Comprehensive ETF Trading Tutorials: A Complete Guide for Success

ETFs (Exchange-Traded Funds) have become one of the most popular financial instruments for both novice and experienced traders. Whether you are a beginner seeking to understand the basics or an

Comprehensive Debugging Checklist for Quant Developers

Introduction As quantitative finance has become increasingly reliant on algorithmic strategies, debugging has emerged as a critical skill for developers. Whether you’re working on quantitative

Comprehensive Acquisitions Analysis for Quantitative Traders

Introduction In the world of quantitative trading, the analysis of acquisitions is a powerful strategy that can unlock significant opportunities for traders. Mergers, acquisitions, and corporate

Common Mistakes in Quantitative Trading by Retail Investors

Quantitative trading has gained significant popularity among retail investors, thanks to the advancements in technology and the accessibility of financial data. However, many retail investors make

Complete Programming Guide for Quantitative Trading

Quantitative trading has become one of the most competitive fields in finance, blending programming, mathematics, and market knowledge into high-performing trading systems. For beginners and

Comparison of Exchange Traded Funds vs Mutual Funds: Which One Fits Your Investment Strategy Best

TL;DR ETFs generally offer lower expense ratios, greater tax efficiency, and the ability to trade intraday, while mutual funds often provide automatic investment features, easier dollar-cost

Common Errors for Experienced Quant Traders: A Complete 2025 Guide

Quantitative trading is often viewed as the pinnacle of financial innovation, combining mathematics, computer science, and market knowledge. Yet even the most seasoned professionals are not immune to

证据缺口清单

需补充的官方/机构/学术来源类型: 最新的量化交易在加密货币市场的具体案例研究和实证数据。 与量化交易在加密货币市场的使用和表现相关的监管报告和政策分析。 对量化交易算法性能分析的学术论文,特别是在加密货币领域。 可信的第三方数据源,能验证市场趋势、回测数据和量化策略的有效性。 建议的检索式与实体词表: “cryptocurrency quantitative trading

Checklist for Getting Venture Capital in Quantitative Trading

Securing venture capital (VC) funding for a quantitative trading venture is both a challenging and rewarding process. Whether you’re an individual quant trader, a startup, or part of an

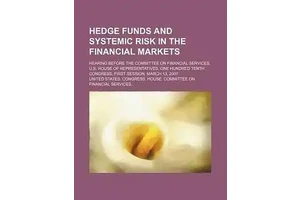

Case Study: Mutual Funds in Quantitative Hedge Funds

Introduction In recent years, quantitative hedge funds have attracted significant attention due to their ability to integrate advanced algorithms, big data, and systematic strategies into portfolio