=========================================

Introduction

In trading, success doesn’t come only from spotting the right entry. The true difference between an amateur and a professional trader lies in how profits are managed. A well-structured take profit strategy for consistent gains ensures that traders systematically lock in profits, reduce emotional decision-making, and improve overall return on investment (ROI).

In this comprehensive guide, we’ll explore multiple take profit approaches, compare their pros and cons, and highlight best practices. By the end, you’ll know not only how to set take profit in trading but also how to build a customized strategy for different markets such as stocks, forex, and cryptocurrency.

Why a Take Profit Strategy is Essential

Eliminating Emotional Bias

Many traders hold on to winning positions for too long, only to watch profits vanish. A structured take profit setup prevents overconfidence and greed.

Enhancing Consistency

Profits accumulated over many small but consistent trades often outperform sporadic large wins. This is why take profit solutions for constant profits matter more for long-term success.

Risk and ROI Management

Just as stop losses prevent catastrophic drawdowns, take profit strategies optimize reward-to-risk ratios, directly impacting ROI. Understanding how take profit impacts ROI can help traders balance aggressiveness and safety.

Core Take Profit Strategies for Consistent Gains

1. Fixed Percentage Take Profit

This method sets a predefined percentage (e.g., 2%–5%) as the target.

Advantages:

- Easy to calculate and automate.

- Reduces emotional interference.

- Works well for high-frequency or day traders.

Disadvantages:

- May cut profits short during strong trends.

- Doesn’t adapt to changing market volatility.

2. Technical Level Take Profit

This strategy relies on chart-based indicators such as support/resistance, Fibonacci retracements, or moving averages.

Advantages:

- Adapts to market structure.

- Provides more accurate targets than fixed percentages.

- Commonly used in swing and position trading.

Disadvantages:

- Requires technical analysis skills.

- Not always reliable in volatile markets like cryptocurrency.

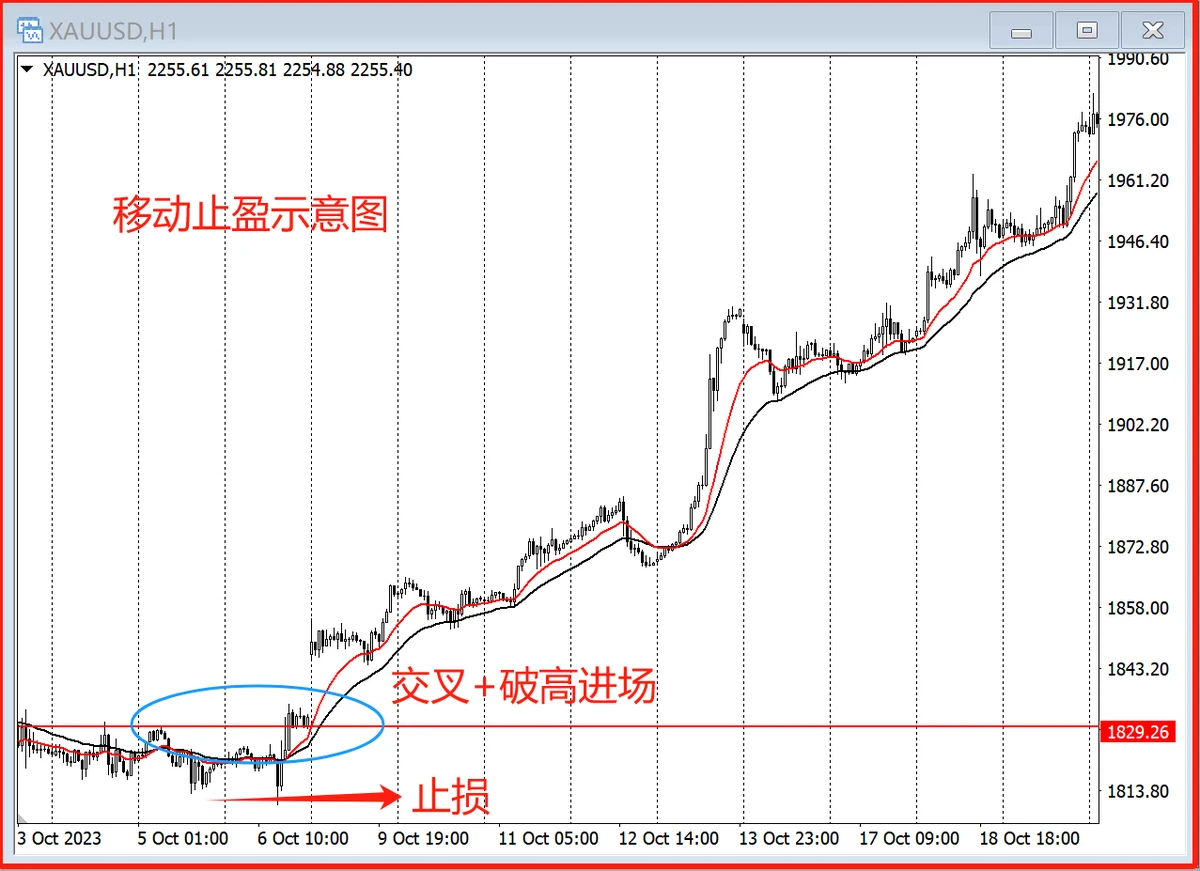

3. Trailing Take Profit

Here, the take profit moves dynamically as the market moves in the trader’s favor, locking in profits without capping potential upside.

Advantages:

- Maximizes gains in strong trends.

- Provides flexibility for long-term strategies.

- Great for traders seeking to ride trends.

Disadvantages:

- Can trigger exits too early during pullbacks.

- Requires advanced platform tools and monitoring.

4. Multi-Target Take Profit (Scaling Out)

Traders close parts of their position at different profit levels.

Advantages:

- Balances between early profit booking and trend riding.

- Reduces stress by securing partial profits.

- Works across multiple asset classes.

Disadvantages:

- More complex to manage.

- May require advanced trading platforms.

Real-World Example: Forex Take Profit Setup

Imagine you’re trading EUR/USD with a 1:2 risk-to-reward ratio.

- Entry: 1.0700

- Stop Loss: 1.0680 (20 pips)

- Take Profit: 1.0740 (40 pips)

Here, you secure consistent 2x returns on risked capital. By applying this repeatedly, even with a 50% win rate, you achieve profitability.

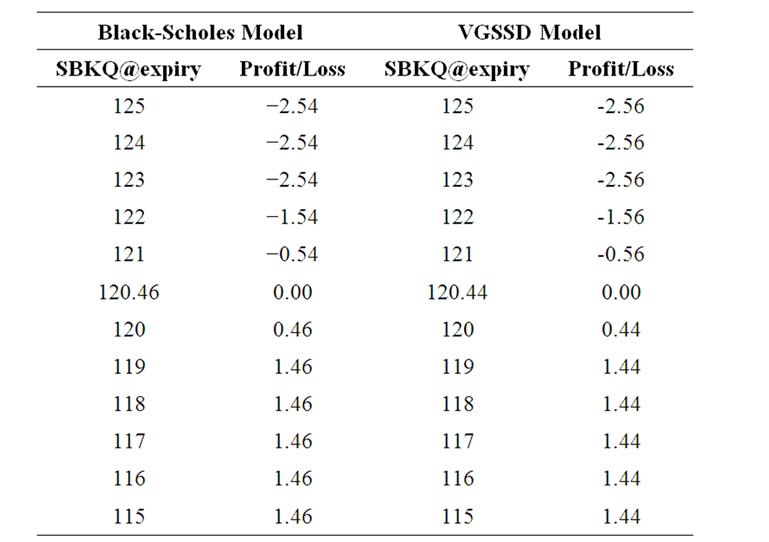

Visual: Common Take Profit Methods Compared

Comparison of fixed, technical, trailing, and multi-target take profit methods.

Choosing the Right Strategy

Day Traders

- Prefer fixed percentage or intraday support/resistance levels.

- Focus on quick, consistent profits.

Swing Traders

- Use technical levels such as Fibonacci or moving averages.

- Employ multi-target exits for flexibility.

Crypto Traders

- Need dynamic methods like trailing stops due to high volatility.

- Should understand why is take profit important in cryptocurrency—to avoid sudden reversals wiping out gains.

Combining Strategies for Consistency

The most effective traders blend approaches. For example:

- Close 50% of the position at a fixed target.

- Let the remaining 50% run with a trailing take profit.

This ensures steady income while still allowing for larger wins when trends extend.

Common Mistakes to Avoid

- No Take Profit Plan – Relying on gut feeling often leads to inconsistency.

- Too Tight Targets – Exiting too early prevents positions from reaching their potential.

- Ignoring Market Context – Using the same percentage rule across all assets ignores volatility differences.

Internal Knowledge Expansion

Many beginners often ask where to apply take profit strategy—the answer depends on both asset class and time frame. For example, forex traders prefer intraday pivots, while stock investors may rely on quarterly earnings catalysts.

Similarly, knowing how to choose take profit levels based on chart patterns, volatility ranges, or average true range (ATR) indicators gives traders a structured way to align targets with market conditions.

Advanced Take Profit Planning

ATR-Based Targets

Using Average True Range ensures that take profit levels adapt to volatility.

Algorithmic Take Profit Rules

Quant traders automate take profit execution using algorithms, improving consistency and avoiding human bias.

Hybrid Approaches

Mixing fundamental catalysts (earnings, macroeconomic events) with technical levels increases accuracy.

Visual: ATR-Based Take Profit Example

ATR-based take profit adapts to market volatility for more accurate targets.

FAQ: Take Profit Strategy for Consistent Gains

1. How does take profit differ from stop loss?

A stop loss protects capital from excessive downside risk, while a take profit secures gains at predetermined levels. Both are essential to complete a risk management framework.

2. Can I trade without setting take profits?

Yes, but it’s risky. Without predefined exits, you may exit emotionally—too early during pullbacks or too late after reversals. Consistency comes from structured planning.

3. What’s the best take profit method for beginners?

For beginners, a fixed percentage or simple support/resistance method works best. As skills grow, traders can experiment with trailing stops and multi-target exits.

Conclusion

A take profit strategy for consistent gains is the backbone of disciplined trading. From fixed percentage exits to advanced ATR-based models, having a structured plan ensures profits are not left to chance.

The best approach combines simplicity with flexibility—lock in partial profits while leaving room for bigger wins. Whether you trade forex, stocks, or crypto, a well-defined take profit framework will elevate your trading game.

💬 Do you use fixed targets, trailing stops, or multi-level exits? Share your favorite take profit strategy in the comments, and if you found this guide helpful, share it with your trading community!

0 Comments

Leave a Comment