===============================================

The increasing complexity and speed of financial markets have made traditional monitoring approaches insufficient for modern trading. With thousands of transactions per second and ever-changing liquidity flows, traders and institutions must rely on real-time anomaly detection systems for trading to identify irregular patterns, mitigate risks, and capture hidden opportunities.

This article explores how anomaly detection works in financial markets, reviews multiple approaches, compares their strengths and weaknesses, and provides actionable insights for traders and quantitative analysts.

What Is Anomaly Detection in Trading?

Anomaly detection refers to identifying data points, patterns, or behaviors that deviate significantly from expected norms. In financial trading, anomalies often indicate potential risks (fraud, flash crashes, liquidity droughts) or opportunities (inefficient pricing, unusual market sentiment).

For example:

- A sudden spike in trading volume without corresponding news may signal insider activity.

- Abnormal order book imbalances could suggest manipulation.

- Price divergence between correlated assets may create arbitrage opportunities.

These real-time insights are invaluable for algorithmic trading systems, hedge funds, and retail traders who want to reduce exposure to unexpected losses and capitalize on inefficiencies.

Why Real-Time Detection Is Critical

Unlike static risk models that rely on end-of-day reports, real-time anomaly detection systems for trading operate continuously, adapting to evolving market conditions.

Key benefits include:

- Faster response: Detect irregularities before they escalate into significant losses.

- Risk reduction: Spot market manipulation or liquidity shocks early.

- Performance improvement: Capture alpha from temporary market inefficiencies.

- Regulatory compliance: Monitor suspicious activities that could trigger compliance alerts.

In today’s high-frequency environment, even a delay of a few seconds can mean the difference between profit and loss.

Core Methods of Real-Time Anomaly Detection

1. Statistical Threshold-Based Detection

This method compares real-time trading data (price, volume, volatility) against predefined statistical ranges, such as Z-scores or standard deviation bands.

Strengths:

- Simple to implement.

- Low computational requirements.

- Easy for traders to interpret.

- Simple to implement.

Weaknesses:

- Prone to false positives in highly volatile markets.

- Cannot capture complex multi-dimensional anomalies.

- Prone to false positives in highly volatile markets.

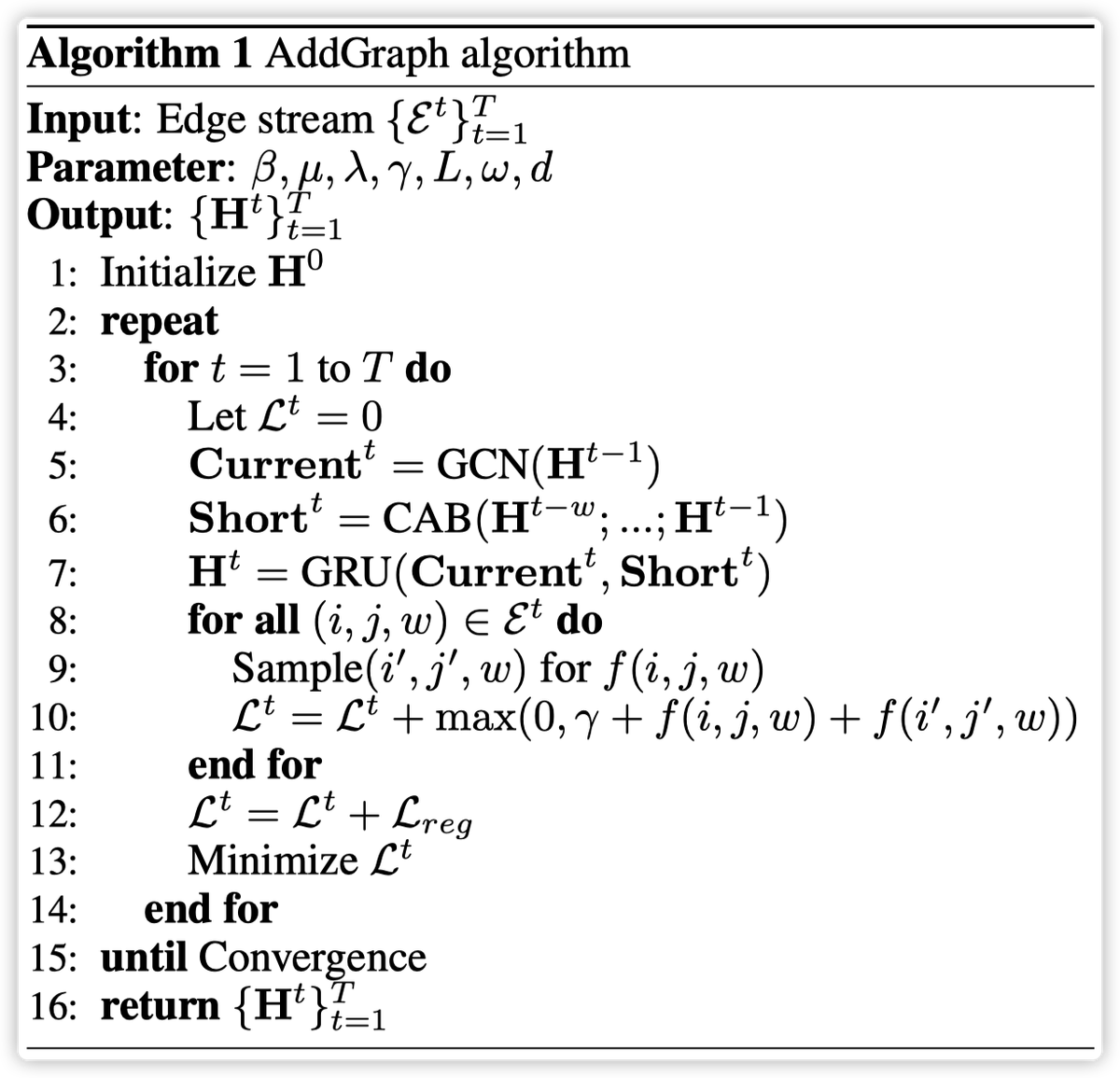

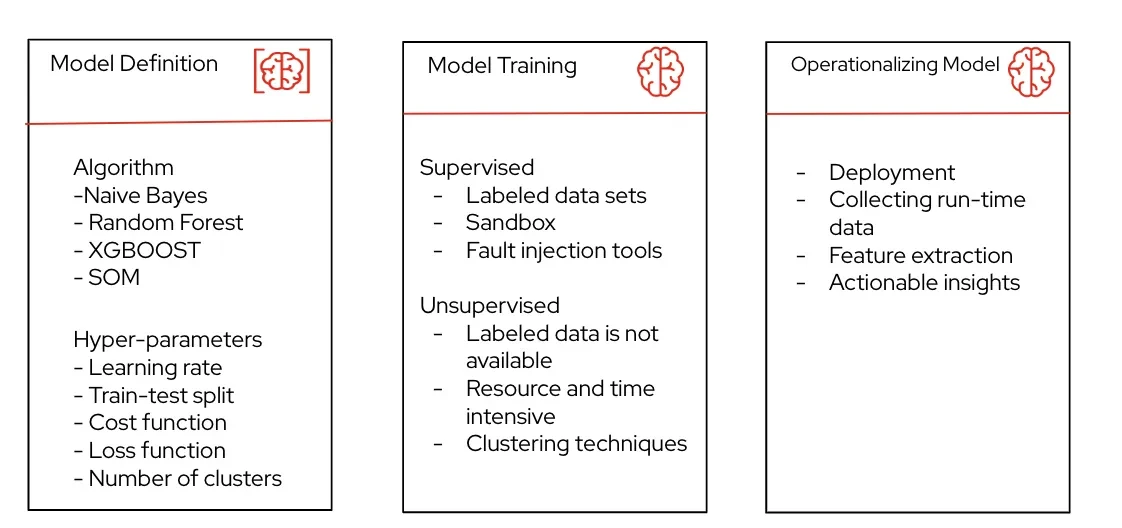

2. Machine Learning Models

Modern anomaly detection often uses unsupervised or semi-supervised machine learning to identify hidden patterns. Algorithms include:

Isolation Forests: Detect outliers by recursively partitioning data.

Autoencoders (Neural Networks): Learn to reconstruct normal patterns, flagging unusual deviations.

Clustering (K-Means, DBSCAN): Identify abnormal groups of market behavior.

Strengths:

- Handle high-dimensional data (e.g., order books).

- Adapt to evolving patterns over time.

- Reduce false alarms compared to static thresholds.

- Handle high-dimensional data (e.g., order books).

Weaknesses:

- Require significant computational power.

- Complex to interpret (black-box problem).

- Depend on high-quality training data.

- Require significant computational power.

Comparison of Methods

| Method | Best Use Case | Pros | Cons |

|---|---|---|---|

| Statistical Thresholds | Monitoring basic metrics like volatility and spreads | Fast, simple, interpretable | Limited accuracy in dynamic conditions |

| Machine Learning Models | Complex anomaly detection in order flow, correlations | Adaptive, scalable, robust | Computationally heavy, harder to explain |

For most professional traders, a hybrid approach—using statistical thresholds for baseline monitoring and machine learning for deeper anomaly analysis—delivers the best balance of speed and accuracy.

Practical Applications of Real-Time Anomaly Detection

Real-time anomaly detection has broad applications across trading environments:

- Fraud Detection

Spot irregular order placements or wash trades that distort prices.

- Market Manipulation Monitoring

Identify spoofing, layering, and pump-and-dump schemes.

- Risk Management

Detect early signs of flash crashes, liquidity crunches, or correlated asset breakdowns.

- Arbitrage Opportunities

Monitor cross-exchange data to exploit temporary mispricings.

When considering how to use anomaly detection in quantitative trading, think of it as both a defensive shield against risks and an offensive tool for strategy enhancement.

Real-World Example: Flash Crash Prevention

The 2010 Flash Crash demonstrated how markets can spiral within minutes. A real-time anomaly detection system monitoring order book imbalances and sudden liquidity withdrawals could have flagged the event before it cascaded, allowing trading systems to halt or adjust strategies accordingly.

This case highlights why anomaly detection is important in trading strategies, especially in algorithmic and high-frequency contexts.

Visual Overview of Anomaly Detection Workflow

Real-time anomaly detection workflow for trading

Steps to Implement Real-Time Anomaly Detection

Define Objectives

- Fraud detection, market monitoring, or strategy optimization.

- Fraud detection, market monitoring, or strategy optimization.

Collect and Process Data

- Order book data, price feeds, volume metrics, sentiment analysis.

- Order book data, price feeds, volume metrics, sentiment analysis.

Choose a Methodology

- Start with thresholds for simplicity, scale into ML for advanced needs.

- Start with thresholds for simplicity, scale into ML for advanced needs.

Integrate with Trading Systems

- Deploy alerts, automated responses, or trading rule adjustments.

- Deploy alerts, automated responses, or trading rule adjustments.

Continuous Improvement

- Retrain ML models, adjust thresholds, and backtest performance.

- Retrain ML models, adjust thresholds, and backtest performance.

Challenges in Real-Time Detection

- Latency: Systems must process massive data streams in milliseconds.

- False Positives: Over-alerting can reduce trader confidence.

- Data Quality: Poor feeds or missing ticks reduce model accuracy.

- Interpretability: Complex ML models often lack transparency, creating trust issues.

The key is balancing accuracy, speed, and interpretability depending on the trading environment.

FAQs About Real-Time Anomaly Detection Systems for Trading

1. How does anomaly detection improve trading performance?

Anomaly detection enhances performance by alerting traders to unusual opportunities (e.g., mispricing across exchanges) while minimizing exposure to risks (e.g., spoofing or liquidity shocks). It helps both offensive trading strategies and defensive risk management.

2. Can retail traders benefit from anomaly detection systems?

Yes. While advanced machine learning models may be costly, retail traders can use lightweight solutions like TradingView alerts, custom Python scripts, or plugins that highlight irregular volume spikes and unusual candlestick patterns.

3. What are the best tools for anomaly detection in trading?

- Quantitative platforms: Python (scikit-learn, TensorFlow, PyTorch) for custom ML models.

- Trading platforms: MetaTrader, NinjaTrader, and TradingView for simple alerts.

- Specialized fintech services: Cloud-based anomaly detection APIs designed for trading firms.

Conclusion

The financial markets are dynamic, unpredictable, and increasingly complex. Real-time anomaly detection systems for trading provide traders with the ability to detect irregularities, mitigate risks, and capture unique opportunities as they unfold.

Whether through simple statistical thresholds or advanced machine learning models, anomaly detection is now a cornerstone of quantitative trading and risk management. For traders and institutions alike, adopting these systems is no longer optional—it’s essential for survival in the modern financial ecosystem.

If you found this article valuable, share it with colleagues, comment with your experiences using anomaly detection, and help expand the conversation on how these systems are shaping the future of trading.

Would you like me to also create a step-by-step Python implementation example of anomaly detection for trading (using real market data) to include as a practical section in this article?

0 Comments

Leave a Comment