How to Reduce Correlation Risk in Quantitative Portfolios

Correlation risk, the risk arising from high correlations between assets or asset classes, is a critical factor that can impact the...

Read ArticleQuant Trading Strategies and Techniques

Correlation risk, the risk arising from high correlations between assets or asset classes, is a critical factor that can impact the...

Read Article

Correlation risk is one of the most underestimated challenges in quantitative portfolio management . Even if individual strategies seem...

Read Article

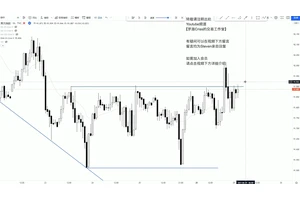

= Understanding how to read price action in trading is one of the most important skills for traders who want to make informed,...

Read Article

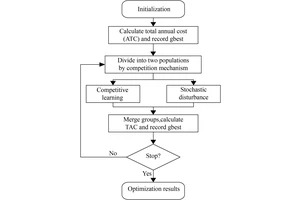

Statistical arbitrage (stat arb) is one of the most powerful and widely used strategies in quantitative trading. It involves taking...

Read Article

Order flow analysis is one of the most powerful tools traders use to understand market dynamics. By analyzing the flow of orders,...

Read Article

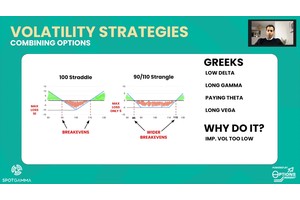

Volatility is one of the most critical metrics in financial markets, directly influencing risk, opportunity, and portfolio performance. Traders,...

Read Article

Statistical arbitrage, often called “stat arb,” has become one of the most widely used quantitative trading strategies in modern...

Read Article

Introduction Volatility is the heartbeat of financial markets. For traders, the ability to predict volatility changes in trading is not just an edge—it...

Read Article

Volatility is one of the most critical factors in financial markets, as it can significantly impact the value of assets and the effectiveness of trading...

Read Article

Introduction In today’s financial markets, futures contracts are among the most actively traded instruments. From commodities like crude oil and gold...

Read Article