Effective trading today demands more than just solid strategies—it requires continuous refinement. By following structured optimization guides for electronic trading, traders can improve profitability, manage risk, and stay ahead of competition.

From parameter tuning to AI-driven optimization, the possibilities are vast. The key is aligning methods with trader experience, resources, and market objectives.

If this article helped you understand how to optimize your trading approach, share it with fellow traders, leave your thoughts in the comments, and join the growing community of professionals refining their edge in electronic markets.

要不要我帮你把这篇文章扩展到 带有 meta description + SEO 标题 + URL slug 的完整 SEO 发布版本?

0 Comments

Leave a Comment