How to Use Data Mining in Quantitative Trading?

Quantitative trading has evolved rapidly over the last two decades, driven by advancements in technology, the rise of big data, and the development of...

Read ArticleQuant Trading Strategies and Techniques

Quantitative trading has evolved rapidly over the last two decades, driven by advancements in technology, the rise of big data, and the development of...

Read Article

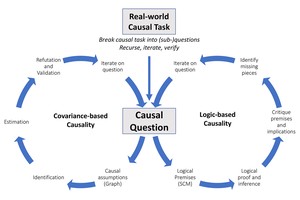

Introduction In the modern financial landscape, risk management is not just about avoiding losses—it’s about understanding the relationships between different...

Read Article

In the fast-paced world of quantitative trading, speed, precision, and efficiency are paramount. C++ has long been a favored language in the field due to its...

Read Article

In the fast-paced world of financial markets, speed, efficiency, and precision are non-negotiable . For these reasons, many top hedge funds, investment banks,...

Read Article

Quantitative trading relies on speed, precision, and efficiency. In this landscape, C++ has become a cornerstone programming language , powering everything...

Read Article

In the world of quantitative trading, “black box” systems have become a fundamental tool for many professional traders and institutions. These...

Read Article

Introduction In today’s financial markets, the use of big data for quantitative trading is no longer optional—it’s essential. Quant traders, hedge funds,...

Read Article

In modern finance, beta plays a central role in measuring risk and constructing systematic trading strategies. For quantitative traders,...

Read Article

Introduction In modern investing and quantitative trading, alpha is often discussed as a measure of excess returns compared to a benchmark. However, its utili...

Read Article

Introduction In modern financial markets, algorithms are at the core of quantitative trading . Understanding how to use algorithm in quantitative trading ...

Read Article