How to Start Quantitative Trading

= Quantitative trading (often called quant trading ) combines mathematics, programming, and finance to build systematic trading strategies. Instead of relying o...

Read ArticleQuant Trading Strategies and Techniques

= Quantitative trading (often called quant trading ) combines mathematics, programming, and finance to build systematic trading strategies. Instead of relying o...

Read Article

Quantitative trading is a highly systematic and data-driven approach to investing that uses mathematical models and algorithms to identify...

Read Article

High-frequency trading (HFT) is one of the most advanced forms of algorithmic trading, where trades are executed in microseconds using sophisticated algorithms...

Read Article

High-frequency trading (HFT) is one of the most sophisticated strategies in modern financial markets. It involves executing a...

Read Article

= Introduction The cryptocurrency market is one of the most volatile, dynamic, and data-driven trading environments in the world. Unlike traditional markets, it...

Read Article

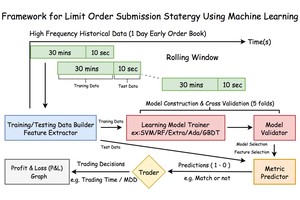

Support Vector Machine (SVM) is one of the most widely adopted machine learning techniques in quantitative finance. It is particularly powerful...

Read Article

Introduction Backtesting is the cornerstone of quantitative trading, allowing traders and institutions to evaluate strategies before risking real capital....

Read Article

Introduction Quantitative trading has revolutionized the financial markets by introducing systematic, data-driven methods that reduce human error and...

Read Article

Introduction In trading and investing, drawdown risk represents one of the most critical performance metrics to monitor. A...

Read Article

Drawdown risk is one of the most critical concerns for traders, portfolio managers, and algorithm developers. Large...

Read Article