Where Fundamental Analysis Fits in Quantitative Trading

In today’s sophisticated financial markets, where fundamental analysis fits in quantitative trading has become a crucial question for traders,

Where Exchange Traded Funds Are Listed

Introduction Exchange Traded Funds (ETFs) have become a cornerstone of modern investing, offering diversification, liquidity, and cost efficiency .

Where Exchange Traded Funds Are Listed

Exchange Traded Funds (ETFs) have become one of the most popular investment vehicles for both retail and institutional investors. Understanding where exchange

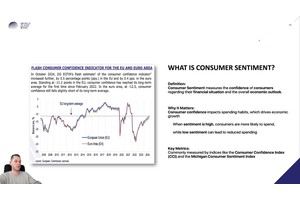

Where Economic Indicators Are Published

Introduction Understanding where economic indicators are published is crucial for traders, analysts, investors, and policymakers. Economic indicators, such as

Where Does Private Equity Use Quantitative Trading Models?

Private equity (PE) firms have traditionally been associated with long-term investments, operational improvements, and financial

Where Do Returns Come From in Algorithmic Trading

Understanding where returns come from in algorithmic trading is crucial for both novice and experienced quantitative traders. Algorithmic trading

Where Do Errors Occur in Quantitative Trading: A Complete Guide

Introduction Quantitative trading, often referred to as “quant trading,” uses mathematical models, statistical methods, and algorithms

Where Can I Find Data on Interest Rates for Trading?

Interest rates play a pivotal role in financial markets, influencing equities, bonds, forex, and derivatives trading. For traders, especially in

Where Can I Find Data on Interest Rates for Trading?

Interest rates are one of the most critical variables influencing financial markets. Whether you are trading forex, equities, bonds, or

Where Beginners Can Learn About Trade Volume

Trade volume is one of the most essential concepts in financial markets, providing insight into market activity, liquidity, and potential price movements.